Official Gift Deed Template

When considering the transfer of property or assets without the exchange of money, a Gift Deed form becomes an essential tool. This legal document facilitates the voluntary transfer of ownership from one individual, the donor, to another, the recipient or donee. It is crucial to understand that a Gift Deed is not just a simple note; it must contain specific elements to be valid and enforceable. Key aspects include the identification of both parties, a clear description of the property being gifted, and the donor’s intent to make the gift without any expectation of receiving something in return. Additionally, the form often requires the signatures of witnesses to ensure authenticity and may need to be notarized, depending on state laws. Understanding these components helps ensure that the gift is legally recognized and that both parties are protected throughout the process. Properly executing a Gift Deed can provide peace of mind, making it a valuable consideration for anyone looking to give or receive property as a gift.

Similar forms

-

Will: A will outlines how a person's assets will be distributed after their death. Like a gift deed, it involves the transfer of property, but a will takes effect only upon death, while a gift deed is effective immediately.

Motor Vehicle Bill of Sale: This form not only serves as proof of ownership transfer but also includes crucial details about the vehicle and transaction, ensuring clarity for both buyer and seller. For more information, you can visit documentonline.org/blank-illinois-motor-vehicle-bill-of-sale/.

-

Trust Agreement: A trust agreement allows a person to transfer assets to a trustee for the benefit of beneficiaries. Similar to a gift deed, it involves the transfer of property, but a trust can provide ongoing management of the assets, whereas a gift deed transfers ownership outright.

-

Sales Agreement: A sales agreement documents the sale of property from one party to another. Both a sales agreement and a gift deed involve the transfer of ownership, but a sales agreement typically requires payment, while a gift deed does not.

-

Quitclaim Deed: A quitclaim deed transfers any interest one party has in a property to another party. Like a gift deed, it is a method of transferring property ownership. However, a quitclaim deed does not guarantee that the property is free of claims, while a gift deed is often used to convey property without such reservations.

Gift Deed - Tailored for State

Guidelines on Writing Gift Deed

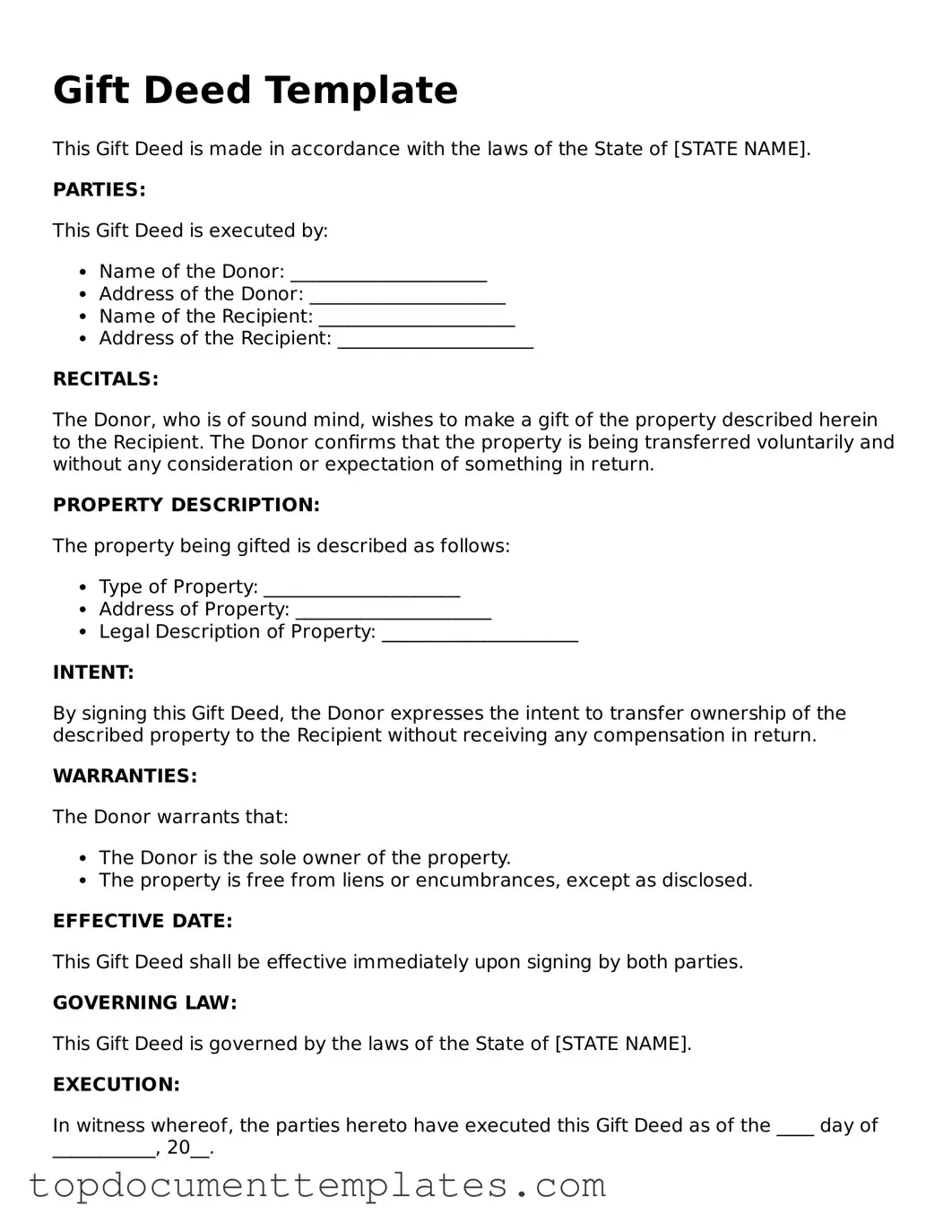

After obtaining the Gift Deed form, it is essential to complete it accurately to ensure a smooth transfer process. Follow these steps carefully to fill out the form correctly.

- Begin by entering the date at the top of the form.

- Provide the full name and address of the donor (the person giving the gift).

- Next, enter the full name and address of the recipient (the person receiving the gift).

- Clearly describe the property being gifted. Include details such as the address, type of property, and any identifying information.

- Specify any conditions or restrictions related to the gift, if applicable.

- Both the donor and the recipient must sign the form. Ensure that signatures are dated.

- If required, have the form notarized to validate the signatures.

- Make copies of the completed form for both parties for their records.

Once the form is filled out and signed, it is important to file it with the appropriate local government office, if necessary, to complete the transfer. Ensure that all parties retain their copies for future reference.

File Information

| Fact Name | Description |

|---|---|

| Definition | A Gift Deed is a legal document used to transfer ownership of property from one person to another without any exchange of money. |

| Consideration | Unlike other property transfers, a Gift Deed does not require any financial consideration, making it a unique form of property transfer. |

| State-Specific Laws | Each state has its own laws governing Gift Deeds. For example, in California, the California Civil Code Section 1146 applies. |

| Tax Implications | Gift Deeds may have tax implications. The IRS allows a certain amount to be gifted tax-free each year, so it's important to understand these limits. |

Find Other Types of Gift Deed Templates

What Is a Deed-in-lieu of Foreclosure? - It's crucial to consult with a financial advisor before considering this option.

For those considering the application process, further information and resources regarding the completion and submission of the USCIS I-589 form can be found at TopTemplates.info, which provides valuable insights and guidance to help applicants navigate this important step in seeking asylum and protection in the United States.