Valid Transfer-on-Death Deed Form for Georgia State

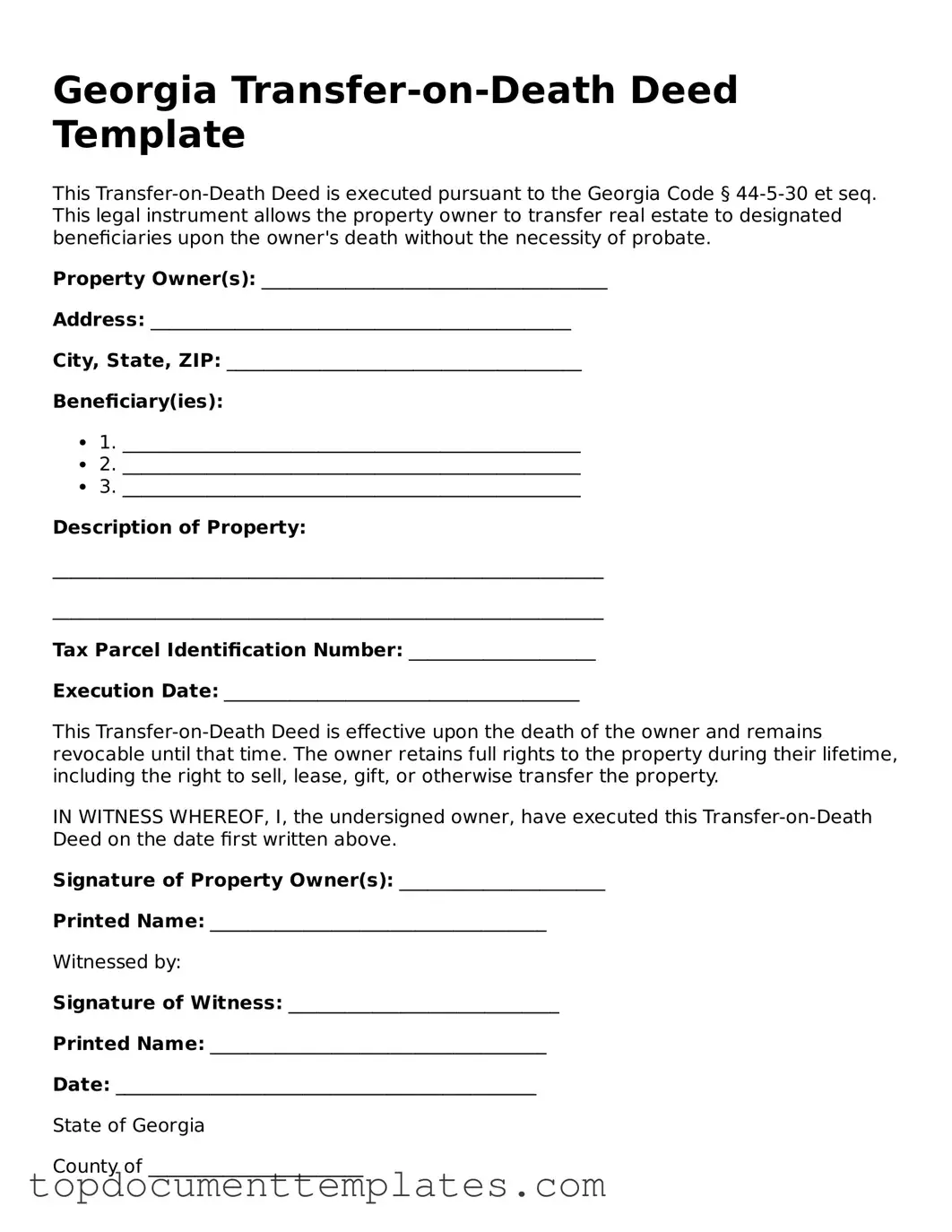

The Georgia Transfer-on-Death Deed form provides a straightforward method for property owners to transfer real estate to beneficiaries upon their death without the need for probate. This legal instrument allows individuals to retain full control over their property during their lifetime, ensuring that ownership automatically passes to designated heirs upon their passing. By utilizing this form, property owners can avoid the lengthy and often costly probate process, simplifying the transfer of assets. The form requires specific information, including the names of the property owner and beneficiaries, a legal description of the property, and the signatures of the involved parties. It is crucial to ensure that the deed is properly executed and recorded with the county clerk to be effective. Understanding the implications and requirements of the Transfer-on-Death Deed is essential for anyone looking to secure their estate planning goals and provide for their loved ones efficiently.

Similar forms

- Will: A will outlines how a person's assets will be distributed after their death. Like a Transfer-on-Death Deed, it allows individuals to specify beneficiaries but requires probate, whereas the deed transfers property outside of probate.

- Living Trust: A living trust holds assets during a person's lifetime and specifies how they are to be distributed after death. Both documents allow for the seamless transfer of property, but a trust can manage assets during life, while a Transfer-on-Death Deed only takes effect upon death.

- Beneficiary Designation: Commonly used for accounts like life insurance or retirement plans, this document allows individuals to name beneficiaries who will receive assets upon their death. Similar to a Transfer-on-Death Deed, it bypasses probate but is typically limited to specific types of accounts.

- Joint Tenancy with Right of Survivorship: In this arrangement, two or more people own property together, and upon the death of one owner, the property automatically transfers to the surviving owner(s). This is akin to the Transfer-on-Death Deed in that it facilitates direct transfer without probate.

- Payable-on-Death (POD) Accounts: These bank accounts allow the account holder to designate a beneficiary who will receive the funds upon the holder's death. Like a Transfer-on-Death Deed, POD accounts provide a straightforward way to transfer assets without going through probate.

- Life Estate Deed: This deed allows a person to retain the right to use a property during their lifetime while transferring ownership to another party upon their death. Both documents facilitate the transfer of property but differ in the rights retained by the original owner during their lifetime.

- Transfer-on-Death Registration for Securities: This allows individuals to designate beneficiaries for stocks and bonds, enabling direct transfer upon death. Similar to the Transfer-on-Death Deed, it avoids probate but is specific to financial assets.

- Community Property with Right of Survivorship: This form of ownership applies in certain states and allows married couples to hold property together, ensuring that upon the death of one spouse, the property automatically transfers to the surviving spouse. It parallels the Transfer-on-Death Deed in its intent to simplify the transfer process.

- Last Will and Testament: This legal document, crucial for outlining asset distribution after death and appointing guardians for minor children, can be accessed at https://documentonline.org/blank-last-will-and-testament/.

- Assignment of Benefits: Often used in insurance and healthcare contexts, this document allows a policyholder to assign benefits to another party. Like the Transfer-on-Death Deed, it streamlines the transfer of rights, although it typically pertains to benefits rather than real property.

- Durable Power of Attorney: This document grants someone the authority to make decisions on behalf of another, particularly in financial matters. While it does not directly transfer property upon death, it can work in conjunction with a Transfer-on-Death Deed by managing assets during life.

Guidelines on Writing Georgia Transfer-on-Death Deed

Filling out the Georgia Transfer-on-Death Deed form is an important step in ensuring that your property is transferred according to your wishes after your passing. Once you have completed the form, it will need to be filed with the appropriate county office to be legally effective. Below are the steps to guide you through the process of filling out the form.

- Obtain the Transfer-on-Death Deed form. You can find it online or request a copy from your local county office.

- Begin by entering your name and address in the designated fields at the top of the form. Ensure that your information is accurate.

- Next, provide a description of the property you wish to transfer. Include the address and any relevant details that clearly identify the property.

- Identify the beneficiary or beneficiaries who will receive the property upon your death. Include their full names and addresses.

- Specify whether the transfer will be to one beneficiary or multiple beneficiaries. If there are multiple beneficiaries, clarify how the property will be divided among them.

- Sign the form in the presence of a notary public. This step is crucial for the validity of the deed.

- After signing, the notary will complete their section of the form, confirming your identity and the signing of the document.

- Make copies of the completed and notarized form for your records and for the beneficiaries.

- Finally, file the original Transfer-on-Death Deed with the county clerk's office in the county where the property is located. There may be a filing fee, so be prepared to pay that at the time of filing.

File Information

| Fact Name | Details |

|---|---|

| Definition | A Transfer-on-Death (TOD) Deed allows property owners to transfer real estate to beneficiaries upon their death without going through probate. |

| Governing Law | The Georgia Transfer-on-Death Deed is governed by O.C.G.A. § 44-6-16 through § 44-6-20. |

| Eligibility | Any individual who owns real property in Georgia can create a TOD Deed. |

| Beneficiary Designation | Property owners can designate one or more beneficiaries in the TOD Deed. |

| Revocation | A TOD Deed can be revoked at any time before the owner's death by executing a new deed or a revocation form. |

| Filing Requirement | The TOD Deed must be recorded in the county where the property is located to be effective. |

| No Immediate Transfer | The transfer of property occurs only upon the death of the owner; the beneficiary has no rights until then. |

| Tax Implications | Property transferred via a TOD Deed may be subject to estate taxes, depending on the owner's estate value. |

| Property Types | Only real estate can be transferred using a TOD Deed; personal property is excluded. |

| Legal Assistance | While individuals can complete a TOD Deed without an attorney, consulting one is advisable to ensure compliance with legal requirements. |

Other Popular Transfer-on-Death Deed State Forms

Death Deed - In case of multiple beneficiaries, the property can be divided according to the owner's instructions.

Transfer on Death Deed Illinois Cost - These deeds can simplify the transfer process for real estate, especially if multiple properties are involved.

The organization and efficiency of the game are greatly enhanced by the Dnd Character Sheet form, which players can conveniently create and manage through resources like OnlineLawDocs.com. This tool allows for detailed tracking of vital character information, ensuring everyone is fully engaged in their role and ready for the adventures that lie ahead.

How to Avoid Probate in New Jersey - By using a Transfer-on-Death Deed, you maintain control of your property during your lifetime.