Valid Quitclaim Deed Form for Georgia State

The Georgia Quitclaim Deed form serves as a crucial legal instrument for property transfers, allowing individuals to convey their interest in real estate without making any guarantees about the title. This type of deed is particularly useful in situations where the parties involved have a pre-existing relationship, such as family members or business partners, and where the transfer is made without monetary exchange. Unlike warranty deeds, which provide assurances regarding the property’s title, a quitclaim deed transfers whatever interest the grantor may have, if any, with no warranties or covenants attached. The form must be executed in accordance with Georgia state laws, which typically require the signatures of both the grantor and the grantee, along with notarization. Additionally, it is important to note that the quitclaim deed should be recorded in the county where the property is located to provide public notice of the change in ownership. This recording process helps to protect the interests of all parties involved and ensures clarity in property rights. Understanding the nuances of the Georgia Quitclaim Deed form can facilitate smoother transactions and help prevent potential disputes over property ownership in the future.

Similar forms

- Warranty Deed: This document guarantees that the seller has clear title to the property and will defend that title against any claims. Unlike a quitclaim deed, it provides more security for the buyer.

- Grant Deed: Similar to a warranty deed, a grant deed transfers property ownership and assures the buyer that the property has not been sold to anyone else. It also offers some protection against undisclosed claims.

- Special Warranty Deed: This type of deed only guarantees the title against issues that arose during the seller's ownership. It is less protective than a full warranty deed but still offers some assurances.

- Deed of Trust: This document involves three parties: the borrower, the lender, and a trustee. It secures a loan with the property as collateral, similar to how a quitclaim deed transfers ownership.

- Bill of Sale: While primarily used for personal property, a bill of sale transfers ownership just like a quitclaim deed does for real estate. It serves as proof of the transaction.

- Lease Agreement: This document allows one party to use property owned by another for a specified time in exchange for rent. Like a quitclaim deed, it establishes rights to the property, though it does not transfer ownership.

- Partition Deed: Used when co-owners of property decide to divide their interests, a partition deed can transfer ownership rights similar to a quitclaim deed, but it specifically addresses shared ownership.

- Power of Attorney: This legal document allows one person to act on behalf of another in property transactions. While it doesn’t transfer ownership directly, it can facilitate a quitclaim deed transaction.

- Affidavit of Heirship: This document is used to establish the heirs of a deceased person’s property. It can help transfer ownership similarly to a quitclaim deed, particularly in settling estates.

- Release of Lien: This document removes a lien from a property, similar to how a quitclaim deed can relinquish ownership rights. It clears the title, making the property free of claims.

Guidelines on Writing Georgia Quitclaim Deed

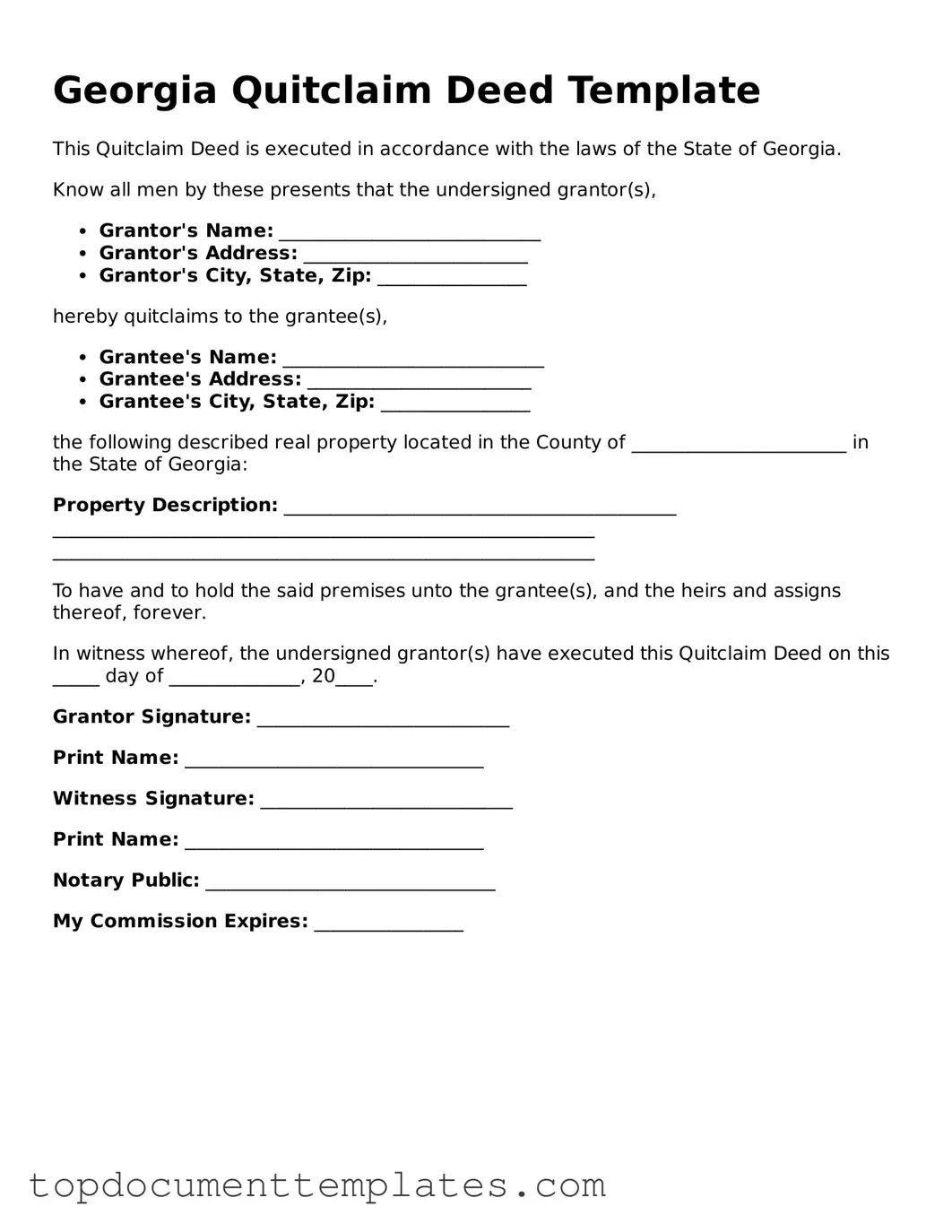

Once you have gathered the necessary information and documents, the next step is to complete the Georgia Quitclaim Deed form accurately. This document is essential for transferring property ownership and must be filled out with care to ensure it meets all legal requirements. Follow these steps to complete the form correctly.

- Begin by entering the name of the grantor (the person transferring the property) at the top of the form.

- Next, provide the name of the grantee (the person receiving the property) directly beneath the grantor's name.

- In the designated section, include the complete legal description of the property being transferred. This information can usually be found on the property deed or tax records.

- Fill in the property address, including the street number, street name, city, and zip code.

- Indicate the consideration amount. This is typically the price paid for the property, even if it is a nominal amount.

- Sign the document in the presence of a notary public. The notary will then complete their section to validate the signature.

- Finally, submit the completed Quitclaim Deed to the appropriate county office for recording. Check with local authorities for any specific filing fees or additional requirements.

File Information

| Fact Name | Description |

|---|---|

| Definition | A quitclaim deed is a legal document used to transfer ownership of real estate without any guarantees about the title. |

| Governing Law | The Georgia Quitclaim Deed is governed by Georgia Code § 44-5-30. |

| Use Cases | This form is often used in situations like transferring property between family members or clearing up title issues. |

| Title Assurance | Unlike warranty deeds, quitclaim deeds do not provide any warranty on the title; the grantor simply transfers whatever interest they have. |

| Signature Requirements | The grantor must sign the quitclaim deed for it to be valid, and the signature must be notarized. |

| Recording | For the deed to be effective against third parties, it should be recorded in the county where the property is located. |

| Consideration | While consideration is often involved, it is not required for a quitclaim deed to be valid. |

| Revocation | A quitclaim deed cannot be revoked once it has been executed and delivered, except through mutual agreement or court order. |

Other Popular Quitclaim Deed State Forms

What Does a Deed Look Like in Nj - Commonly used in real estate transactions among partial owners.

Michigan Quit Claim Deed Pdf - A Quitclaim Deed facilitates easier transfers by removing the requirement for title guarantees.