Valid Promissory Note Form for Georgia State

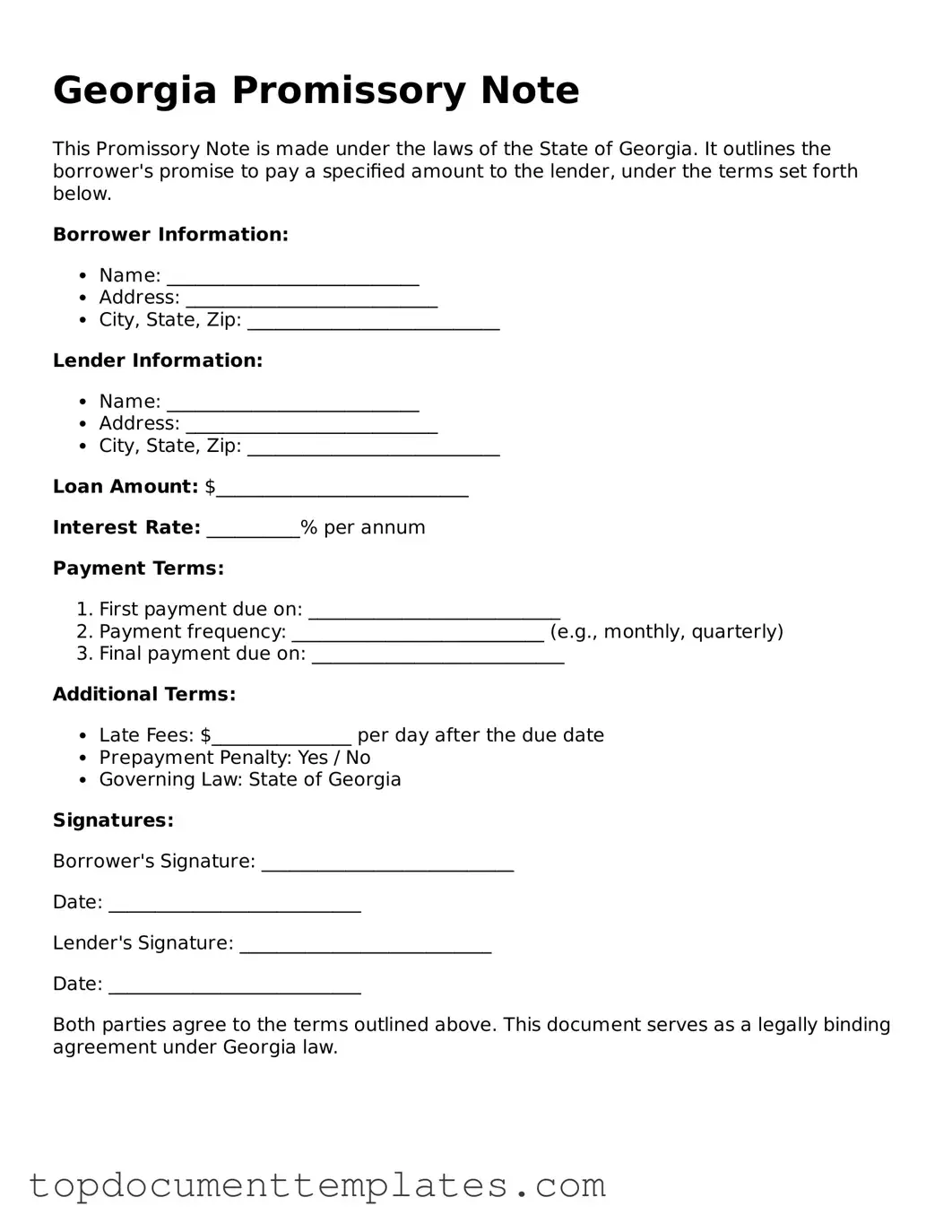

In the realm of financial transactions, the Georgia Promissory Note form plays a crucial role in establishing clear terms between lenders and borrowers. This legally binding document outlines the borrower's promise to repay a specified amount of money to the lender, detailing essential elements such as the principal amount, interest rate, and repayment schedule. It serves not only as a record of the loan but also as a protective measure for both parties involved. The form typically includes provisions regarding late fees, default conditions, and the governing law, ensuring that all parties understand their rights and obligations. By utilizing this form, individuals and businesses can navigate the complexities of borrowing and lending with confidence, fostering transparency and accountability in their financial dealings.

Similar forms

A Promissory Note is a financial document that outlines a promise to pay a specific amount of money to a designated person or entity under agreed-upon terms. Several other documents share similarities with a Promissory Note, particularly in their purpose of establishing financial obligations. Here are ten such documents:

- Loan Agreement: This document details the terms of a loan, including the amount borrowed, interest rates, and repayment schedule, similar to a Promissory Note.

- Mortgage: A mortgage is a type of loan secured by real property. Like a Promissory Note, it includes a promise to repay the borrowed amount, but it also outlines the collateral involved.

- Lease Agreement: In a lease, one party agrees to pay rent for the use of property owned by another. This agreement specifies payment terms and obligations, akin to the terms in a Promissory Note.

California Deed Form: To ensure proper transfer of property ownership, utilize the accurate California deed form instructions to comply with legal requirements.

- Security Agreement: This document grants a lender a security interest in the borrower's property. It establishes a promise to repay, similar to a Promissory Note, but also addresses collateral specifics.

- Installment Agreement: An installment agreement allows a buyer to pay for goods or services over time. It includes payment terms and obligations, paralleling the structure of a Promissory Note.

- Credit Agreement: This document outlines the terms under which credit is extended to a borrower, including repayment obligations, similar to a Promissory Note.

- Bond: A bond is a debt security where the issuer promises to pay back borrowed funds at a specified interest rate. This promise mirrors the commitment found in a Promissory Note.

- IOU (I Owe You): An informal document acknowledging a debt, an IOU includes the amount owed and the promise to repay, resembling the essence of a Promissory Note.

- Debt Settlement Agreement: This document outlines the terms under which a debtor agrees to repay a portion of their debt. It includes repayment terms, similar to those found in a Promissory Note.

- Personal Guarantee: This document involves an individual promising to repay a debt if the primary borrower defaults. It establishes a financial obligation akin to a Promissory Note.

Guidelines on Writing Georgia Promissory Note

After obtaining the Georgia Promissory Note form, you will need to fill it out carefully to ensure that all necessary information is included. Once completed, the document should be signed by both parties involved. This step is crucial for the note to be legally binding.

- Begin by entering the date at the top of the form.

- Provide the full name and address of the borrower in the designated section.

- Next, write the full name and address of the lender.

- Specify the principal amount being borrowed. This is the total amount that the borrower is agreeing to repay.

- Indicate the interest rate, if applicable. This should be stated as a percentage.

- Detail the repayment schedule, including the frequency of payments (e.g., monthly, bi-weekly) and the due date for the first payment.

- Include any additional terms or conditions that both parties have agreed upon. This could involve late fees or prepayment options.

- Both the borrower and lender should sign and date the form at the bottom. Ensure that each party receives a copy of the signed document.

File Information

| Fact Name | Description |

|---|---|

| Definition | A Georgia Promissory Note is a written promise to pay a specified amount of money to a designated person or entity at a specified time. |

| Governing Law | The Georgia Promissory Note is governed by the Georgia Uniform Commercial Code (UCC), specifically Title 11, Article 3. |

| Requirements | The note must include the date, the amount to be paid, the names of the parties involved, and the terms of repayment. |

| Enforceability | A properly executed promissory note is enforceable in a court of law, provided it meets all legal requirements. |

Other Popular Promissory Note State Forms

Notarized Promissory Note Sample - Promissory notes can vary widely in length and complexity, tailored to the specific loan scenario.

For those navigating the complex process of seeking asylum, resources such as TopTemplates.info can provide invaluable guidance on the correct completion of the USCIS I-589 form, ensuring that applicants present their case effectively and thereby increasing their chances of receiving the protection they need.

Promissory Note Download - Can be secured or unsecured, depending on the agreement.

Texas Promissory Note Requirements - They may also include clauses addressing what happens in the event of bankruptcy.

Iowa Promissory Note - It can be useful for tracking the repayment progress over time.