Valid Loan Agreement Form for Georgia State

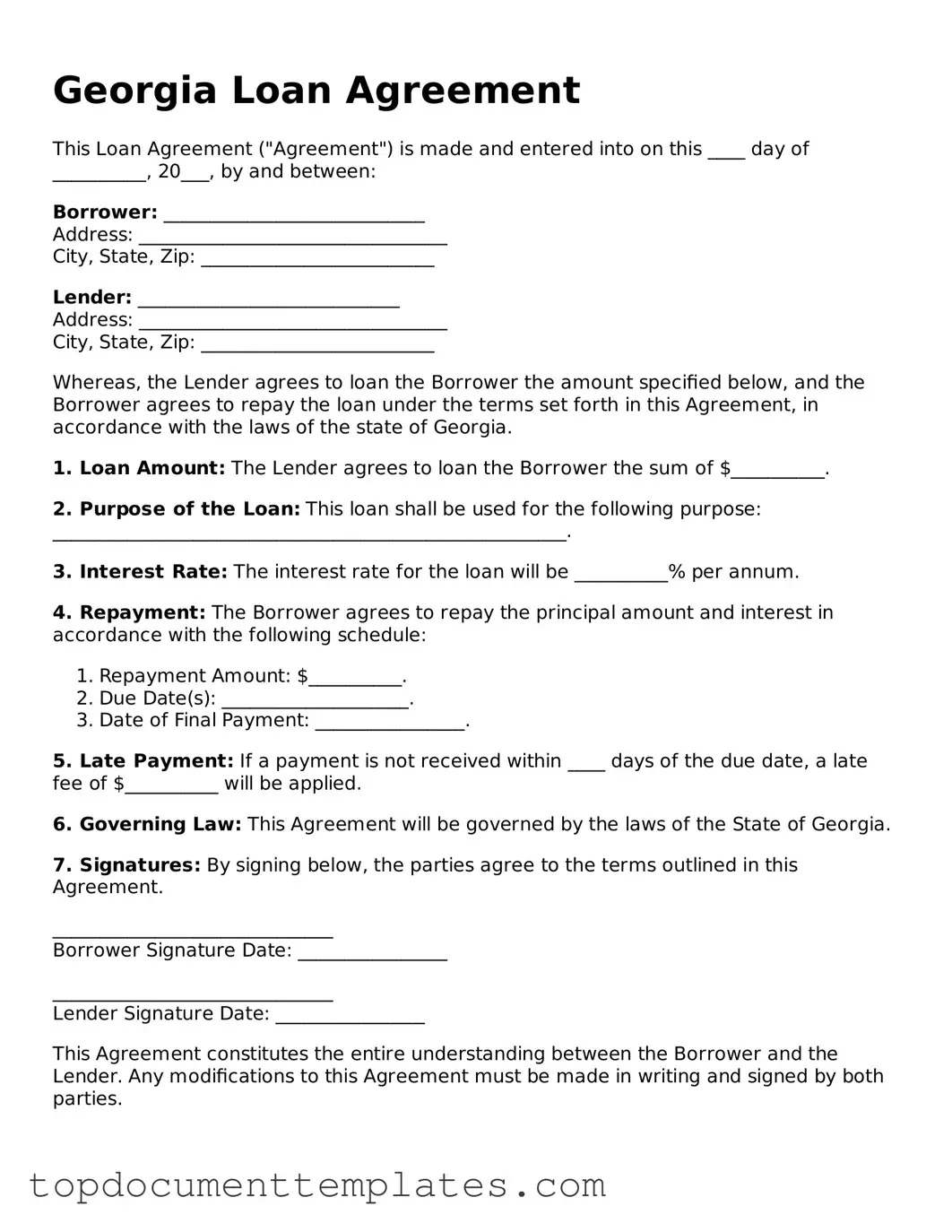

The Georgia Loan Agreement form serves as a crucial document in the lending process, outlining the terms and conditions agreed upon by both the borrower and the lender. This form typically includes essential details such as the loan amount, interest rate, repayment schedule, and any collateral involved. It also stipulates the rights and responsibilities of each party, ensuring clarity and reducing the potential for disputes. By addressing aspects like late fees, default consequences, and governing law, the agreement aims to protect both parties throughout the duration of the loan. Understanding these components is vital for anyone considering entering into a loan agreement in Georgia, as it lays the groundwork for a transparent and legally binding relationship between the lender and the borrower.

Similar forms

The Loan Agreement form shares similarities with several other financial documents. Each of these documents serves a specific purpose in the lending process, helping to clarify the terms and responsibilities of both parties involved. Here are four documents that are comparable to the Loan Agreement:

- Promissory Note: This document outlines the borrower's promise to repay the loan. It details the loan amount, interest rate, and repayment schedule, similar to a Loan Agreement. However, it typically does not include as many terms and conditions.

-

California Non-disclosure Agreement: This document is essential for establishing confidentiality in various business transactions. It ensures that entities sharing sensitive information under contractual obligations maintain the privacy of that information, emphasizing its critical role in protecting proprietary data, particularly in California's legal landscape. For more information, visit https://onlinelawdocs.com/.

- Security Agreement: Often used when collateral is involved, this document specifies the assets pledged by the borrower to secure the loan. Like the Loan Agreement, it defines the obligations of both parties but focuses more on the collateral aspect.

- Loan Disclosure Statement: This statement provides borrowers with essential information about the loan, including fees, interest rates, and terms. It complements the Loan Agreement by ensuring that borrowers fully understand their financial commitments.

- Credit Agreement: This document outlines the terms of a credit facility, such as a line of credit. While it serves a broader purpose, it shares similarities with the Loan Agreement in detailing the terms of borrowing and repayment obligations.

Guidelines on Writing Georgia Loan Agreement

Once you have the Georgia Loan Agreement form in front of you, it's time to fill it out accurately. This process involves providing specific information about the loan, the borrower, and the lender. Follow these steps to ensure that all necessary details are included.

- Begin by entering the date at the top of the form.

- Fill in the name and contact information of the lender.

- Provide the name and contact information of the borrower.

- Specify the loan amount in the designated space.

- Indicate the interest rate for the loan.

- State the repayment terms, including the duration of the loan and the payment schedule.

- Include any additional terms or conditions that apply to the loan.

- Both the lender and borrower should sign and date the form at the bottom.

File Information

| Fact Name | Description |

|---|---|

| Governing Law | The Georgia Loan Agreement is governed by the laws of the State of Georgia. |

| Purpose | This form is used to outline the terms of a loan between a lender and a borrower. |

| Parties Involved | The agreement identifies the lender and the borrower, including their legal names and addresses. |

| Loan Amount | The specific amount of money being loaned is clearly stated in the agreement. |

| Interest Rate | The form specifies the interest rate applicable to the loan, whether fixed or variable. |

| Repayment Terms | Details regarding the repayment schedule, including due dates and amounts, are included. |

| Default Conditions | The agreement outlines what constitutes a default and the consequences of such a default. |

| Governing Language | The form is typically written in clear and straightforward language to ensure understanding. |

| Signatures | Both parties must sign the agreement for it to be legally binding. |

| Amendments | Any changes to the agreement must be documented in writing and signed by both parties. |

Other Popular Loan Agreement State Forms

Florida Promissory Note Template - Payment methods and schedules are clearly designated within the form.

Promissory Note Template Texas - It is advisable to consult legal counsel before signing this form.

Promissory Note Template California Word - Personalize your agreement to reflect the unique terms of your loan situation.

For those navigating the complexities of the asylum process, it is crucial to understand the significance of the USCIS I-589 form. This official document not only details an applicant's fears but also plays a vital role in determining their safety in the U.S. To aid in this process, resources like TopTemplates.info provide valuable guidance on how to accurately complete the form, ensuring that all necessary information is conveyed effectively.

Promissory Note Template Illinois - Clarifies the rights and obligations of both the lender and borrower.