Valid Gift Deed Form for Georgia State

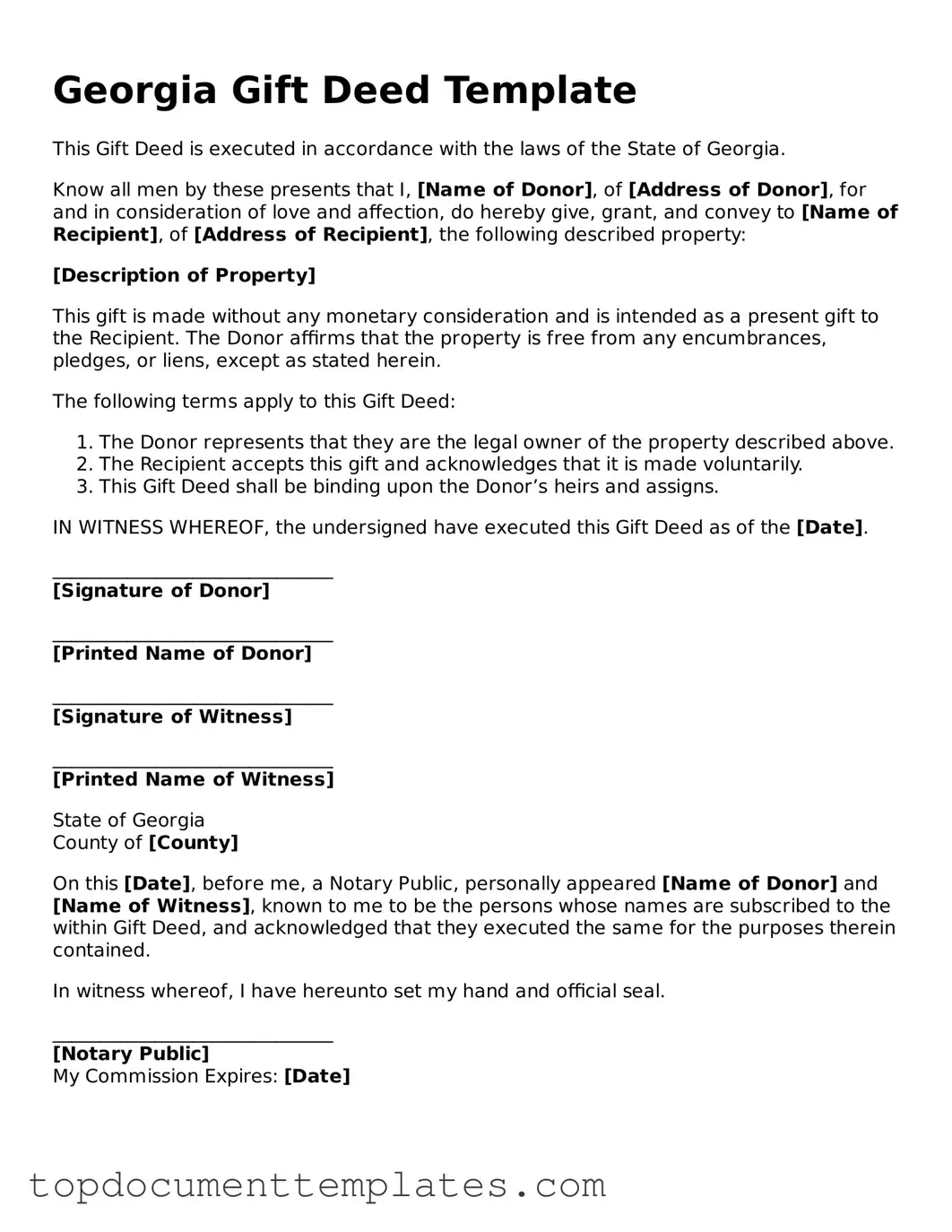

The Georgia Gift Deed form serves as a crucial legal instrument for individuals wishing to transfer property without any exchange of money. This document allows a property owner, known as the donor, to convey ownership of real estate to another person, referred to as the donee, as a gift. The form includes essential details such as the names and addresses of both parties, a clear description of the property being gifted, and the donor's intent to make the transfer without compensation. It is important to note that the gift must be made voluntarily and without any expectation of repayment. Additionally, the Gift Deed must be signed by the donor in the presence of a notary public to ensure its validity. Recording the deed with the local county office is also necessary to protect the donee's ownership rights and to provide public notice of the transfer. Understanding these elements is vital for anyone considering a property gift in Georgia, as it ensures that the process is executed smoothly and legally.

Similar forms

- Will: A will outlines how a person's assets should be distributed after their death. Like a gift deed, it involves the transfer of property but occurs posthumously rather than during the individual's lifetime.

- Trust Deed: A trust deed establishes a trust, allowing a trustee to manage assets for beneficiaries. Similar to a gift deed, it involves transferring ownership but focuses on management and distribution over time.

- Quitclaim Deed: A quitclaim deed transfers whatever interest a person has in a property without guaranteeing that interest is valid. Both documents facilitate the transfer of property but differ in the assurances provided.

- Warranty Deed: A warranty deed guarantees that the grantor has clear title to the property being transferred. While a gift deed does not typically include warranties, both serve to transfer property ownership.

- Sales Contract: A sales contract outlines the terms of a property sale, detailing the transfer of ownership in exchange for payment. Both documents involve the transfer of property, but a sales contract is transactional, while a gift deed is not.

- Lease Agreement: A lease agreement allows one party to use another's property for a specified time in exchange for rent. Both documents involve property rights but differ in ownership and duration of use.

- Power of Attorney: A power of attorney grants someone the authority to act on another's behalf in legal or financial matters. While it does not transfer property directly, it can facilitate transactions similar to those outlined in a gift deed.

- Deed of Trust: A deed of trust secures a loan by transferring property to a trustee until the debt is paid. Like a gift deed, it involves property transfer, but it is primarily used in financing contexts.

- Birth Certificate: The CDC U.S. Standard Certificate of Live Birth form is essential for officially registering a birth in the United States and is a crucial element in various legal and public health contexts. For more information, visit OnlineLawDocs.com.

- Affidavit of Heirship: An affidavit of heirship establishes the heirs of a deceased person's estate. Similar to a gift deed, it involves property rights but is used in the context of inheritance rather than gifting.

Guidelines on Writing Georgia Gift Deed

Filling out the Georgia Gift Deed form is an important step in transferring property ownership without a sale. After completing the form, it should be signed and notarized before being filed with the appropriate county office. This ensures that the transfer is legally recognized and properly recorded.

- Begin by entering the names of the grantor (the person giving the gift) and the grantee (the person receiving the gift) at the top of the form.

- Provide the current address of the grantor and the grantee. This information is crucial for identification purposes.

- Describe the property being gifted. Include details such as the property address, legal description, and any other identifying information.

- Indicate the date of the gift. This is important for legal records and tax purposes.

- Include any conditions or restrictions related to the gift, if applicable. This may affect how the property can be used in the future.

- Both the grantor and grantee must sign the form. Ensure that the signatures are clear and legible.

- Have the form notarized. A notary public will verify the identities of the signers and witness the signing.

- Submit the completed and notarized Gift Deed form to the county clerk's office where the property is located. Be sure to check if there are any filing fees required.

File Information

| Fact Name | Details |

|---|---|

| Definition | A Georgia Gift Deed is a legal document used to transfer property ownership as a gift without any exchange of money. |

| Governing Law | The Georgia Gift Deed is governed by Georgia state law, particularly O.C.G.A. § 44-5-30. |

| Parties Involved | The document involves two parties: the donor (the person giving the gift) and the donee (the person receiving the gift). |

| Consideration | Unlike other deeds, a Gift Deed does not require monetary consideration; the property is given freely. |

| Property Type | Real property, such as land or a house, can be transferred using a Gift Deed. |

| Signature Requirements | The deed must be signed by the donor in the presence of a notary public for it to be valid. |

| Tax Implications | Gift taxes may apply depending on the value of the property and the relationship between the donor and donee. |

| Recording | To ensure legal recognition, the Gift Deed should be recorded with the local county clerk’s office. |

| Revocability | Once executed, a Gift Deed is generally irrevocable unless specific conditions are included in the document. |

Other Popular Gift Deed State Forms

Gift Deed Form Texas - It's essential to ensure that the donor has the legal capacity to give the gift when executing the deed.

The IRS Form 2553 is used by small businesses to elect to be treated as an S Corporation for federal tax purposes, and for more detailed guidance, you can visit documentonline.org/blank-irs-2553/. This designation allows income, deductions, and credits to flow through to shareholders, thus avoiding double taxation. Completing this form correctly is essential for ensuring compliance and optimizing tax benefits.

How to Transfer Property Title to Family Member in California - Understanding the laws surrounding gifts in your state is crucial when filling out this form.