Valid Deed in Lieu of Foreclosure Form for Georgia State

The Georgia Deed in Lieu of Foreclosure form serves as a crucial legal instrument for homeowners facing financial hardship and potential foreclosure. This form allows a property owner to voluntarily transfer the title of their property to the lender, effectively settling the outstanding mortgage debt without the lengthy and often stressful foreclosure process. By utilizing this option, homeowners can mitigate the negative impact on their credit scores and may avoid additional legal fees associated with foreclosure proceedings. The form outlines essential details, including the property description, the parties involved, and any existing liens or encumbrances. Additionally, it may include provisions regarding the condition of the property at the time of transfer, ensuring both parties have a clear understanding of their responsibilities. This process not only provides a more amicable resolution for distressed homeowners but also enables lenders to reclaim their assets more efficiently. Understanding the implications and requirements of the Georgia Deed in Lieu of Foreclosure is vital for homeowners considering this route, as it can lead to a fresh start and a more manageable financial future.

Similar forms

- Loan Modification Agreement: This document alters the terms of an existing loan, similar to how a Deed in Lieu of Foreclosure transfers property ownership to the lender to avoid foreclosure.

- Short Sale Agreement: In a short sale, the lender agrees to accept less than the total amount owed on the mortgage. Both documents aim to mitigate losses for the lender and provide a solution for the homeowner.

- Forbearance Agreement: This agreement allows a borrower to temporarily pause or reduce payments, similar to a Deed in Lieu, which helps homeowners avoid foreclosure by providing an alternative solution.

- Quitclaim Deed: This document transfers ownership of property without warranties. Like a Deed in Lieu, it relinquishes the homeowner's claim to the property, often to resolve financial issues.

- Bankruptcy Filing: Filing for bankruptcy can stop foreclosure proceedings. Both options serve to protect the homeowner from losing their property while addressing financial distress.

- Release of Mortgage: This document releases the borrower from the mortgage obligation. It is similar to a Deed in Lieu, as both effectively end the borrower's responsibility for the debt.

- Power of Attorney Agreement: This document authorizes a designated person to make decisions on behalf of another, ensuring their preferences are honored. For more information, you can visit TopTemplates.info.

- Property Settlement Agreement: Often used in divorce cases, this agreement divides property between parties. Like a Deed in Lieu, it involves the transfer of ownership to resolve financial matters.

- Deed of Trust: This document secures a loan with the property as collateral. While a Deed in Lieu relinquishes the property, both documents are integral to the lending process and property rights.

Guidelines on Writing Georgia Deed in Lieu of Foreclosure

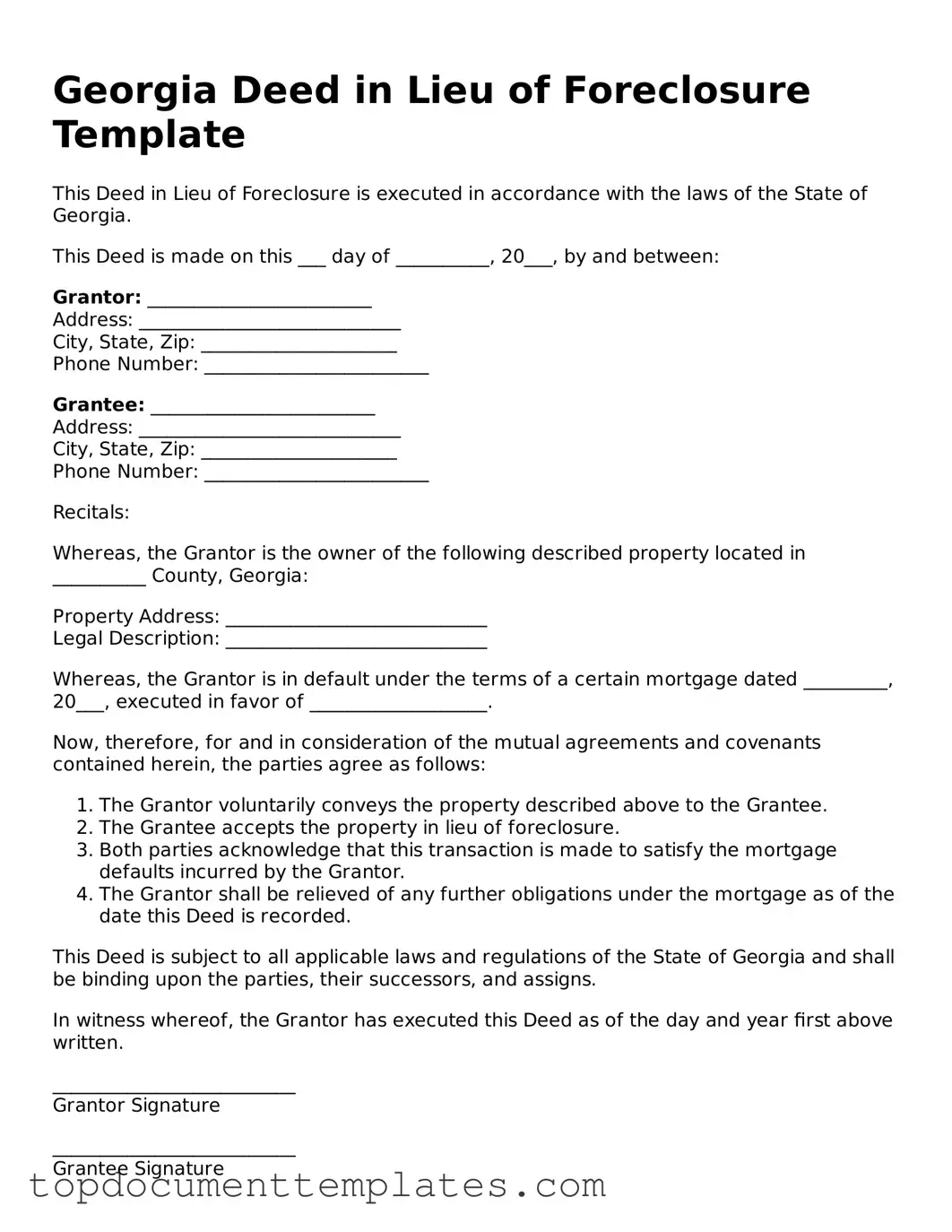

Filling out the Georgia Deed in Lieu of Foreclosure form is an important step in addressing your financial situation. After you complete the form, you will need to submit it to the appropriate parties involved in your mortgage. This process can help you move forward and start fresh.

- Begin by downloading the Georgia Deed in Lieu of Foreclosure form from a reliable source.

- At the top of the form, enter the date on which you are filling out the document.

- In the first section, provide the names of the parties involved. This includes your name as the borrower and the lender's name.

- Next, fill in the property address. Be sure to include the street number, street name, city, and zip code.

- Indicate the legal description of the property. This can usually be found on your mortgage documents or property deed.

- In the next section, write down any outstanding loan amounts that you owe to the lender.

- Sign the form in the designated area. Make sure to date your signature as well.

- Have the form notarized. This step is crucial to ensure that the document is legally binding.

- Once notarized, make copies of the signed form for your records.

- Finally, submit the completed form to your lender or the designated representative.

File Information

| Fact Name | Description |

|---|---|

| Definition | A Deed in Lieu of Foreclosure is a legal document where a borrower voluntarily transfers ownership of their property to the lender to avoid foreclosure. |

| Purpose | This form is used to simplify the foreclosure process and allow the borrower to walk away from the mortgage obligation. |

| Governing Law | The deed is governed by Georgia law, specifically O.C.G.A. § 44-14-162. |

| Eligibility | Borrowers who are facing financial difficulties and wish to avoid foreclosure may be eligible to use this form. |

| Mutual Agreement | Both the borrower and the lender must agree to the terms outlined in the deed. |

| Property Condition | The property must be in good condition, as the lender may require repairs before accepting the deed. |

| Impact on Credit | A Deed in Lieu of Foreclosure can negatively impact the borrower's credit score, though typically less than a foreclosure. |

| Tax Implications | Borrowers may face tax consequences related to any forgiven debt, so consulting a tax professional is advisable. |

| Process Duration | The process can be quicker than traditional foreclosure, potentially taking a few weeks to a couple of months. |

Other Popular Deed in Lieu of Foreclosure State Forms

The Loan Servicer Might Agree to Put the Foreclosure on Hold to Give You Some Time to Sell Your Home - In many cases, lenders still retain the right to pursue any remaining balances after the property transfer.

The Loan Servicer Might Agree to Put the Foreclosure on Hold to Give You Some Time to Sell Your Home - A Deed in Lieu can facilitate a fresh financial start for homeowners needing to relinquish their property.

California Voluntary Foreclosure Deed - This option might work best for those with little equity in their homes, making foreclosure less impactful.

A Motor Vehicle Bill of Sale form is a legal document that records the sale of a vehicle between a buyer and a seller in the state of Illinois. This form serves as proof of ownership transfer and includes important details about the vehicle and transaction. For more information about the form and to access a template, visit https://documentonline.org/blank-illinois-motor-vehicle-bill-of-sale/. Understanding its purpose can help protect both parties and simplify the sale process.

Deed in Lieu Vs Foreclosure - It can help mitigate damage to a homeowner's credit score compared to a formal foreclosure.