Blank Generic Direct Deposit PDF Form

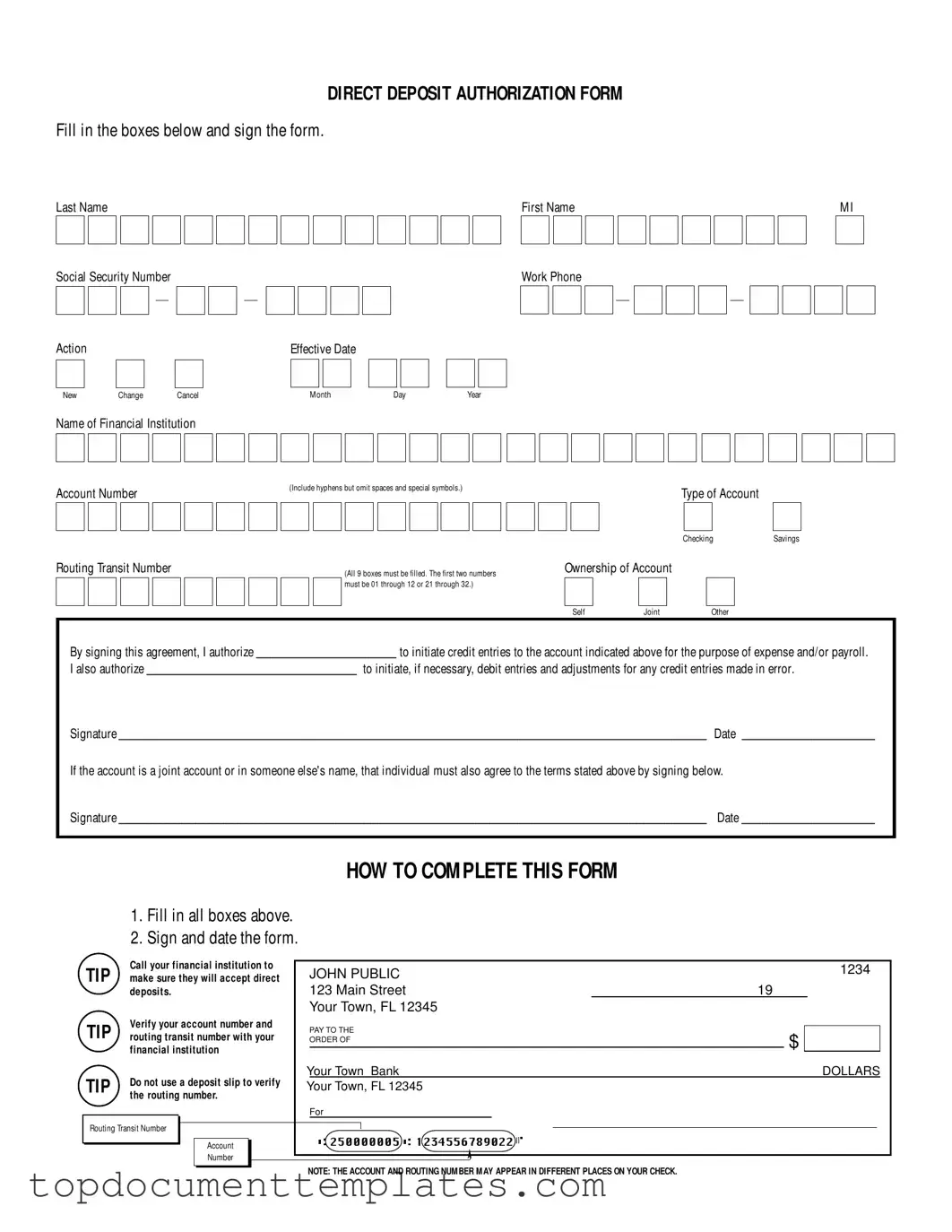

The Generic Direct Deposit form is a vital tool for individuals seeking to streamline their payment processes, whether for payroll or expense reimbursements. This form allows users to authorize their employers or organizations to deposit funds directly into their bank accounts, eliminating the need for paper checks. Key components of the form include personal identification fields such as last name, first name, and Social Security number, which help verify the individual's identity. Users must specify whether they are setting up a new direct deposit, making changes to an existing one, or canceling a previous authorization. Additionally, the form requires details about the financial institution, including the name, account number, and routing transit number, ensuring that funds are accurately directed to the correct account. It also distinguishes between account types, allowing users to choose either a savings or checking account. The authorization section mandates signatures from both the account holder and, if applicable, any joint account holders, confirming their agreement to the terms outlined. Clear instructions guide users on how to complete the form properly, emphasizing the importance of verifying account details with the financial institution to avoid errors. Overall, this form simplifies the direct deposit setup process, making it accessible for a wide range of users.

Similar forms

-

W-4 Form: This form is used by employees to indicate their tax situation to their employer. Like the Direct Deposit form, it requires personal information such as your name and Social Security Number. Both forms need to be filled out accurately to ensure proper processing of payments.

- California Real Estate Purchase Agreement Form: For those involved in real estate transactions, the California real estate purchase agreement insights provide essential guidance on formalizing property agreements.

-

Paycheck Authorization Form: This document allows employees to authorize their employer to deposit their paycheck directly into their bank account. Similar to the Direct Deposit form, it includes details about the bank account and requires a signature for authorization.

-

Automatic Bill Payment Authorization: This form enables individuals to set up automatic payments for recurring bills. Like the Direct Deposit form, it requires bank account information and authorization to withdraw funds. Both forms facilitate electronic transactions.

-

Direct Deposit Change Form: This document is specifically for changing existing direct deposit information. It shares similarities with the Generic Direct Deposit form as it also requires personal and banking details, along with a signature to confirm the changes.

-

Bank Account Application: When opening a new bank account, individuals fill out an application that includes personal information and account preferences. This form, like the Direct Deposit form, collects essential details to set up financial services and requires identification verification.

Guidelines on Writing Generic Direct Deposit

After completing the Generic Direct Deposit form, you will need to submit it to your employer or the appropriate payroll department. Make sure to double-check all entries for accuracy to avoid any delays in processing your direct deposit.

- Fill in your Last Name, First Name, and Middle Initial in the designated boxes.

- Enter your Social Security Number in the format XXX-XX-XXXX.

- Select the Action you wish to take: New, Change, or Cancel.

- Provide the Effective Date by filling in the month, day, and year.

- Input your Work Phone number in the format XXX-XXX-XXXX.

- Write the Name of Financial Institution where your account is held.

- Fill in your Account Number, including hyphens but omitting spaces and special symbols.

- Select the type of account: Savings or Checking.

- Enter the Routing Transit Number, ensuring all nine boxes are filled correctly. The first two numbers must be between 01-12 or 21-32.

- Indicate the Ownership of Account by checking the appropriate box: Self, Joint, or Other.

- Sign the form in the designated area to authorize your employer to initiate credit entries to your account.

- Date your signature.

- If applicable, have the co-owner of a joint account sign and date the form as well.

Before submitting, consider calling your financial institution to confirm they accept direct deposits. Additionally, verify your account and routing numbers to ensure accuracy. Avoid using a deposit slip for verification, as the information may appear in different places on your check.

Form Data

| Fact Name | Fact Description |

|---|---|

| Purpose | The Generic Direct Deposit form authorizes the electronic transfer of funds into a bank account. |

| Personal Information | Users must provide their last name, first name, middle initial, and Social Security number. |

| Action Options | The form allows for three actions: New, Change, or Cancel. |

| Effective Date | Users must specify the effective date for the direct deposit changes. |

| Account Information | Account details required include the financial institution's name, account number, and routing transit number. |

| Account Type | Users must indicate whether the account is a Checking or Savings account. |

| Ownership | The form includes options for account ownership: Self, Joint, or Other. |

| Signature Requirement | A signature is required to authorize the initiation of credit entries and any necessary adjustments. |

| Joint Accounts | If the account is joint, the co-owner must also sign the form to agree to the terms. |

Other PDF Documents

Florida Metropolitan University Transcripts - Each section of the form is important for accurate processing.

A Florida Non-disclosure Agreement form is a legal document that businesses in Florida use to safeguard their confidential information. It ensures that the recipient of this information does not disclose it to anyone outside of the agreement. This form plays a crucial role in protecting trade secrets and maintaining competitive advantages, and resources like OnlineLawDocs.com can provide further assistance in drafting these agreements.

Affidavit of Death of Joint Tenant - The affidavit promotes clarity in joint ownership situations after a loss.

Passport Update - For assistance or feedback, visit the official website or contact the department directly.