Valid Transfer-on-Death Deed Form for Florida State

The Florida Transfer-on-Death Deed form offers a straightforward method for property owners to ensure their real estate passes directly to designated beneficiaries upon their death, bypassing the probate process. This legal instrument allows individuals to maintain full control of their property during their lifetime while providing peace of mind regarding its future distribution. By completing this form, property owners can specify who will inherit their property, which can simplify estate planning and reduce potential conflicts among heirs. Importantly, the deed must be executed and recorded in accordance with Florida law to be effective. Understanding the requirements and implications of this deed is crucial for anyone considering this option as part of their estate planning strategy.

Similar forms

- Will: A will outlines how a person's assets should be distributed after their death. Like a Transfer-on-Death Deed, it allows individuals to specify beneficiaries, but a will must go through probate, while a Transfer-on-Death Deed does not.

- Living Trust: A living trust holds assets during a person's lifetime and specifies how they should be managed and distributed after death. Both documents allow for a smooth transfer of assets, but a living trust requires more management and can be more complex.

- Beneficiary Designation: This document is often used for financial accounts, such as life insurance policies or retirement accounts. Similar to a Transfer-on-Death Deed, it allows individuals to name beneficiaries who will receive assets directly upon death, avoiding probate.

- Joint Tenancy with Right of Survivorship: This form of property ownership allows two or more people to own property together. When one owner dies, the surviving owner automatically receives full ownership, similar to how a Transfer-on-Death Deed transfers property directly to the designated beneficiary.

- California Deed Form: For those involved in real estate transactions, understanding our essential California deed form details is crucial for ensuring property ownership is accurately transferred and recorded.

- Payable-on-Death (POD) Accounts: These accounts allow individuals to name a beneficiary who will receive the account balance upon the account holder's death. Like a Transfer-on-Death Deed, POD accounts bypass probate and directly transfer assets to the named beneficiary.

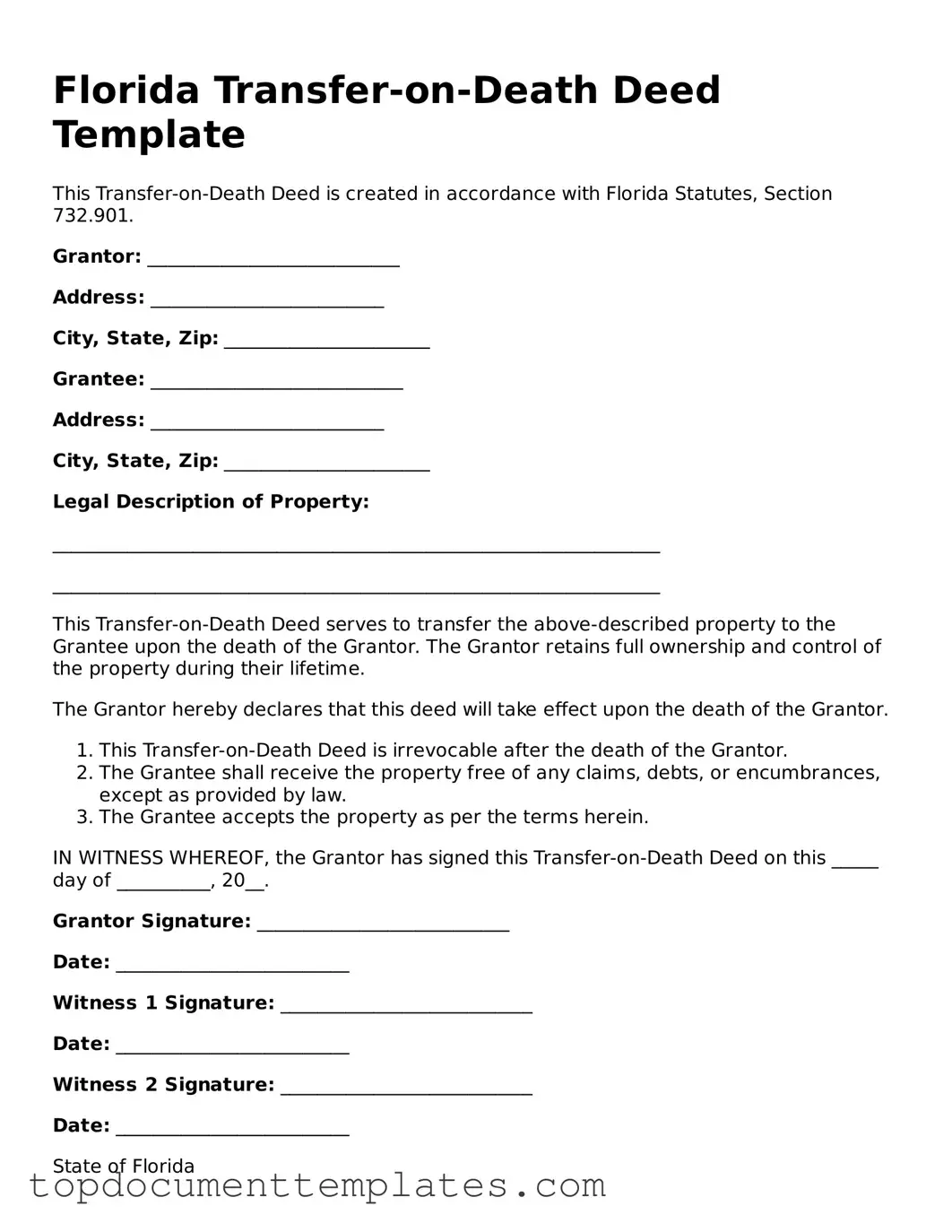

Guidelines on Writing Florida Transfer-on-Death Deed

Filling out the Florida Transfer-on-Death Deed form is a straightforward process. After completing the form, you will need to file it with the appropriate county clerk's office to ensure it is legally recognized. Follow these steps to fill out the form accurately.

- Begin by entering your name as the current owner of the property. Make sure to include any middle initials or suffixes, if applicable.

- Next, provide the property address. This should include the street number, street name, city, state, and zip code.

- Identify the legal description of the property. This can usually be found on your property tax bill or deed. It may include lot numbers, block numbers, and subdivision names.

- Designate the beneficiary. Write the full name of the person or entity who will inherit the property upon your passing. Include their relationship to you, if relevant.

- If there are multiple beneficiaries, list them all in the order you wish them to inherit the property. Be clear about how the property should be divided among them.

- Sign and date the form. Your signature must match the name you provided at the beginning of the form.

- Have the form notarized. This step is crucial for the deed to be legally binding. A notary public will verify your identity and witness your signature.

- Finally, file the completed form with the county clerk's office where the property is located. Check for any filing fees that may apply.

File Information

| Fact Name | Details |

|---|---|

| Definition | A Transfer-on-Death Deed allows property owners in Florida to transfer real estate to beneficiaries upon their death without going through probate. |

| Governing Law | The Florida Transfer-on-Death Deed is governed by Florida Statutes, Chapter 732.401, which outlines the rules for such deeds. |

| Execution Requirements | The deed must be signed by the property owner and witnessed by two individuals to be valid. |

| Revocation | Property owners can revoke a Transfer-on-Death Deed at any time by executing a new deed or a formal revocation document. |

| Tax Implications | Beneficiaries typically do not incur taxes on the transfer until they sell the property, making this a potentially tax-efficient option. |

Other Popular Transfer-on-Death Deed State Forms

How to Avoid Probate in Georgia - This is an ideal tool for those wanting to avoid probate but still control their property while alive.

Completing and submitting the California Homeschool Letter of Intent form is an essential step for parents who are choosing to homeschool their children, as it informs the school district of their decision. This document plays a key role in ensuring adherence to California's educational requirements. For more detailed guidance on this process, you can visit onlinelawdocs.com/.

Survivorship Deed Vs Transfer on Death - This deed simplifies the transfer process and avoids the lengthy probate process for your loved ones.

Death Deed - This option is especially useful for individuals concerned about family dynamics posthumously.

How to Avoid Probate in New Jersey - A Transfer-on-Death Deed can be revoked or changed at any time before the owner's death.