Valid Promissory Note Form for Florida State

In the realm of financial transactions, the Florida Promissory Note form stands out as a crucial document for individuals and businesses alike. This legally binding agreement outlines the terms under which one party agrees to pay a specific sum of money to another, establishing clear expectations and responsibilities. The form typically includes essential details such as the principal amount, interest rate, repayment schedule, and any applicable late fees. Importantly, it also specifies the consequences of default, ensuring that both parties are aware of their rights and obligations. Whether used for personal loans, business financing, or real estate transactions, the Florida Promissory Note serves as a safeguard, fostering trust and clarity in lending relationships. Understanding its components and implications can empower borrowers and lenders to navigate their financial agreements with confidence.

Similar forms

- Loan Agreement: A loan agreement outlines the terms and conditions of a loan, including the repayment schedule, interest rate, and consequences of default. Like a promissory note, it serves as a formal acknowledgment of the debt.

- Mortgage: A mortgage secures a loan with real property. It includes terms of repayment and obligations of the borrower, similar to how a promissory note details the borrower's promise to repay.

- Installment Agreement: This document specifies a payment plan for a debt, detailing the amount and frequency of payments. It shares the same goal of ensuring repayment, akin to a promissory note.

- Incorporation Document: Similar to a Promissory Note in its legal significance, this document is essential for establishing a corporation. It provides foundational details required for legal registration, comparable to the role played by https://onlinelawdocs.com/ in guiding business owners through the incorporation process.

- Personal Guarantee: A personal guarantee involves an individual promising to repay a debt if the primary borrower defaults. This document reinforces the commitment to repay, similar to a promissory note.

- Security Agreement: A security agreement grants a lender a security interest in collateral. It defines the terms of the loan and the borrower's obligations, paralleling the structure of a promissory note.

- Debt Acknowledgment: This document confirms the existence of a debt and the borrower's obligation to repay it. It serves a similar purpose to a promissory note by formally recognizing the debt.

- Credit Agreement: A credit agreement outlines the terms of a line of credit, including repayment terms. It functions similarly to a promissory note by detailing the borrower's obligations.

- Loan Commitment Letter: This letter from a lender indicates the terms under which they agree to lend money. It shares similarities with a promissory note by setting expectations for repayment.

- Repayment Plan: A repayment plan lays out how a borrower intends to pay back a debt over time. It mirrors the repayment structure found in a promissory note.

- Letter of Credit: A letter of credit is a financial document that guarantees payment to a seller upon meeting specific conditions. It shares the essence of guaranteeing repayment, much like a promissory note does for a borrower.

Guidelines on Writing Florida Promissory Note

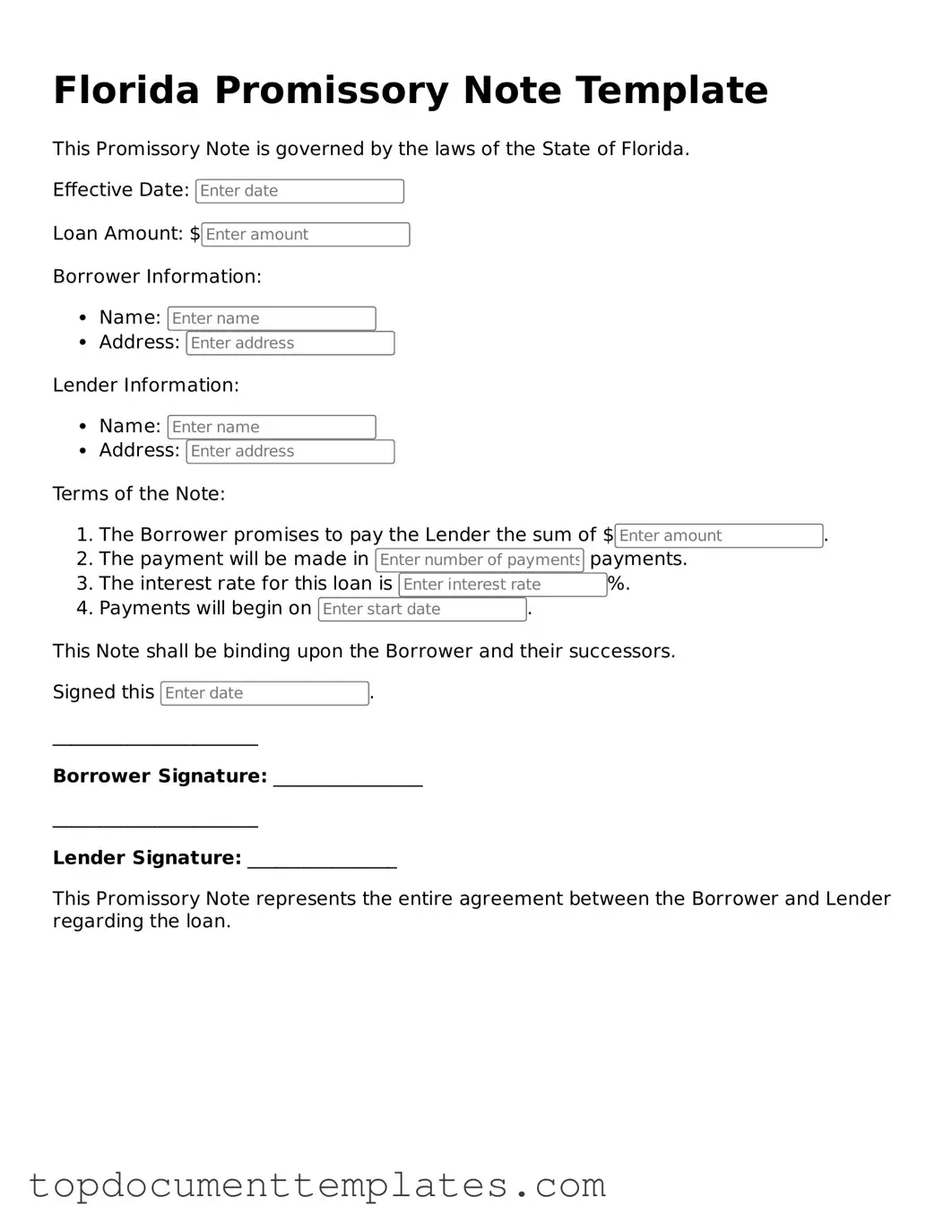

Once you have the Florida Promissory Note form in hand, it's time to complete it accurately. Follow these steps to ensure that all necessary information is filled out correctly. This will help facilitate the agreement between the parties involved.

- Identify the parties: Write the full legal names of the borrower and the lender at the top of the form.

- Specify the loan amount: Clearly state the total amount of money being borrowed.

- Set the interest rate: Indicate the interest rate applicable to the loan. If there is no interest, specify that as well.

- Define the repayment terms: Outline the schedule for repayment, including the due dates and frequency (e.g., monthly, quarterly).

- Include any late fees: State any penalties for late payments, if applicable.

- Signatures: Both the borrower and lender must sign and date the form to make it legally binding.

- Witness or notarization: Depending on your situation, you may need a witness or notary to validate the signatures.

After completing the form, review it for accuracy. Ensure that all information is correct and that both parties understand the terms before finalizing the agreement.

File Information

| Fact Name | Description |

|---|---|

| Definition | A Florida Promissory Note is a written promise to pay a specific amount of money to a designated person or entity at a defined time. |

| Governing Law | Florida Statutes Chapter 673 governs promissory notes in Florida. |

| Parties Involved | The note involves two primary parties: the borrower (maker) and the lender (payee). |

| Interest Rates | Interest rates can be specified in the note, and they must comply with Florida's usury laws. |

| Payment Terms | Payment terms, including due dates and installment amounts, should be clearly outlined in the note. |

| Default Clauses | Provisions for default can be included, detailing the consequences if the borrower fails to make payments. |

| Signatures | Both parties must sign the promissory note for it to be legally binding, and notarization is recommended. |

Other Popular Promissory Note State Forms

Illinois Promissory Note - A Promissory Note often includes the lender's rights in case of default.

Iowa Promissory Note - It usually includes the date when the note was created and signed.

For those navigating the complexities of separation, understanding the California Marital Separation Agreement can be invaluable. This form provides essential clarity regarding the terms of your separation, ensuring both parties are informed of their rights and responsibilities. For more information about this critical document, please visit the California Marital Separation Agreement guidelines.

Texas Promissory Note Requirements - In a secured note, specific assets are pledged as a guarantee for repayment.