Valid Power of Attorney Form for Florida State

In Florida, the Power of Attorney form serves as a crucial legal document that allows an individual, known as the principal, to designate another person, referred to as the agent or attorney-in-fact, to make decisions on their behalf. This form can be tailored to meet specific needs, whether for financial matters, healthcare decisions, or other personal affairs. One of the key features of the Florida Power of Attorney is its ability to grant broad or limited powers, depending on the principal's preferences. It is important to understand that the document must be executed with certain formalities, including the principal's signature and the presence of witnesses, to ensure its validity. Additionally, the form can be durable, meaning it remains effective even if the principal becomes incapacitated, or it can be non-durable, which terminates upon the principal's incapacity. Understanding the implications of each type is essential for anyone considering this legal tool. Furthermore, the Power of Attorney can be revoked at any time, provided the principal is mentally competent, allowing for flexibility and control over one's personal affairs. As such, navigating the nuances of the Florida Power of Attorney form is vital for ensuring that individuals can effectively manage their legal and financial responsibilities, especially in times of need.

Similar forms

- Living Will: Similar to a Power of Attorney, a living will outlines an individual's preferences for medical treatment in situations where they cannot communicate their wishes. It focuses specifically on healthcare decisions, while a Power of Attorney can cover a broader range of financial and legal matters.

- Health Care Proxy: This document allows someone to make medical decisions on behalf of another person if they are unable to do so. Like a Power of Attorney, it grants authority to act, but it is specifically limited to health-related decisions.

- Durable Power of Attorney: This is a specific type of Power of Attorney that remains effective even if the principal becomes incapacitated. It shares the same purpose of granting authority but emphasizes its durability in the face of incapacity.

- Financial Power of Attorney: This document specifically grants authority to manage financial matters. It is a subset of the broader Power of Attorney, focusing solely on financial transactions, such as managing bank accounts or paying bills.

- Trust Agreement: A trust agreement allows a person (the trustee) to manage assets on behalf of another (the beneficiary). While a Power of Attorney authorizes someone to act on behalf of another, a trust establishes a legal arrangement for asset management and distribution.

- Will: A will outlines how a person's assets should be distributed after their death. While a Power of Attorney is effective during a person’s life, a will only takes effect upon death, making them complementary documents in estate planning.

- Advance Directive: An advance directive encompasses both living wills and health care proxies. It provides a comprehensive approach to making healthcare decisions, similar to how a Power of Attorney allows for broader decision-making authority.

Guidelines on Writing Florida Power of Attorney

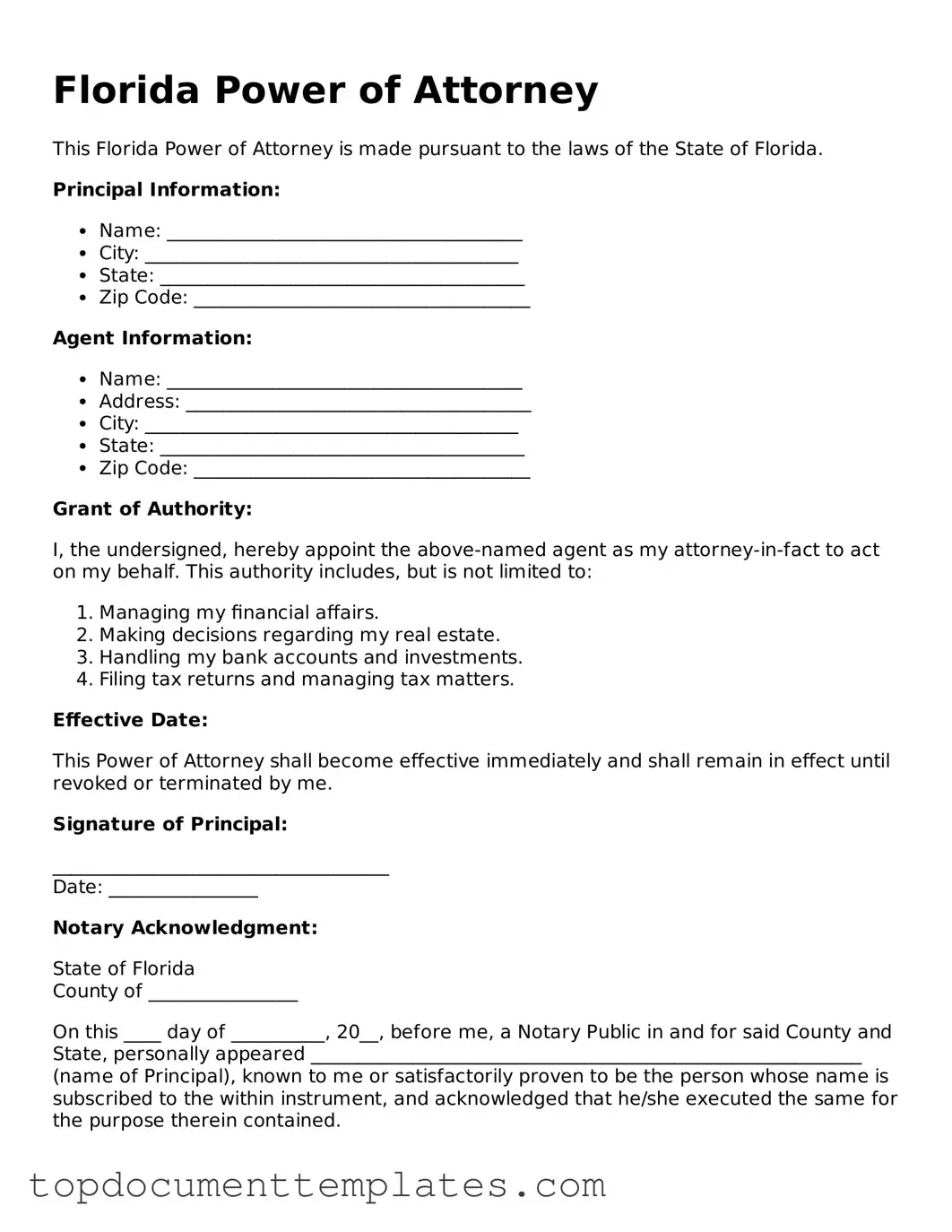

After obtaining the Florida Power of Attorney form, it's important to fill it out carefully to ensure that it accurately reflects your intentions. Follow these steps to complete the form correctly.

- Begin by entering your name and address in the designated section at the top of the form. This identifies you as the principal.

- Next, provide the name and address of the person you are appointing as your agent. This individual will have the authority to act on your behalf.

- Specify the powers you wish to grant to your agent. You can choose general powers or limit them to specific actions, such as managing financial matters or making healthcare decisions.

- Indicate whether the Power of Attorney will be effective immediately or if it will become effective at a later date. If it’s the latter, specify the date or event that will trigger its activation.

- Include any additional instructions or limitations you want to impose on your agent’s authority, if applicable.

- Sign and date the form in the presence of a notary public. This step is crucial for the validity of the document.

- Finally, provide a copy of the completed form to your agent and any relevant institutions or individuals who may need it.

File Information

| Fact Name | Description |

|---|---|

| Definition | A Florida Power of Attorney is a legal document that allows an individual (the principal) to appoint another person (the agent) to make decisions on their behalf. |

| Governing Law | The Florida Power of Attorney is governed by Florida Statutes, specifically Chapter 709. |

| Durable Power of Attorney | A durable power of attorney remains effective even if the principal becomes incapacitated, provided it includes specific language indicating durability. |

| Revocation | The principal can revoke the power of attorney at any time, as long as they are mentally competent to do so. |

| Agent's Authority | The authority granted to the agent can be broad or limited, depending on the specific powers outlined in the document. |

| Notarization Requirements | In Florida, a power of attorney must be signed in the presence of a notary public and two witnesses to be valid. |

Other Popular Power of Attorney State Forms

Financial Power of Attorney Michigan - Can cover real estate transactions, banking, and investments.

Durable Power of Attorney Arizona - Your Power of Attorney can be effective until you decide to change or revoke it.

How to Get Power of Attorney for Elderly Parent in Georgia - This form can offer peace of mind knowing decisions will be made as desired.