Valid Loan Agreement Form for Florida State

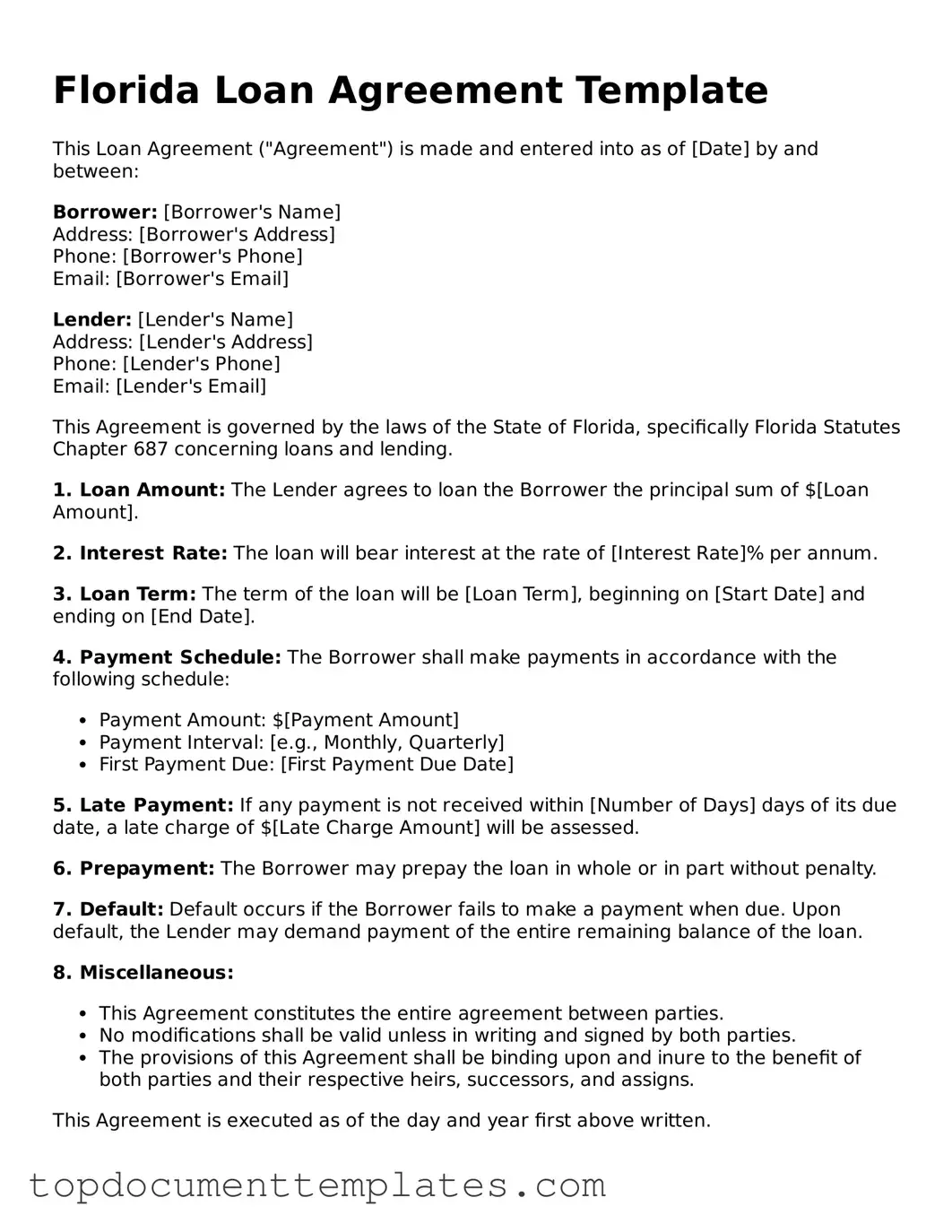

When entering into a loan agreement in Florida, understanding the essential components of the loan agreement form is crucial for both borrowers and lenders. This document serves as a binding contract that outlines the terms and conditions of the loan, including the principal amount borrowed, interest rates, repayment schedules, and any collateral involved. Additionally, it specifies the rights and responsibilities of each party, ensuring clarity and protection in the lending process. Provisions regarding late fees, default consequences, and dispute resolution methods are also typically included, providing a comprehensive framework for the financial transaction. By carefully reviewing and understanding this form, individuals can navigate the lending landscape with greater confidence, minimizing the risk of misunderstandings or legal complications down the line.

Similar forms

- Promissory Note: This document outlines a borrower's promise to repay a loan, specifying the amount borrowed, interest rate, and repayment schedule. It serves as evidence of the debt and can be used in legal proceedings if necessary.

- Mortgage Agreement: Similar to a loan agreement, this document secures a loan with real property as collateral. It details the terms of the loan and the rights of both the lender and borrower regarding the property.

- Security Agreement: This document establishes a security interest in personal property. It is used when a borrower offers specific assets as collateral for a loan, outlining the rights of the lender in case of default.

- Lease Agreement: While primarily used for rental situations, a lease agreement can resemble a loan agreement in that it details payment terms and obligations. It outlines the responsibilities of both the landlord and tenant, similar to the roles of lender and borrower.

- Credit Agreement: This document governs the terms under which a lender extends credit to a borrower. It includes repayment terms, interest rates, and conditions for default, similar to a loan agreement.

-

Marital Separation Agreement: This legally binding document outlines the terms of separation between spouses in Arizona, including division of assets, debts, and, if applicable, custody arrangements. Completing this form can simplify the separation process, ensure fairness, and help avoid disputes in the future. For those ready to take this step towards formal separation in Arizona, filling out the form is made easy by clicking the button below. For more information, visit All Arizona Forms.

- Personal Loan Agreement: This type of agreement specifically pertains to loans between individuals. It includes terms such as the loan amount, repayment schedule, and any interest, mirroring the structure of a formal loan agreement.

Guidelines on Writing Florida Loan Agreement

Once you have the Florida Loan Agreement form in hand, it's time to fill it out carefully. This document requires specific information to ensure that both parties understand their rights and responsibilities. Follow the steps below to complete the form accurately.

- Begin by entering the date at the top of the form. This should be the date on which you are filling out the agreement.

- Next, provide the names of both the lender and the borrower. Ensure that the names are spelled correctly and match the identification documents.

- In the following section, fill in the address of both parties. Include street addresses, city, state, and zip codes.

- Specify the loan amount in numerical and written form. This helps to avoid any confusion regarding the total sum being borrowed.

- Detail the interest rate applicable to the loan. Clearly indicate whether it is fixed or variable and provide the percentage.

- Indicate the repayment terms, including the payment schedule, such as monthly or bi-weekly payments, and the total duration of the loan.

- Include any collateral information if applicable. Describe what assets, if any, are being used to secure the loan.

- Both parties should review the default terms. Clearly state what happens if the borrower fails to repay the loan as agreed.

- Finally, ensure that both parties sign and date the document at the bottom. This signifies that both agree to the terms outlined in the agreement.

File Information

| Fact Name | Details |

|---|---|

| Governing Law | The Florida Loan Agreement is governed by the laws of the State of Florida. |

| Purpose | This form is used to outline the terms and conditions of a loan between a lender and a borrower. |

| Key Components | It typically includes details such as loan amount, interest rate, repayment schedule, and default terms. |

| Signature Requirement | Both parties must sign the agreement to ensure its enforceability. |

| Dispute Resolution | The agreement may include provisions for mediation or arbitration in the event of a dispute. |

Other Popular Loan Agreement State Forms

Georgia Promissory Note - This form sets clear conditions for defaulting on the loan.

Promissory Note Template Illinois - Indicates how disbursement of funds will occur after signing.

Creating and maintaining an accurate Dnd Character Sheet form is crucial for every player, as it allows them to reference important details quickly and efficiently during gameplay. For those looking to keep their character information organized, resources like OnlineLawDocs.com provide helpful templates and tools that streamline the process, ensuring that every aspect of a character's abilities and backstory is easily accessible and well-documented.

Promissory Note Template California Word - It may include any fees associated with the loan, such as origination fees.