Valid Lady Bird Deed Form for Florida State

In the vibrant landscape of Florida real estate, the Lady Bird Deed has emerged as a powerful tool for property owners seeking to navigate the complexities of estate planning. This unique form allows individuals to transfer their property to loved ones while retaining the right to live in and control the property during their lifetime. One of its most appealing features is the ability to avoid probate, which can be a lengthy and costly process. With the Lady Bird Deed, property owners can ensure a seamless transition of ownership upon their passing, all while maintaining the flexibility to change their minds or make adjustments as needed. This deed not only provides peace of mind but also offers potential tax advantages, making it an attractive option for many. Understanding the nuances of the Lady Bird Deed can empower individuals to make informed decisions about their property and legacy.

Similar forms

The Lady Bird Deed is a unique estate planning tool, but it shares similarities with several other legal documents. Each of these documents serves specific purposes in property transfer and estate management. Here are ten documents that are similar to the Lady Bird Deed:

- Will: A will outlines how a person's assets will be distributed after their death. Like a Lady Bird Deed, it addresses property transfer but does so through the probate process.

- Trust: A trust allows for the management of assets during a person's lifetime and after their death. It provides more control over how assets are distributed, similar to the intent behind a Lady Bird Deed.

- ATV Bill of Sale: This document ensures the legal transfer of ownership for all-terrain vehicles. For more information, visit documentonline.org/blank-new-york-atv-bill-of-sale/.

- Quitclaim Deed: This document transfers ownership of property without any warranties. It is straightforward, like a Lady Bird Deed, but does not offer the same level of control or benefits for retaining rights during the grantor's lifetime.

- Life Estate Deed: A life estate deed allows a person to retain the right to use the property during their lifetime, similar to the Lady Bird Deed. However, it typically does not provide the same flexibility regarding property sale or mortgage.

- Transfer on Death Deed (TOD): This deed allows property to pass directly to a beneficiary upon the owner's death, bypassing probate. It shares the same goal of simplifying property transfer as the Lady Bird Deed.

- Power of Attorney: A power of attorney grants someone authority to make decisions on behalf of another person. While it does not transfer property directly, it can be used in conjunction with a Lady Bird Deed to manage property during the grantor's lifetime.

- Beneficiary Designation: This document specifies who will receive certain assets upon death, similar to how a Lady Bird Deed designates heirs for property. It simplifies the transfer process but is limited to certain types of assets.

- Deed of Trust: A deed of trust secures a loan with real estate as collateral. It is similar to a Lady Bird Deed in that it involves property rights, but it primarily serves as a financial instrument rather than an estate planning tool.

- Joint Tenancy Deed: This deed allows two or more people to own property together, with rights of survivorship. Like a Lady Bird Deed, it facilitates the transfer of property upon the death of one owner, but it also involves shared ownership during life.

- Community Property Agreement: This agreement allows spouses to manage their community property together. It is similar to the Lady Bird Deed in that it addresses property rights and transfers but is specific to married couples and their shared assets.

Guidelines on Writing Florida Lady Bird Deed

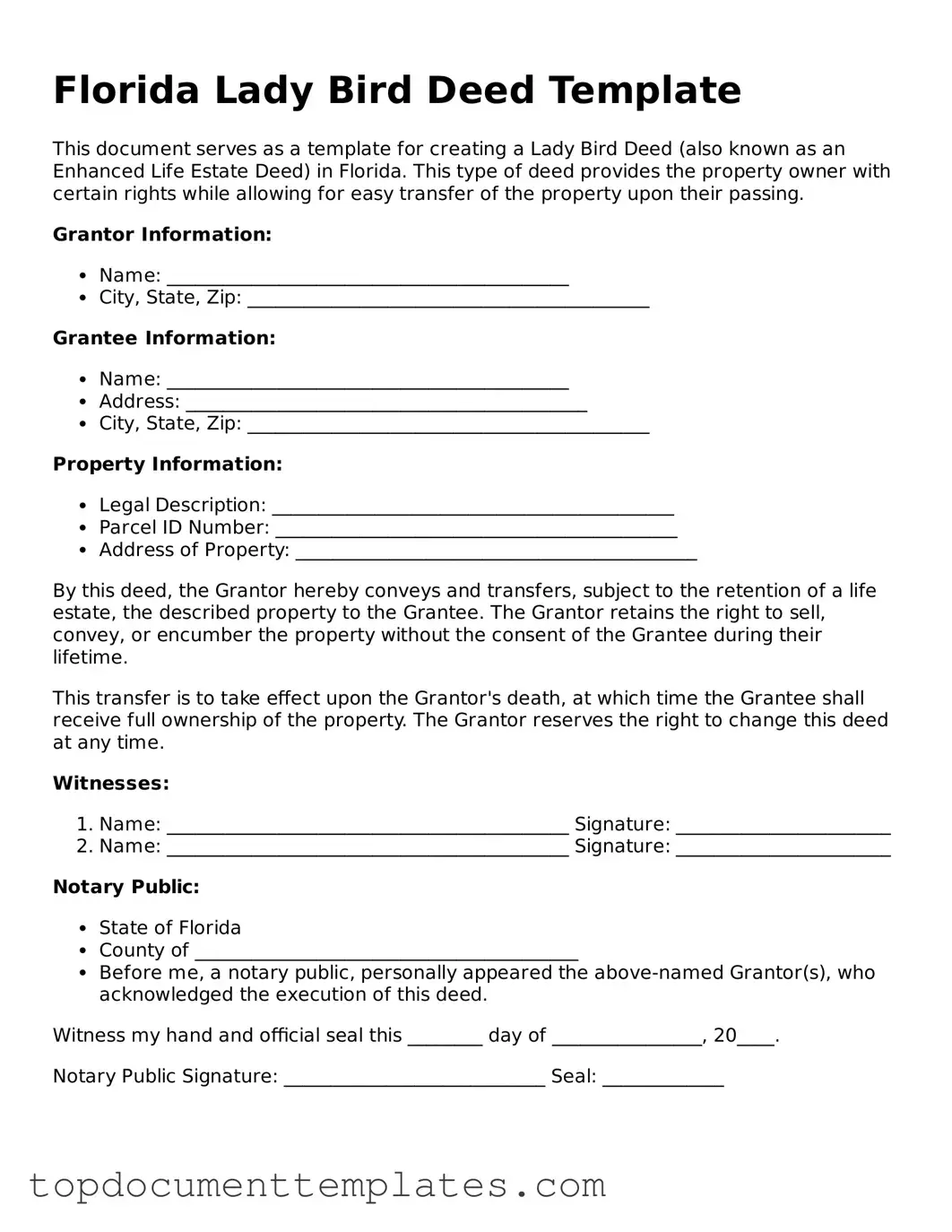

Once you have your Florida Lady Bird Deed form in hand, it's time to start filling it out. This process involves providing specific details about the property and the parties involved. Carefully follow the steps below to ensure accuracy and completeness.

- Obtain the Form: Download or acquire the Florida Lady Bird Deed form from a reliable source.

- Property Description: Enter the full legal description of the property. This information can typically be found on the property deed or tax records.

- Grantor Information: Fill in the name(s) of the current owner(s) of the property (the grantor(s)). Include their address and any other required identifying information.

- Beneficiary Information: Specify the name(s) of the person(s) who will inherit the property (the beneficiary(ies)). Again, include their address and any relevant details.

- Intent Statement: Clearly state the intent of the deed, indicating that the grantor retains the right to use and control the property during their lifetime.

- Signatures: All grantors must sign the form in the designated area. Ensure that the signatures are dated appropriately.

- Notarization: Have the document notarized. This step is crucial for the deed to be legally valid.

- Recording the Deed: Submit the completed and notarized deed to the local county clerk's office for recording. Check for any specific requirements or fees.

After completing these steps, you will have officially filled out the Florida Lady Bird Deed form. The next step is to ensure it is properly recorded with the county, securing your intentions regarding the property for the future.

File Information

| Fact Name | Description |

|---|---|

| Definition | A Florida Lady Bird Deed allows property owners to transfer real estate to beneficiaries while retaining control during their lifetime. |

| Governing Law | The Florida Lady Bird Deed is governed by Florida Statutes, specifically Section 732.4015. |

| Retained Control | Property owners can sell, mortgage, or change the property without the beneficiaries' consent. |

| Avoids Probate | Assets transferred via a Lady Bird Deed typically avoid the probate process, simplifying the transfer upon death. |

| Tax Implications | The property retains its tax basis, which can be beneficial for estate tax purposes. |

| Beneficiary Designation | Multiple beneficiaries can be named, allowing for flexibility in estate planning. |

| Revocability | The deed can be revoked or modified at any time by the property owner. |

| Form Requirements | The deed must be signed, notarized, and recorded in the county where the property is located. |

| Common Uses | Often used by individuals looking to pass on their homes to children or other heirs without the complexities of probate. |

Other Popular Lady Bird Deed State Forms

Ladybird Deed Michigan Form - While effective, proper legal guidance is recommended for execution.

The Florida Employment Verification form is a document used by employers to confirm the eligibility of their employees to work in the United States. This form plays a crucial role in ensuring adherence to federal and state employment laws. Employers can find additional resources and guidance regarding this process at OnlineLawDocs.com. By verifying the work authorization of their workforce, employers not only comply with legal requirements but also contribute to the integrity of the labor market.