Valid Deed in Lieu of Foreclosure Form for Florida State

In the face of financial difficulties, homeowners in Florida may find themselves exploring various options to avoid foreclosure. One such option is the Deed in Lieu of Foreclosure, a legal process that allows a homeowner to voluntarily transfer the ownership of their property back to the lender. This form serves as a crucial document in this process, detailing the agreement between the homeowner and the lender. By signing this form, the homeowner relinquishes their rights to the property, while the lender agrees to release the homeowner from the mortgage debt. This arrangement can benefit both parties: homeowners can sidestep the lengthy and often stressful foreclosure process, while lenders can recover their losses more efficiently. It's important to understand the implications of this form, including potential impacts on credit scores and future homeownership opportunities. Additionally, the Deed in Lieu of Foreclosure may come with specific conditions, such as the requirement to vacate the property and the possibility of negotiating for a deficiency waiver. Overall, this form can be a practical solution for those facing financial hardship, but it is essential to approach it with careful consideration and a clear understanding of its consequences.

Similar forms

- Short Sale Agreement: Similar to a deed in lieu of foreclosure, a short sale agreement allows homeowners to sell their property for less than the amount owed on the mortgage. Both options aim to avoid foreclosure, but a short sale involves selling the property to a third party, while a deed in lieu transfers ownership directly to the lender.

- Loan Modification Agreement: A loan modification agreement alters the terms of an existing mortgage to make it more manageable for the homeowner. While a deed in lieu of foreclosure relinquishes ownership, a loan modification seeks to keep the homeowner in their property by adjusting payment terms, interest rates, or loan duration.

- Forebearance Agreement: A forbearance agreement allows a borrower to temporarily pause or reduce mortgage payments due to financial hardship. This document differs from a deed in lieu because it provides a temporary solution, whereas a deed in lieu signifies a permanent transfer of property ownership to the lender.

- Bankruptcy Filing: Filing for bankruptcy can provide relief from debts, including mortgage obligations. While a deed in lieu of foreclosure transfers property to the lender, bankruptcy can halt foreclosure proceedings and allow the homeowner time to reorganize their finances, potentially keeping their home.

- Motor Vehicle Bill of Sale: This legal document serves as proof of ownership transfer in a vehicle sale, essential for both parties. For more information, visit documentonline.org/blank-illinois-motor-vehicle-bill-of-sale.

- Real Estate Settlement Statement: This document outlines the details of a real estate transaction, including costs and fees. While it serves a different purpose, both the settlement statement and the deed in lieu of foreclosure are essential in documenting the transfer of property ownership and the financial implications involved.

Guidelines on Writing Florida Deed in Lieu of Foreclosure

After completing the Florida Deed in Lieu of Foreclosure form, the next steps involve submitting the document to the appropriate parties and ensuring that all necessary actions are taken to finalize the process. It is important to keep copies of all documents for your records and to follow up with your lender or legal representative to confirm that the deed has been processed correctly.

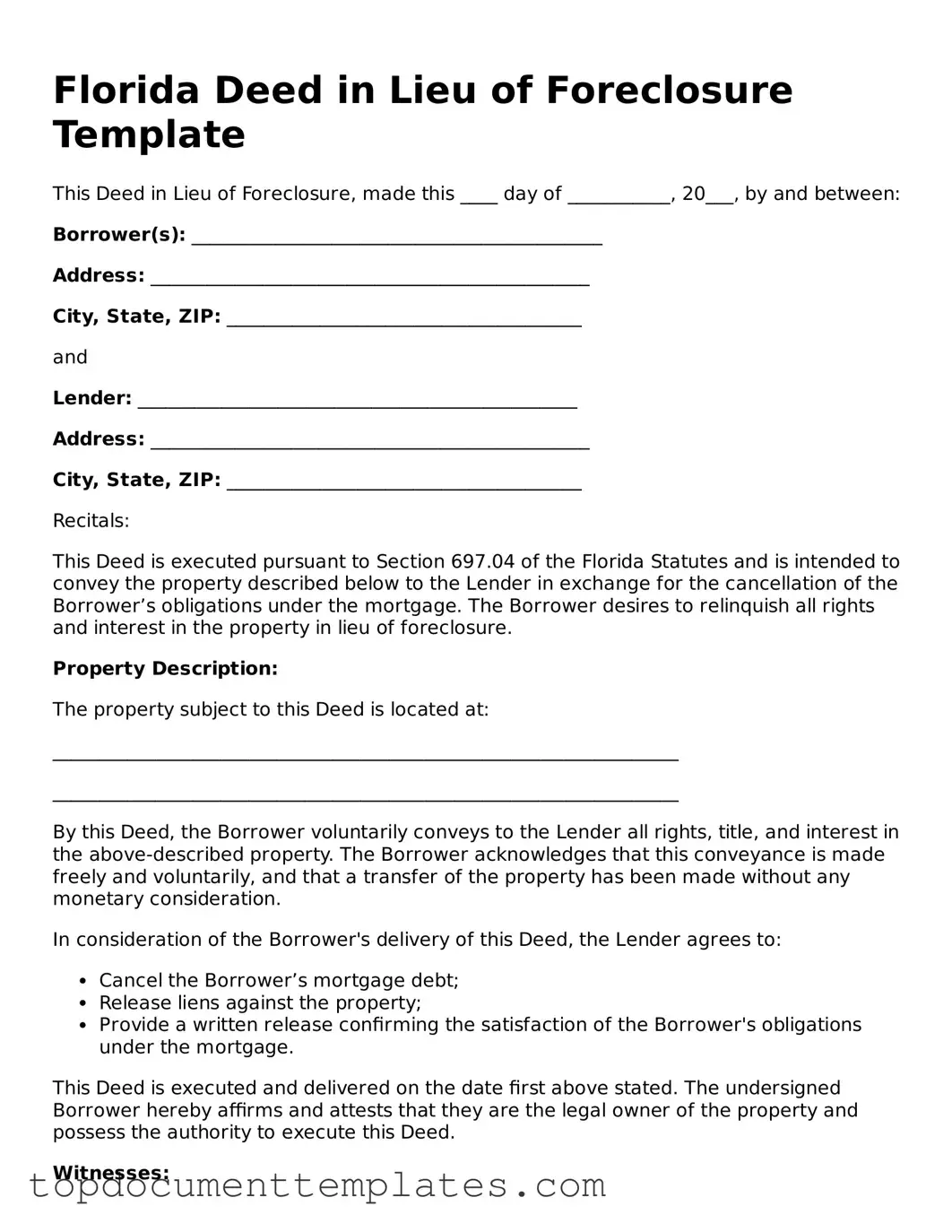

- Begin by downloading the Florida Deed in Lieu of Foreclosure form from a reliable source.

- Carefully read through the form to understand the information required.

- Fill in the names of the parties involved, including the borrower (grantor) and the lender (grantee).

- Provide the property address, including the county where the property is located.

- Include the legal description of the property. This information can typically be found on the property deed or tax records.

- State the date of the transaction clearly.

- Sign the document in the presence of a notary public. Ensure that the notary public also signs and stamps the document.

- Make copies of the signed document for your records.

- Submit the completed form to the lender and any other relevant parties.

- Follow up with the lender to confirm receipt and processing of the deed.

File Information

| Fact Name | Description |

|---|---|

| Definition | A deed in lieu of foreclosure is a legal agreement where a homeowner voluntarily transfers ownership of their property to the lender to avoid foreclosure. |

| Governing Law | In Florida, the deed in lieu of foreclosure is governed by state property laws, particularly under Chapter 701 of the Florida Statutes. |

| Eligibility | Homeowners facing financial difficulties may be eligible for this option, provided they have no other liens on the property. |

| Benefits | This process can help homeowners avoid the lengthy and stressful foreclosure process, and it may also protect their credit score more than a foreclosure would. |

| Considerations | Homeowners should be aware that they may still be responsible for any remaining mortgage balance after the deed is executed, depending on the lender's policies. |

| Legal Advice | It is advisable for homeowners to seek legal counsel before proceeding with a deed in lieu of foreclosure to understand all implications and ensure their rights are protected. |

Other Popular Deed in Lieu of Foreclosure State Forms

The Loan Servicer Might Agree to Put the Foreclosure on Hold to Give You Some Time to Sell Your Home - Understanding the full scope of this process, including any tax implications, is essential before moving forward.

Understanding the significance of the USCIS I-589 form is crucial for those seeking asylum, as it outlines their fears and justifications for requiring protection. This form must be filled out with precision, and resources such as TopTemplates.info can provide valuable guidance to ensure that applicants present their cases effectively and improve their chances of receiving asylum or protection from removal.

Georgia Foreclosure Laws - Understanding the specific terms of the deed in lieu can prevent misunderstandings during the transfer process.