Blank Erc Broker Market Analysis PDF Form

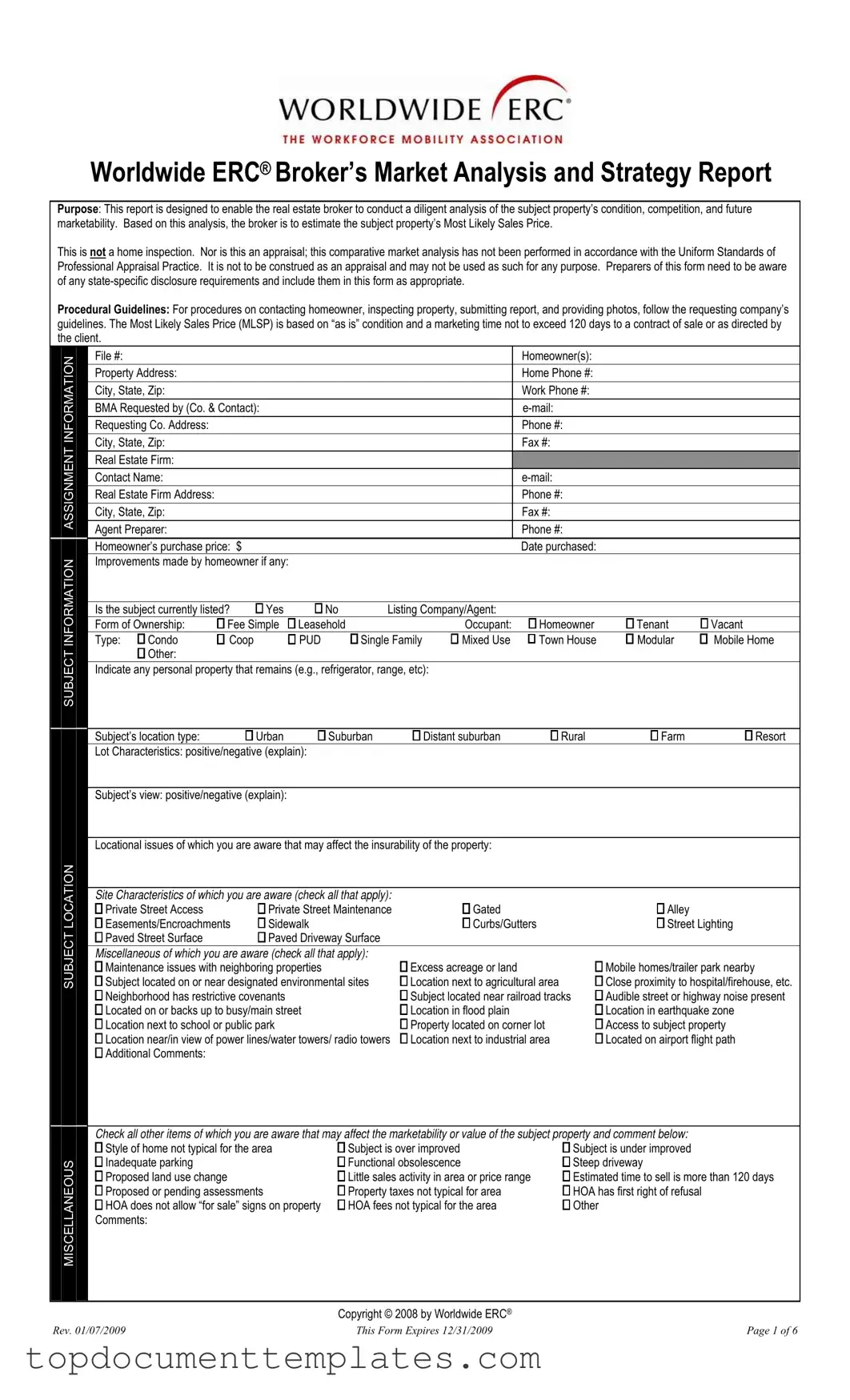

The ERC Broker Market Analysis form is a vital tool for real estate brokers looking to assess a property's market position and potential sale price. This report guides brokers through a thorough evaluation of the property, its condition, and the competitive landscape. It aims to help estimate the Most Likely Sales Price (MLSP) based on the property’s current state and expected marketing timeframe. Importantly, this analysis is not an appraisal and does not conform to appraisal standards, so it should not be used as such. The form requires brokers to gather specific information about the property, including its location, features, and any improvements made by the homeowner. Additionally, it prompts brokers to note any potential issues that may affect the property’s insurability and marketability. By following the procedural guidelines, brokers can efficiently collect data, inspect the property, and submit their findings, ensuring compliance with any state-specific disclosure requirements. This comprehensive approach allows brokers to provide accurate and insightful market analysis, ultimately aiding homeowners in making informed decisions about their real estate investments.

Similar forms

- Comparative Market Analysis (CMA): Similar to the ERC Broker Market Analysis, a CMA evaluates the value of a property based on comparable properties in the area. It helps agents determine a competitive listing price.

- Property Inspection Report: This document assesses the physical condition of a property. While the ERC form focuses on marketability, the inspection report provides a detailed account of any structural issues.

- Appraisal Report: An appraisal determines a property's market value based on various factors. Unlike the ERC form, which estimates a likely sales price, an appraisal is a formal valuation often required by lenders.

- Non-disclosure Agreement (NDA): A crucial legal tool that protects sensitive information during negotiations; for further details, visit OnlineLawDocs.com.

- Listing Agreement: This contract outlines the terms between a seller and a real estate agent. It includes pricing strategies and marketing plans, similar to the strategic insights found in the ERC form.

- Disclosure Statement: Sellers must disclose known issues with the property. This aligns with the ERC form's emphasis on identifying conditions that may affect marketability.

- Market Condition Report: This document provides an overview of the real estate market, including trends and statistics. It parallels the ERC form's analysis of market conditions affecting the subject property.

- Sales Comparison Approach Report: This report compares the subject property to similar properties that have recently sold. It shares the goal of estimating a property's value based on market data, much like the ERC analysis.

Guidelines on Writing Erc Broker Market Analysis

Filling out the ERC Broker Market Analysis form requires careful attention to detail. Each section must be completed accurately to ensure a thorough analysis of the property in question. Once the form is filled out, it will be submitted for review, and any necessary follow-ups will be conducted based on the findings. Below are the steps to guide you through the process of completing the form.

- Start with the INFORMATION section. Fill in the file number, homeowner's name(s), property address, and contact numbers.

- Provide the details of the requesting company, including the name, contact person, email, address, and phone number.

- In the ASSIGNMENT section, enter the real estate firm’s name, contact information, and the agent preparer’s details.

- Record the homeowner’s purchase price and date of purchase in the designated fields.

- Detail any improvements made to the property by the homeowner, and indicate if the property is currently listed for sale.

- Specify the form of ownership and occupancy status, and note the property type (e.g., condo, single-family home).

- Describe any personal property that remains with the sale, as well as the subject’s location type (urban, suburban, etc.).

- Assess and comment on the lot characteristics and the view from the property, noting any positive or negative aspects.

- Identify any locational issues that may affect the insurability of the property.

- Check all applicable site characteristics and miscellaneous issues that may impact the property.

- In the SUBJECT CONDITION INSPECTIONS/DISCLOSURES section, check the boxes for any observed property conditions and provide comments.

- Estimate repair costs for interior and exterior items, providing comments for each category.

- List all required, customary, and recommended inspections for the property.

- Identify potential financing options and any anticipated issues that may affect financing.

- Provide details about the subject neighborhood, including price range, property values, and average days on market.

- Gather data on competing listings and comparable sales, filling in the required details for each property.

- Finally, review all sections to ensure completeness and accuracy before submitting the form.

Form Data

| Fact Name | Description |

|---|---|

| Purpose | The Erc Broker Market Analysis form enables real estate brokers to analyze property conditions, competition, and marketability. |

| Not an Appraisal | This form is not an appraisal and should not be used as one. It does not comply with the Uniform Standards of Professional Appraisal Practice. |

| Most Likely Sales Price | The form helps estimate the Most Likely Sales Price (MLSP) based on the property’s current condition and expected marketing time. |

| State-Specific Requirements | Preparers must be aware of state-specific disclosure requirements and incorporate them into the analysis. |

| Inspection Guidelines | Guidelines for contacting homeowners, inspecting properties, and submitting reports should follow the requesting company's procedures. |

| Disclosure of Issues | Any known issues affecting the insurability or marketability of the property must be disclosed in the report. |

| Property Condition | The form includes sections to check for various property conditions, such as water damage or structural problems. |

| Financing Types | It identifies potential financing options for the property, including FHA, VA, and conventional loans. |

| Neighborhood Analysis | The form requires a description of the subject neighborhood, including price range and property value trends. |

| Expiration Date | This version of the form is valid until December 31, 2009, and should be updated or replaced thereafter. |

Other PDF Documents

Progressive Logo Png - Keep a record of your policy information alongside this card for added security.

Understanding the significance of a Power of Attorney form in Texas is crucial for individuals planning for the future, as it safeguards their interests when unable to make decisions. By designating a trusted person to handle essential affairs, individuals can ensure their financial and medical choices are respected. For more information on this vital legal document, visit TopTemplates.info, which offers detailed insights and resources on creating a Power of Attorney that aligns with your needs.

How to Know You Had a Miscarriage - The form outlines the required documentation for fathers seeking to register fetal death.