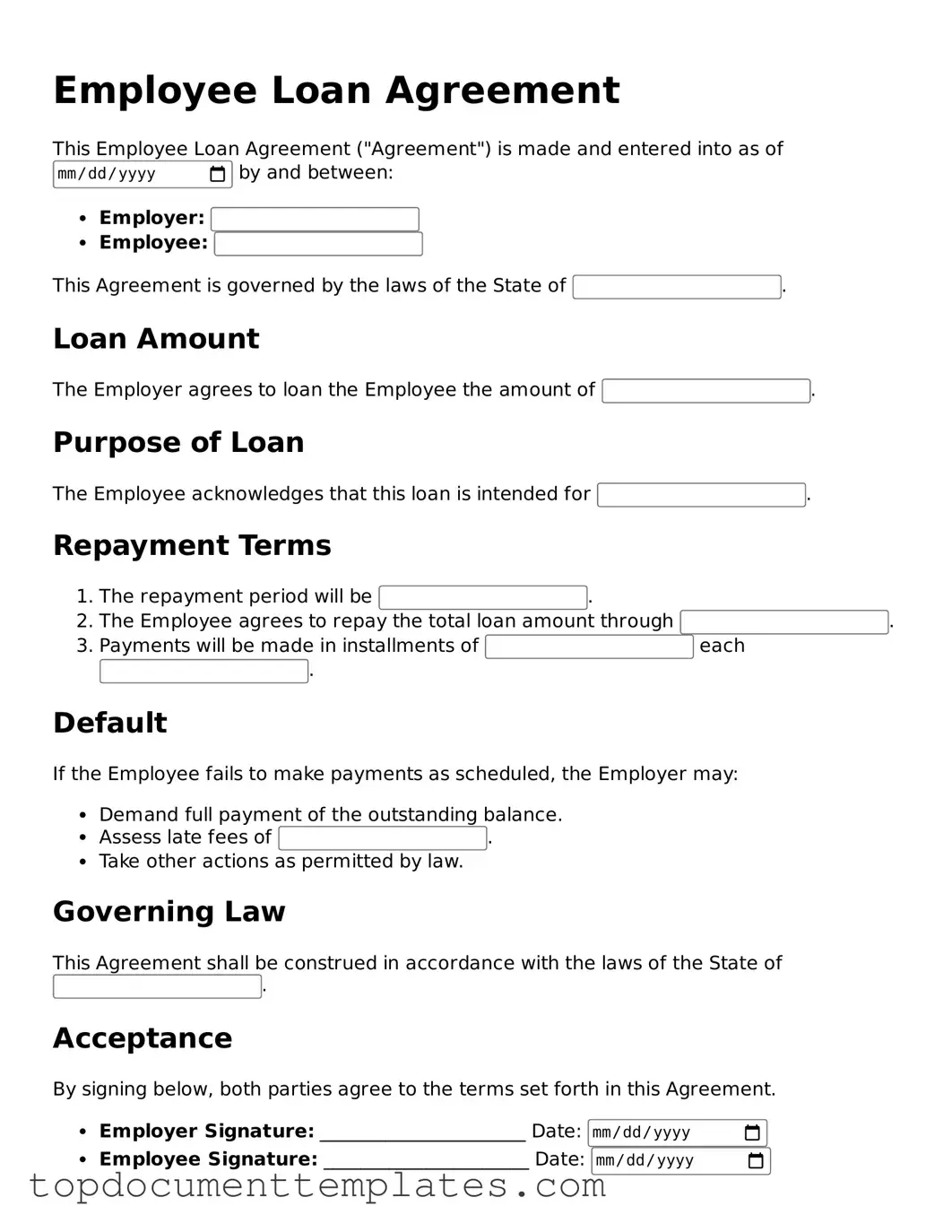

Official Employee Loan Agreement Template

An Employee Loan Agreement is a formal document that outlines the terms and conditions under which an employer lends money to an employee. This agreement serves to protect both parties by clearly detailing repayment terms, interest rates, and any applicable fees. Understanding the importance of this form can help ensure a smooth financial transaction between employer and employee.

To get started, please fill out the form by clicking the button below.

Open This Form