Official Durable Power of Attorney Template

Planning for the future often involves making important decisions about how to manage your affairs, especially in the event that you become unable to do so yourself. One crucial tool in this planning process is the Durable Power of Attorney (DPOA) form. This legal document allows you to designate a trusted individual—often referred to as your agent or attorney-in-fact—to make decisions on your behalf regarding financial and legal matters. Unlike a regular power of attorney, which may become invalid if you become incapacitated, a durable power of attorney remains effective even in such circumstances. This means that your chosen agent can handle tasks such as paying bills, managing investments, and dealing with insurance claims without interruption. It’s important to understand that the DPOA can be tailored to fit your specific needs, allowing you to specify the extent of the authority granted to your agent. Additionally, you can choose to include specific instructions or limitations, ensuring that your wishes are respected. By preparing a Durable Power of Attorney, you not only safeguard your interests but also provide peace of mind for yourself and your loved ones during challenging times.

Similar forms

- General Power of Attorney: Like the Durable Power of Attorney, this document allows someone to act on your behalf. However, it becomes invalid if you become incapacitated.

- Healthcare Proxy: This document designates someone to make medical decisions for you if you are unable to do so. It focuses specifically on healthcare matters.

- Living Will: A living will outlines your wishes regarding medical treatment in situations where you cannot communicate. It complements a healthcare proxy.

- Financial Power of Attorney: Similar to the Durable Power of Attorney, this document allows someone to manage your financial affairs, but it may not remain effective if you become incapacitated.

- Trust: A trust can manage your assets during your lifetime and after your death. It can provide some similar powers as a Durable Power of Attorney but is often more complex.

- Will: A will outlines how your assets should be distributed after your death. While it does not grant powers during your lifetime, it is a crucial part of estate planning.

- Advance Healthcare Directive: This combines a healthcare proxy and a living will. It provides instructions for medical care and designates a decision-maker.

- Representative Payee Authorization: This document allows someone to receive and manage your government benefits on your behalf, ensuring your financial needs are met.

Durable Power of Attorney - Tailored for State

Guidelines on Writing Durable Power of Attorney

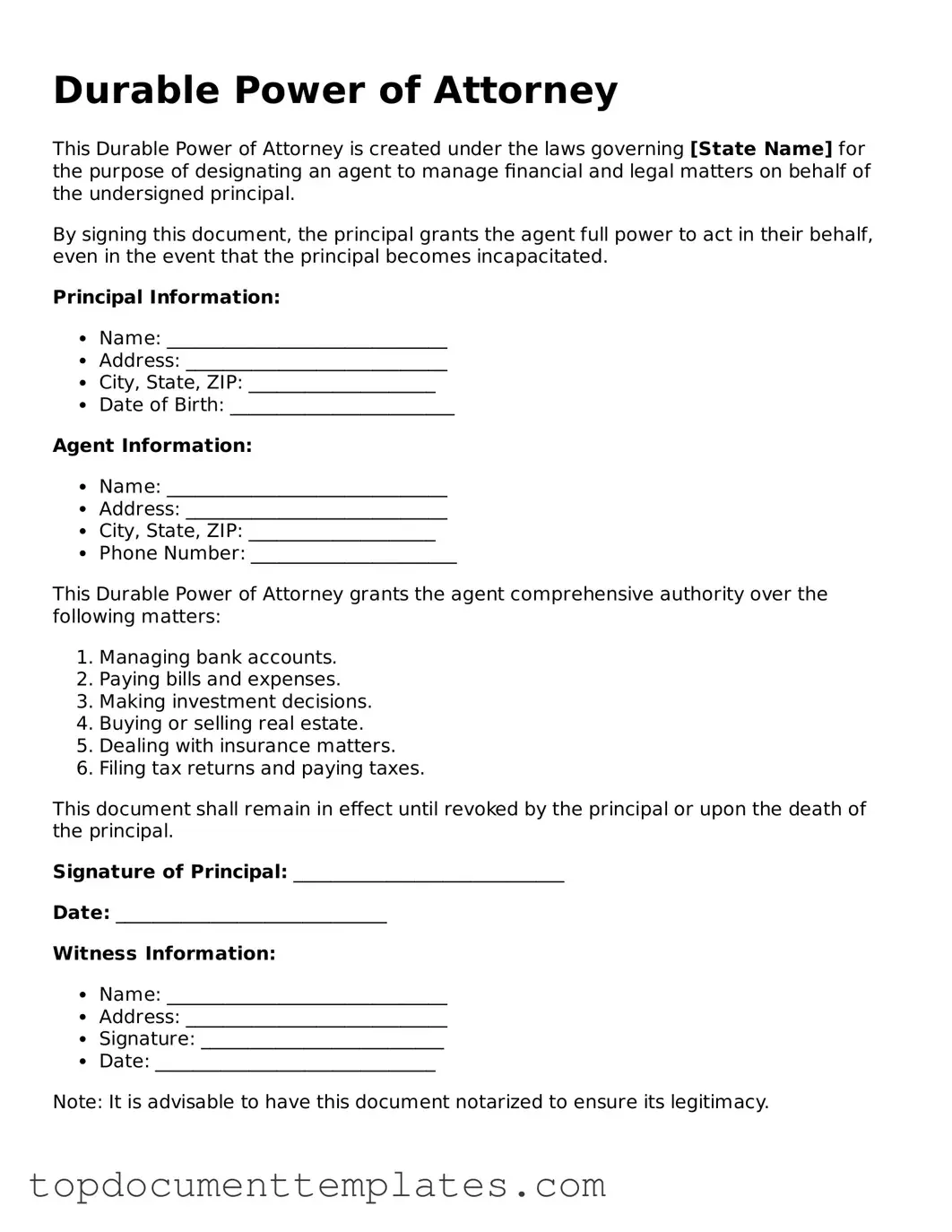

Once you have your Durable Power of Attorney form ready, it’s time to fill it out accurately. Completing this form allows you to designate someone to make decisions on your behalf when you are unable to do so. Follow these steps carefully to ensure the document is filled out correctly.

- Begin by entering your full name at the top of the form. This should be your legal name as it appears on official documents.

- Next, provide your current address. Make sure to include your city, state, and zip code.

- Identify the person you are appointing as your agent. Write their full name and relationship to you. This could be a family member, friend, or trusted advisor.

- Include the agent’s address, ensuring it is complete with city, state, and zip code.

- Specify the powers you wish to grant your agent. You can choose general powers or limit them to specific areas, such as financial or medical decisions.

- In the designated section, indicate when the powers will begin. You may choose to have them take effect immediately or only under certain conditions.

- Sign and date the form at the bottom. Your signature must be your own, and it should match the name you provided at the beginning.

- Have the form witnessed. Depending on your state’s requirements, you may need one or two witnesses to sign the document.

- If required, have the form notarized. A notary public will verify your identity and witness your signature.

After completing these steps, store the form in a safe place and provide copies to your agent and any relevant family members or professionals. This ensures that your wishes are clear and accessible when needed.

File Information

| Fact Name | Description |

|---|---|

| Definition | A Durable Power of Attorney is a legal document that allows one person to authorize another to act on their behalf in financial or legal matters, even if they become incapacitated. |

| Durability | This type of power of attorney remains effective even if the principal becomes mentally or physically incapacitated. |

| Governing Law | The laws governing Durable Power of Attorney vary by state. In California, for example, it is governed by the California Probate Code. |

| Agent Responsibilities | The agent has a fiduciary duty to act in the best interests of the principal and must manage the principal’s affairs responsibly. |

| Revocation | The principal can revoke the Durable Power of Attorney at any time as long as they are mentally competent to do so. |

| Notarization | Most states require that the Durable Power of Attorney be notarized to be considered valid, ensuring authenticity and preventing fraud. |

| Limitations | While a Durable Power of Attorney grants broad authority, it cannot be used for certain actions, such as making medical decisions unless specified in a separate document. |

Find Other Types of Durable Power of Attorney Templates

Reg 260 - Allows an agent to sign documents related to the ownership, transfer, or sale of a vehicle.