Official Deed in Lieu of Foreclosure Template

The Deed in Lieu of Foreclosure form serves as a significant legal instrument in the realm of real estate, particularly for homeowners facing financial difficulties. This document allows a property owner to voluntarily transfer the title of their home to the lender, effectively avoiding the lengthy and often costly foreclosure process. By executing this form, the homeowner can mitigate the negative impact on their credit score and seek a more amicable resolution to their financial obligations. The form typically outlines the terms of the transfer, including any agreements regarding outstanding debts and the condition of the property. It is essential for both parties to understand their rights and responsibilities as detailed in the document. Additionally, the Deed in Lieu of Foreclosure can provide a pathway for lenders to recover their investment without resorting to foreclosure, which can be beneficial for both the lender and the borrower. Understanding the implications and requirements of this form is crucial for anyone considering this option as a means to navigate financial distress.

Similar forms

- Mortgage Release: This document officially releases the borrower from the mortgage obligation. Similar to a deed in lieu, it signifies that the lender has accepted the property in satisfaction of the debt, allowing the borrower to walk away without further liability.

- Short Sale Agreement: In a short sale, the lender agrees to accept less than the total amount owed on the mortgage. Like a deed in lieu, it provides a way for the borrower to avoid foreclosure, but it involves selling the property rather than transferring it back to the lender.

- Motor Vehicle Bill of Sale: This form records the transfer of ownership of a motor vehicle and includes essential details such as the vehicle's identification number and agreed-upon sale price. For more information, visit documentonline.org/blank-motor-vehicle-bill-of-sale.

- Loan Modification Agreement: This document alters the terms of an existing mortgage to make payments more manageable. While it does not involve transferring property, both processes aim to help the borrower avoid foreclosure and maintain homeownership.

- Foreclosure Settlement Agreement: This agreement outlines the terms under which a borrower can settle their mortgage debt with the lender before foreclosure occurs. Similar to a deed in lieu, it allows the borrower to resolve their obligations without going through the foreclosure process.

- Quitclaim Deed: This document transfers ownership of property from one party to another without warranties. While it typically does not involve debt settlement, it can be used in situations where a borrower wants to relinquish their interest in a property, similar to how a deed in lieu transfers ownership to the lender.

Guidelines on Writing Deed in Lieu of Foreclosure

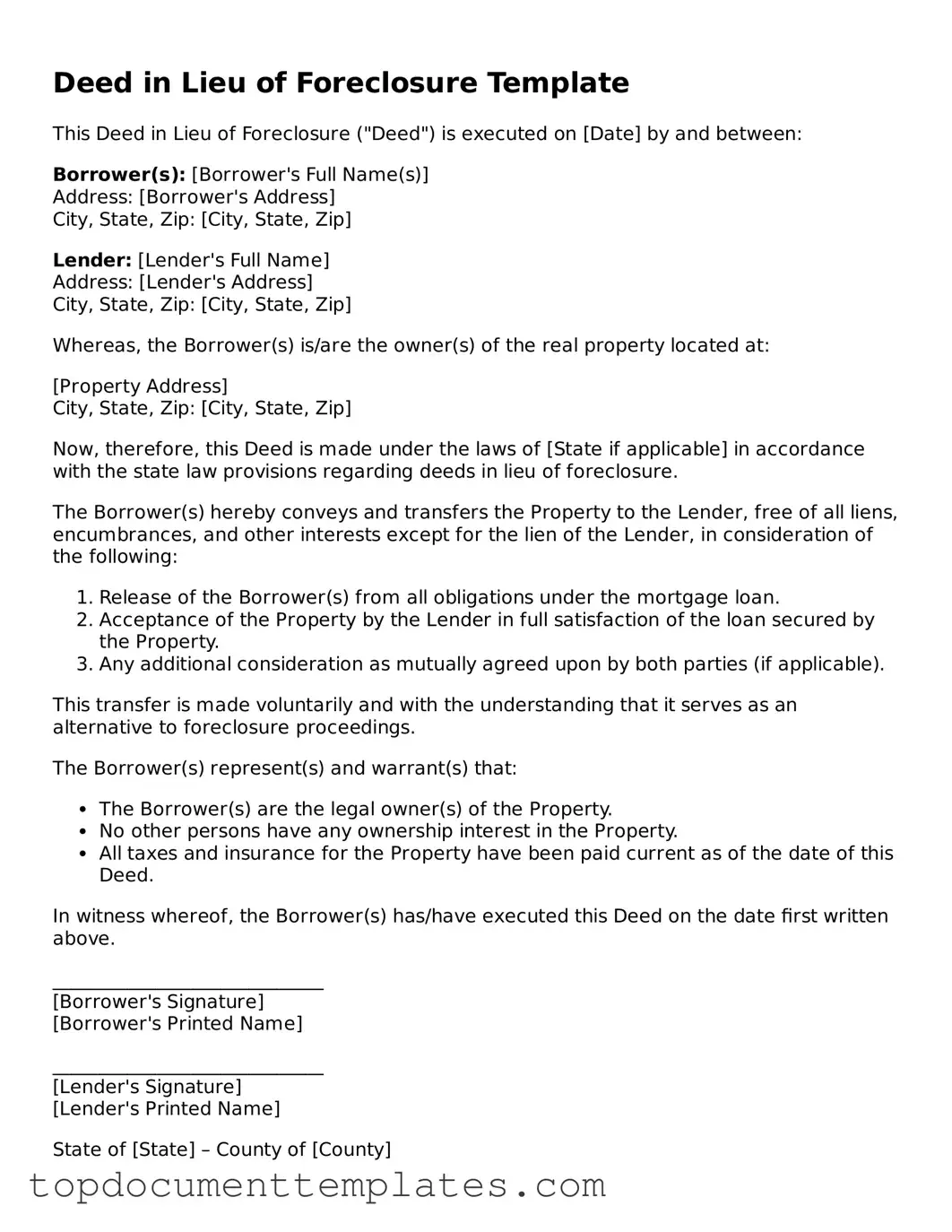

Once you have gathered the necessary information, you can begin filling out the Deed in Lieu of Foreclosure form. This process involves providing specific details about the property and the parties involved. After completing the form, it will need to be signed and submitted according to your lender's instructions.

- Start by entering the date at the top of the form.

- Fill in the name of the current property owner(s). Make sure to include all owners as listed on the title.

- Provide the complete address of the property, including the city, state, and ZIP code.

- Include the legal description of the property. This can usually be found on the property deed or tax documents.

- List the name of the lender or mortgage company that holds the mortgage on the property.

- Indicate the reason for the deed in lieu of foreclosure. Be clear and concise.

- Sign the form where indicated. All owners must sign.

- Have the signatures notarized. This step is often required to validate the document.

- Make copies of the completed form for your records.

- Submit the original form to your lender, following their specific submission guidelines.

File Information

| Fact Name | Description |

|---|---|

| Definition | A Deed in Lieu of Foreclosure is an agreement where a homeowner voluntarily transfers ownership of their property to the lender to avoid foreclosure. |

| Purpose | This process helps homeowners avoid the lengthy and stressful foreclosure process while allowing lenders to recover their investment more efficiently. |

| Eligibility | Homeowners facing financial hardship and unable to make mortgage payments may qualify for this option. |

| State-Specific Forms | Each state may have its own specific form for a Deed in Lieu of Foreclosure, governed by local laws. For example, California follows Civil Code Section 2943. |

| Impact on Credit | A Deed in Lieu of Foreclosure can negatively impact a homeowner's credit score, but typically less than a foreclosure. |

| Tax Implications | Homeowners should be aware of potential tax implications, as forgiven debt may be considered taxable income. |

| Legal Assistance | It is advisable for homeowners to seek legal assistance to understand their rights and obligations before proceeding. |

Find Other Types of Deed in Lieu of Foreclosure Templates

Tod in California - This deed is a simple legal instrument that embodies your wishes regarding property inheritance in a clear manner.

Understanding the intricacies of a Durable Power of Attorney is essential for effective estate planning, and resources are available to help navigate this process. For comprehensive information and assistance regarding the creation of such forms, you can visit OnlineLawDocs.com, which offers guidance on ensuring your legal documents are properly prepared and meet your needs.

Quitclaim Deed Iowa - This form is often considered less formal than other deed types.