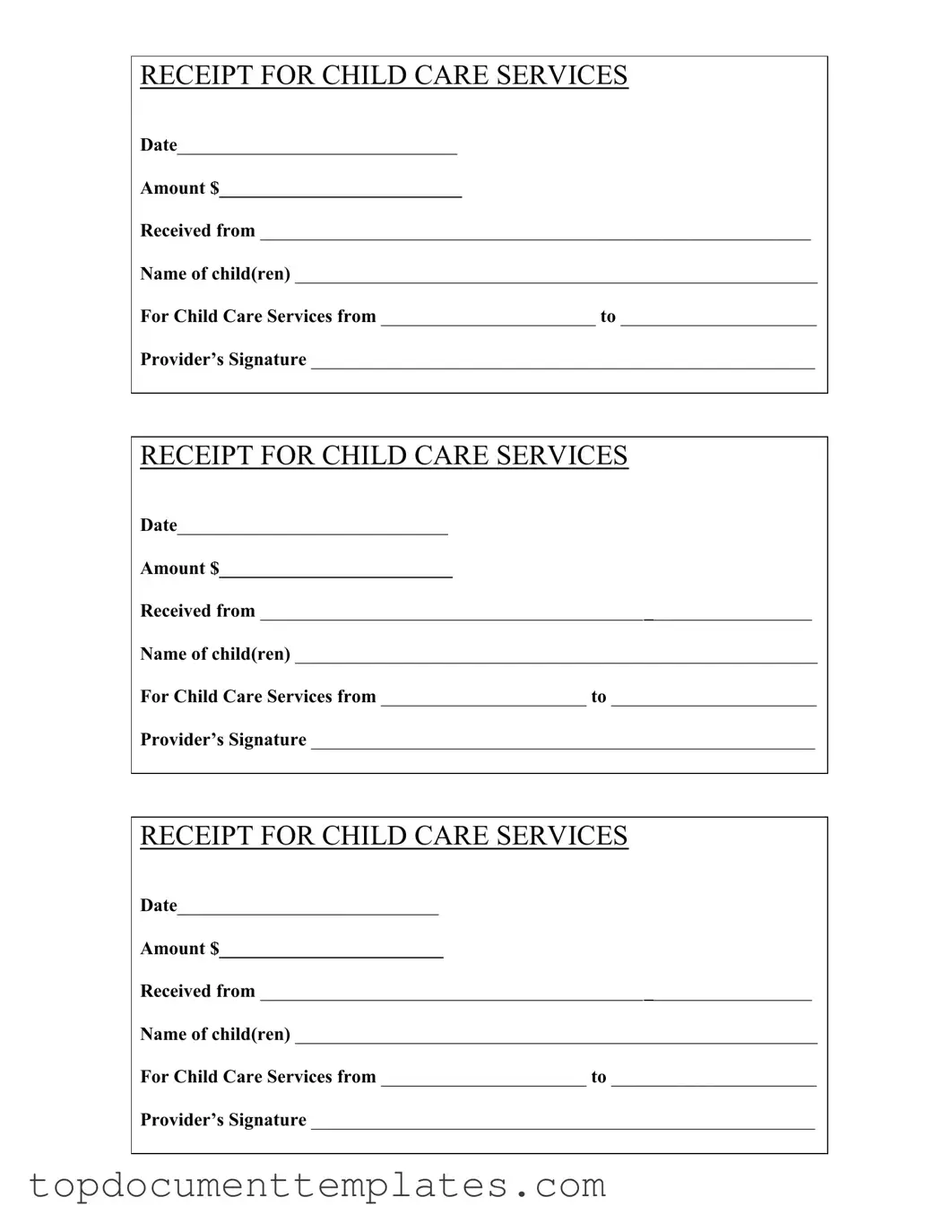

Blank Childcare Receipt PDF Form

The Childcare Receipt form is a crucial document for parents and childcare providers alike, ensuring that both parties have a clear record of services rendered and payments made. This form includes essential details such as the date of service, the total amount paid, and the name of the individual or organization providing the childcare. It also captures the names of the children receiving care, which helps maintain accurate records. Additionally, the form specifies the time frame during which the childcare services were provided, offering clarity on the period covered by the payment. Finally, the provider's signature is required, adding an element of accountability and authenticity to the transaction. Overall, this form serves as a reliable reference for parents when managing their childcare expenses and can also be beneficial for tax purposes or reimbursement requests.

Similar forms

The Childcare Receipt form serves as a vital document for parents and caregivers. It confirms the payment for childcare services rendered. Several other documents share similarities with this form in terms of purpose and structure. Here are ten such documents:

- Invoice for Services Rendered: Like the childcare receipt, this document outlines the services provided and the amount due. It includes details such as the date, service provider, and client information.

- Payment Receipt: This document confirms that a payment has been made for goods or services. It typically contains the date, amount paid, and the recipient's details, similar to the childcare receipt.

- Tuition Receipt: For educational services, this receipt shows that tuition fees have been paid. It includes the student's name, payment date, and the amount, paralleling the structure of the childcare receipt.

- Service Agreement: This document outlines the terms of service between a provider and a client. While it may not confirm payment, it includes details about the services provided, akin to the childcare receipt.

- Contract for Services: Similar to a service agreement, this document specifies the obligations of both parties. It often includes payment details, making it comparable to the childcare receipt.

- Billing Statement: This document summarizes charges and payments over a period. It provides a clear record of what has been paid and what is owed, resembling the childcare receipt.

ATV Bill of Sale: This document is crucial for the sale of an all-terrain vehicle, detailing transaction specifics and vehicle information. For more information, visit https://documentonline.org/blank-new-york-atv-bill-of-sale.

- Expense Report: This document itemizes expenses incurred for business or personal purposes. It may include childcare costs, similar to the way the childcare receipt details specific services and payments.

- Donation Receipt: This confirms that a donation has been made to a charitable organization. It includes the donor's information and the amount donated, paralleling the structure of the childcare receipt.

- Rental Receipt: This document confirms payment for rental services, such as housing or equipment. It includes details like the date and amount, similar to the childcare receipt.

- Health Care Receipt: This confirms payment for medical services. It contains similar elements, such as the date, provider's signature, and amount paid, much like the childcare receipt.

Each of these documents serves to provide a clear record of transactions and services, just as the childcare receipt does for parents and caregivers.

Guidelines on Writing Childcare Receipt

Completing the Childcare Receipt form is straightforward. After filling out the form, you will have a documented record of the childcare services provided, which can be useful for personal records or tax purposes. Follow the steps below to ensure you fill it out correctly.

- Locate the Date field at the top of the form. Enter the date when the payment was made.

- In the Amount field, write the total amount received for the childcare services.

- Find the Received from section. Fill in the name of the person who made the payment.

- In the Name of child(ren) area, list the names of the children who received care.

- Identify the For Child Care Services from section. Enter the start date of the childcare services.

- Next, fill in the to field with the end date of the childcare services.

- Lastly, sign the form in the Provider’s Signature area to validate the receipt.

Form Data

| Fact Name | Description |

|---|---|

| Date | This field is essential for recording the exact date when the childcare services were provided. |

| Amount | The total payment received for the childcare services must be clearly stated in this section. |

| Received From | The name of the individual or entity making the payment should be entered here for accountability. |

| Name of Child(ren) | It's important to list the names of the child or children receiving care to ensure proper documentation. |

| Service Dates | Start and end dates for the childcare services must be provided to clarify the duration of care. |

| Provider’s Signature | The childcare provider must sign the form to validate that the services were rendered and payment was received. |

| Duplicate Receipts | It is advisable to keep copies of the receipt for personal records and tax purposes. |

| State-Specific Regulations | Some states may have specific laws governing the issuance of childcare receipts; check local regulations. |

| Tax Implications | This receipt can be used for tax deductions or credits related to childcare expenses, so retain it carefully. |

Other PDF Documents

Employee Status Change Form Template Word - Address changes in work hours through this form.

To ensure clarity in liability matters, parties often turn to resources such as OnlineLawDocs.com, which provide essential templates and guidance on how to properly draft a Hold Harmless Agreement. This form is not only vital for preventing misunderstandings but also crucial for safeguarding interests during various activities.

Broward Animal Control - Indicate the animal's sex: male or female.