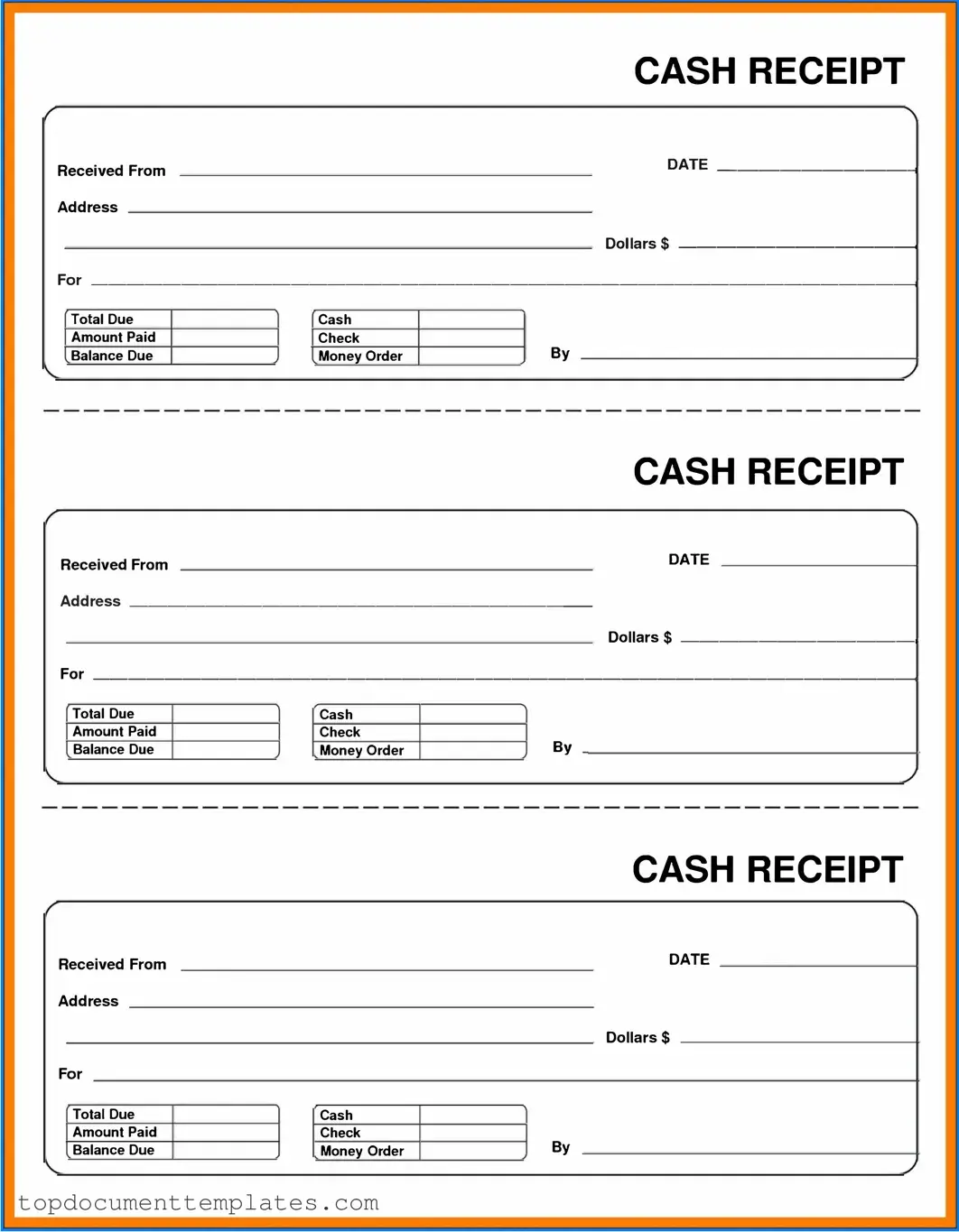

Blank Cash Receipt PDF Form

The Cash Receipt form plays a crucial role in financial transactions, serving as a vital record for both businesses and customers. This form documents the details of cash payments received, ensuring transparency and accountability in monetary exchanges. It typically includes essential information such as the date of the transaction, the amount received, the name of the payer, and the purpose of the payment. Additionally, the form may contain a unique receipt number for tracking and reference purposes. By providing a clear and organized way to record cash transactions, the Cash Receipt form helps businesses maintain accurate financial records and supports effective auditing processes. Understanding its components and proper usage is essential for anyone involved in managing finances or handling cash transactions.

Similar forms

Invoice: Like a cash receipt, an invoice documents a transaction. It specifies the amount owed for goods or services and serves as a request for payment.

Sales Receipt: A sales receipt confirms a purchase. It provides details about the transaction, including the date, items purchased, and the amount paid, similar to a cash receipt.

Payment Voucher: This document authorizes payment. It includes details about the transaction and is used to ensure proper approval before funds are disbursed, much like a cash receipt confirms payment received.

Deposit Slip: A deposit slip is used to deposit cash or checks into a bank account. It records the amount being deposited, akin to how a cash receipt records money received.

Credit Memo: A credit memo is issued to reduce the amount owed by a customer. It serves a similar purpose to a cash receipt by documenting financial transactions.

Expense Report: An expense report tracks spending by employees. It documents expenses incurred and is similar to a cash receipt in that it provides a record of financial transactions.

Purchase Order: A purchase order is a document that authorizes a purchase. While it is used before a transaction occurs, it serves as a record of intent, similar to how a cash receipt records completed transactions.

Refund Receipt: A refund receipt is issued when a customer returns a product. It documents the return and the amount refunded, paralleling the way a cash receipt confirms payment received.

- ATV Bill of Sale: The documentonline.org/blank-new-york-atv-bill-of-sale serves as a vital document that records the sale of an all-terrain vehicle, documenting essential details like the vehicle identification number and personal information of the involved parties.

Statement of Account: This document summarizes all transactions over a specific period. It provides a comprehensive view of payments and charges, similar to the summary function of a cash receipt.

Financial Report: A financial report provides an overview of a business's financial status. It includes various transactions and can summarize cash receipts along with other financial data.

Guidelines on Writing Cash Receipt

Completing the Cash Receipt form is a straightforward process that ensures accurate tracking of cash transactions. Once you have filled out the form, it will be processed according to your organization's financial protocols. This step is crucial for maintaining transparency and accountability in your financial records.

- Start by entering the date of the transaction in the designated field.

- Next, provide the name of the individual or organization making the payment.

- In the following section, write a brief description of the purpose of the payment.

- Indicate the amount received in the appropriate box, ensuring it matches the payment made.

- If applicable, include any reference number associated with the payment for future tracking.

- Finally, sign the form to validate the transaction and confirm receipt of the cash.

Once completed, ensure that you keep a copy for your records and submit the original as required by your organization’s policies.

Form Data

| Fact Name | Description |

|---|---|

| Definition | A Cash Receipt form is used to document cash transactions received by a business. |

| Purpose | This form serves as proof of payment for customers and helps maintain accurate financial records. |

| Components | The form typically includes the date, amount received, payer's name, and purpose of payment. |

| Record Keeping | Businesses must keep these forms for auditing and tax purposes. |

| State-Specific Forms | Some states may have specific requirements for cash receipt forms. Check local regulations. |

| Governing Laws | In California, for example, the governing law includes the California Commercial Code. |

| Digital Options | Many businesses now use digital cash receipt forms for ease of use and storage. |

| Signature Requirement | It is advisable to have the payer sign the receipt to confirm the transaction. |

| Audit Trail | Using cash receipts creates an audit trail, which can help in financial reviews and investigations. |

Other PDF Documents

Reg 262 Pdf Fillable - Buyers and sellers should be diligent about meeting all regulatory requirements associated with the REG 262.

Understanding the nuances of a Hold Harmless Agreement is essential, and resources such as OnlineLawDocs.com can provide valuable insights into its formulation and application in Florida, ensuring that parties can effectively manage risk and liability during various activities.

Roof Certification Form Florida - Provide a summary at the end of the inspection form with key findings.