Valid Transfer-on-Death Deed Form for California State

In the state of California, the Transfer-on-Death Deed (TOD Deed) serves as a vital tool for property owners seeking to simplify the transfer of real estate upon their passing. This legal instrument allows individuals to designate one or more beneficiaries who will automatically receive ownership of the property without the need for probate, thereby streamlining the process and minimizing potential disputes among heirs. By filling out and recording a TOD Deed, property owners can retain full control of their assets during their lifetime, ensuring that their wishes are honored after their death. This deed is particularly beneficial for those who wish to avoid the often lengthy and costly probate process. Additionally, the TOD Deed provides a level of flexibility, as it can be revoked or altered at any time prior to the owner's death, allowing for adjustments as family dynamics or personal circumstances change. Understanding the nuances of this form is essential for anyone considering its use, as it can significantly impact the future of one’s estate and the well-being of loved ones.

Similar forms

The Transfer-on-Death Deed (TODD) is a unique legal instrument that allows property owners to designate beneficiaries who will inherit their property upon their death, without the need for probate. This deed shares similarities with several other legal documents. Below are four documents that resemble the Transfer-on-Death Deed, along with explanations of how they are similar:

- Will: A will is a legal document that outlines how a person's assets should be distributed after their death. Like a TODD, a will allows individuals to specify beneficiaries, but it typically requires probate, which can prolong the transfer process.

- Living Trust: A living trust is a fiduciary arrangement that allows a person to place their assets into a trust during their lifetime, with instructions on how to distribute those assets after their death. Similar to a TODD, a living trust can help avoid probate, providing a smoother transition of property to beneficiaries.

- Beneficiary Designation: This document is often used for financial accounts, such as life insurance policies or retirement accounts, allowing account holders to name beneficiaries who will receive the assets upon their death. Like a TODD, it bypasses the probate process, ensuring a direct transfer to the designated individuals.

- Horse Bill of Sale Form: For those dealing with equine transactions, the thorough California horse bill of sale document is essential for legally recording the transfer of ownership.

- Joint Tenancy with Right of Survivorship: This property ownership arrangement allows two or more individuals to hold title to a property together. Upon the death of one owner, the surviving owner automatically inherits the deceased's share. This method, similar to a TODD, facilitates the seamless transfer of property without the need for probate.

Guidelines on Writing California Transfer-on-Death Deed

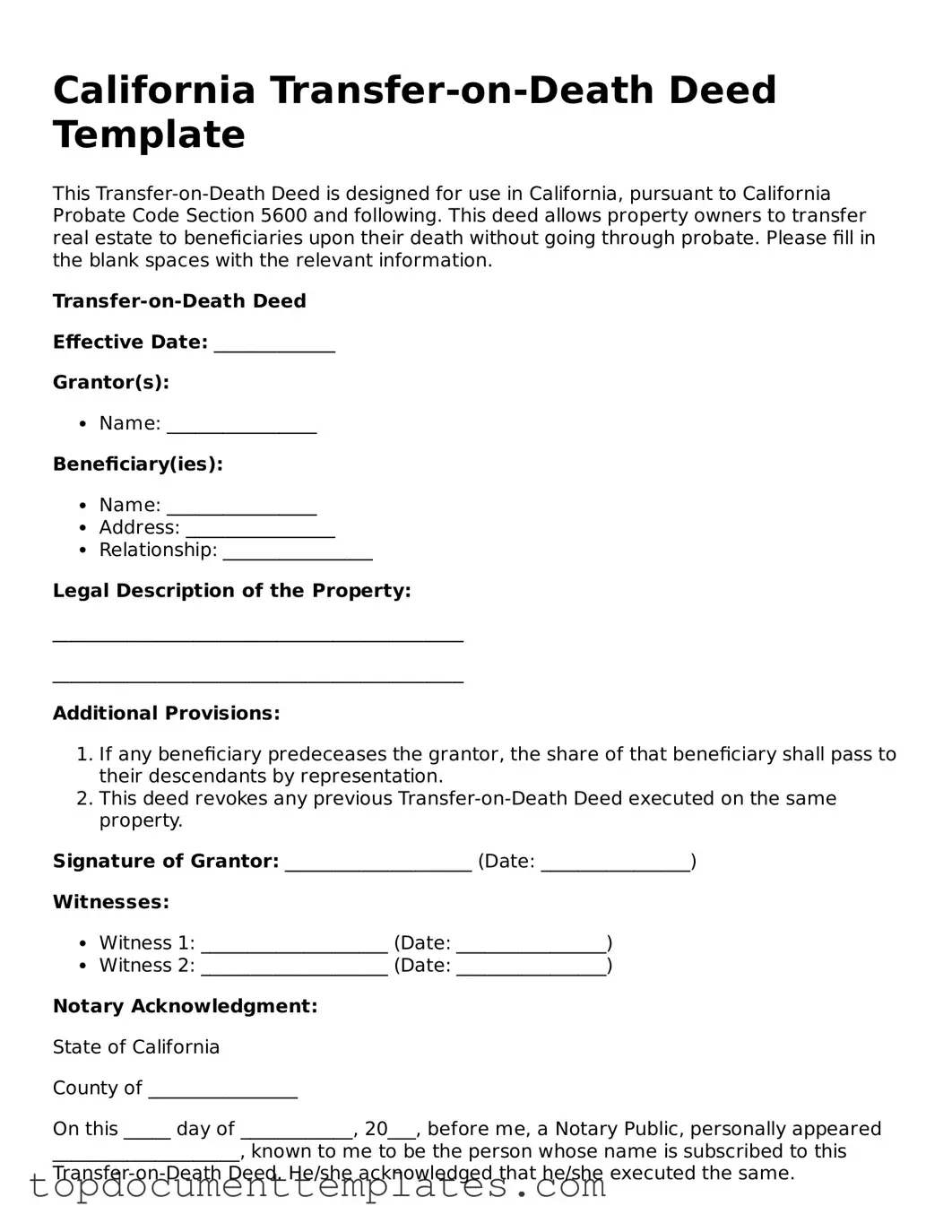

Once you have the California Transfer-on-Death Deed form ready, it is essential to complete it accurately. This deed allows you to designate a beneficiary for your real property upon your passing. Follow these steps carefully to ensure the form is filled out correctly.

- Begin by entering your name as the transferor at the top of the form.

- Provide your address, including the city, state, and ZIP code.

- Next, list the legal description of the property. This may include the parcel number or the address of the property you wish to transfer.

- Identify the beneficiary or beneficiaries. Enter their names and addresses. If there are multiple beneficiaries, list them clearly.

- Indicate whether the transfer is to be made to all beneficiaries equally or if specific shares are designated.

- Sign and date the form in the designated area. Ensure your signature matches your name as the transferor.

- Have the form notarized. A notary public must witness your signature for the deed to be valid.

- Finally, file the completed deed with the county recorder’s office in the county where the property is located.

File Information

| Fact Name | Details |

|---|---|

| Definition | A Transfer-on-Death Deed allows a property owner to transfer real estate to beneficiaries upon their death without going through probate. |

| Governing Law | The California Transfer-on-Death Deed is governed by California Probate Code Sections 5600-5694. |

| Eligibility | Only individuals, not entities, can create a Transfer-on-Death Deed for their property in California. |

| Property Types | This deed can be used for residential real estate, including single-family homes and condominiums. |

| Revocation | A Transfer-on-Death Deed can be revoked at any time before the property owner's death by filing a new deed or a revocation form. |

| Beneficiary Designation | Property owners can designate one or more beneficiaries to receive the property upon their death. |

| Filing Requirements | The deed must be recorded with the county recorder's office where the property is located to be effective. |

| No Immediate Transfer | Ownership does not transfer to the beneficiaries until the property owner's death, allowing the owner to retain full control during their lifetime. |

| Tax Implications | Beneficiaries receive a step-up in basis for tax purposes, which may reduce capital gains taxes when they sell the property. |

| Legal Assistance | While legal assistance is not required, consulting with an attorney can help ensure the deed is correctly completed and recorded. |

Other Popular Transfer-on-Death Deed State Forms

Transfer on Death Deed Iowa Form - Property owners can choose multiple beneficiaries or specify a different allocation for each, providing flexibility in how assets are distributed.

The Motor Vehicle Bill of Sale form is essential for anyone involved in the sale or purchase of a vehicle, as it not only documents the transfer of ownership but also serves as proof of the transaction. For a comprehensive template to facilitate this process, you can visit documentonline.org/blank-motor-vehicle-bill-of-sale, which provides a clear and concise framework ensuring that both parties can avoid potential disputes down the line.

Survivorship Deed Vs Transfer on Death - With a Transfer-on-Death Deed, you retain full control of your property while living.