Valid Promissory Note Form for California State

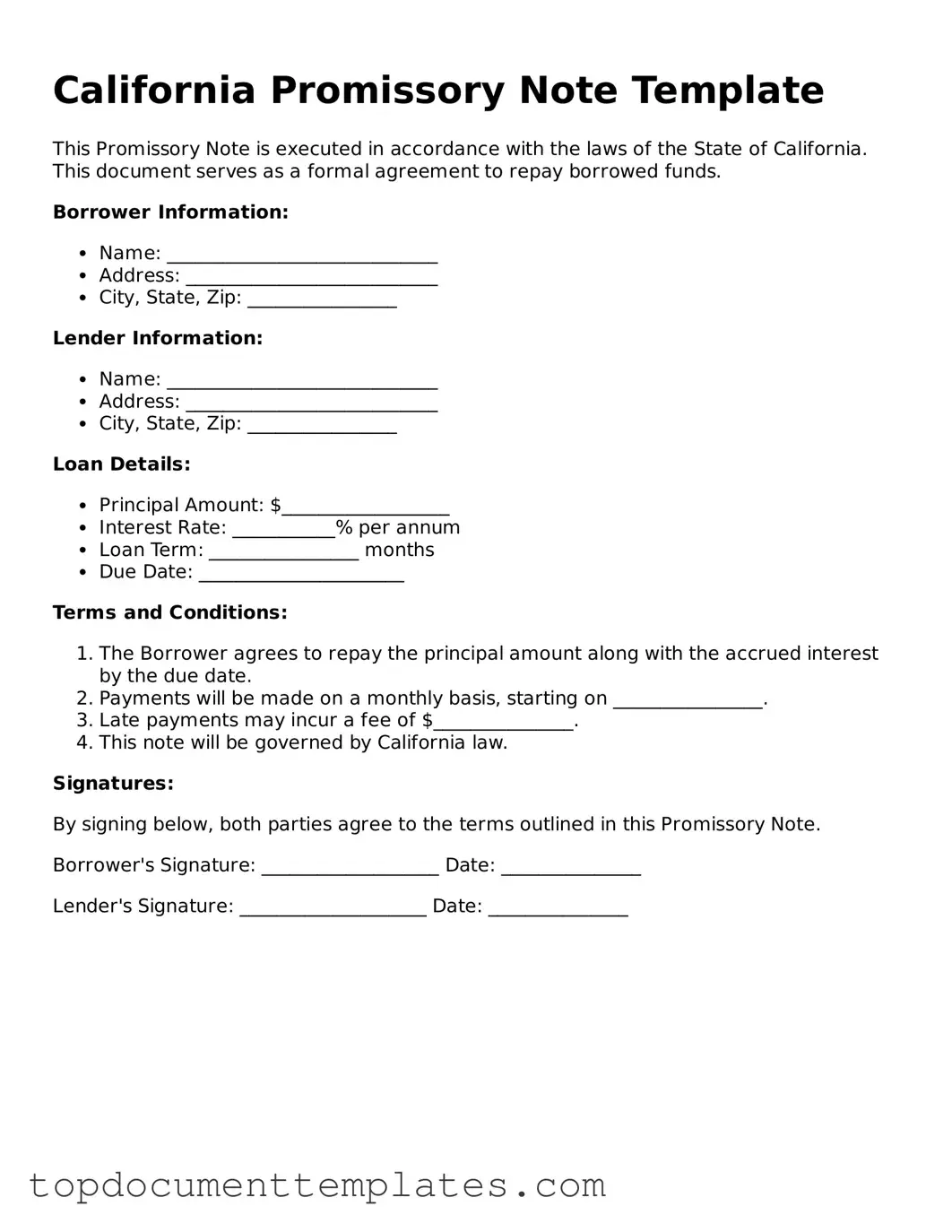

The California Promissory Note is a crucial financial document that outlines the terms of a loan agreement between a borrower and a lender. This form serves as a written promise from the borrower to repay the borrowed amount, known as the principal, along with any applicable interest, by a specified date. Key components of the form include the names and addresses of both parties, the loan amount, the interest rate, and the repayment schedule. Additionally, it may detail any collateral securing the loan, conditions for default, and the rights of both parties in case of non-payment. By clearly stating these terms, the Promissory Note helps to protect the interests of both the lender and the borrower, reducing the potential for disputes in the future. Understanding this document is essential for anyone entering into a loan agreement in California, as it lays the groundwork for the financial relationship and ensures that both parties are aware of their obligations.

Similar forms

-

Loan Agreement: Similar to a promissory note, a loan agreement outlines the terms of a loan, including the amount borrowed, interest rate, and repayment schedule. However, it typically contains more detailed provisions regarding the obligations of both the borrower and lender, including covenants and default clauses.

-

Mortgage: A mortgage is a specific type of loan agreement secured by real property. Like a promissory note, it involves the borrower’s promise to repay the loan, but it also includes the lender’s right to take possession of the property if the borrower defaults.

-

Installment Agreement: An installment agreement allows a borrower to repay a debt in a series of scheduled payments. This document shares similarities with a promissory note in that it specifies the total amount owed and the payment terms, but it may also include provisions for late fees and penalties.

-

Personal Guarantee: A personal guarantee is a document where an individual agrees to be personally responsible for a debt. While a promissory note binds the borrower to repay, a personal guarantee adds an extra layer of security for the lender, as it allows them to pursue the guarantor’s personal assets in case of default.

- Hold Harmless Agreement: This form is essential for protecting parties from liability during activities. It effectively transfers risks and is vital for asset protection, often detailed at OnlineLawDocs.com.

-

Credit Agreement: A credit agreement establishes the terms under which a lender extends credit to a borrower. Like a promissory note, it includes details about the amount borrowed and repayment terms, but it may also cover credit limits, fees, and conditions for future borrowing.

Guidelines on Writing California Promissory Note

Completing a California Promissory Note form is an important step in formalizing a loan agreement between two parties. Once the form is filled out correctly, it serves as a legal document that outlines the terms of the loan, ensuring that both the borrower and lender understand their responsibilities. Following these steps will help ensure clarity and compliance.

- Gather necessary information: Collect all relevant details about the loan, including the names and addresses of both the borrower and lender, the loan amount, interest rate, and repayment terms.

- Start with the title: At the top of the form, write "Promissory Note" to clearly indicate the purpose of the document.

- Fill in borrower information: Write the full name and address of the borrower in the designated section.

- Provide lender information: Enter the full name and address of the lender in the appropriate area.

- Specify the loan amount: Clearly state the total amount being borrowed, using both numbers and words for clarity.

- Set the interest rate: Indicate the agreed-upon interest rate, ensuring it complies with California's usury laws.

- Detail repayment terms: Outline how and when the borrower will repay the loan, including the payment frequency and due dates.

- Include any late fees: If applicable, specify any late fees that will be charged if payments are not made on time.

- Sign and date: Both the borrower and lender should sign and date the document to make it legally binding.

- Consider notarization: Although not always required, having the document notarized can provide an additional layer of security and authenticity.

After completing the form, it is advisable for both parties to keep a copy for their records. This ensures that everyone involved has access to the agreed-upon terms and conditions, which can help prevent misunderstandings in the future.

File Information

| Fact Name | Description |

|---|---|

| Definition | A California Promissory Note is a written promise to pay a specified amount of money to a designated person or entity at a specified time. |

| Governing Law | The California Uniform Commercial Code (UCC), specifically Sections 3101-3108, governs promissory notes in California. |

| Parties Involved | The document typically involves a borrower (maker) and a lender (payee). |

| Interest Rates | Interest rates can be fixed or variable, and must comply with California usury laws. |

| Payment Terms | Promissory notes outline specific payment terms, including the amount, due date, and payment frequency. |

| Default Clauses | These notes often contain clauses that define default and the consequences of non-payment. |

| Secured vs. Unsecured | A promissory note can be secured by collateral or unsecured, affecting the risk for the lender. |

| Transferability | Promissory notes in California can be transferred to another party, allowing for negotiation and sale. |

| Legal Enforceability | For a promissory note to be legally enforceable, it must meet certain requirements, including clarity and mutual agreement. |

| Notarization | While notarization is not always required, having a note notarized can provide additional legal protection. |

Other Popular Promissory Note State Forms

Promissory Note Download - Serves as proof of a loan agreement between two parties.

To facilitate a smooth transaction, it is crucial for both parties to complete the New York ATV Bill of Sale form accurately, with attention to all relevant details about the vehicle and the individuals involved. This not only protects their interests but also provides a clear record of the agreement. For further reference and to access the form, you can visit https://documentonline.org/blank-new-york-atv-bill-of-sale/.

Create Promissory Note - Promissory Notes can be secured or unsecured, depending on the agreement.

Iowa Promissory Note - A promissory note can be written in simple language for clarity.

Free Promissory Note Template Florida - Promissory notes are often more personal and flexible than bank loans.