Valid Power of Attorney Form for California State

In California, the Power of Attorney form is a crucial legal document that empowers individuals to designate someone they trust to make decisions on their behalf. This form can cover various aspects of life, including financial matters, healthcare choices, and real estate transactions. By granting authority through this document, individuals can ensure their wishes are respected even if they become unable to communicate them directly. The form can be tailored to be broad or limited, depending on the needs of the person granting the power. Additionally, it is essential to understand the different types of Power of Attorney available, such as Durable Power of Attorney, which remains effective even if the person becomes incapacitated. Understanding the nuances of this document can provide peace of mind, knowing that your affairs will be managed according to your preferences. As life circumstances change, having a Power of Attorney in place can be a vital step in safeguarding your interests and ensuring that your voice is heard when it matters most.

Similar forms

The Power of Attorney (POA) form serves a crucial function in legal and financial matters. It allows one person to act on behalf of another in specified areas. Several other documents share similarities with the POA, each offering different scopes of authority and purposes. Below is a list of eight such documents, along with explanations of how they relate to the Power of Attorney.

- Living Will: A Living Will outlines an individual’s wishes regarding medical treatment in situations where they are unable to communicate. Like a POA, it involves decision-making on behalf of another, but it specifically addresses healthcare preferences.

- Healthcare Proxy: This document designates someone to make medical decisions for an individual if they become incapacitated. Similar to a POA, it grants authority to act on another’s behalf, but it is focused solely on health-related matters.

- Durable Power of Attorney: This is a specific type of POA that remains effective even if the principal becomes incapacitated. It emphasizes the continuity of authority, akin to a standard POA but with a critical distinction regarding the principal’s mental state.

- Financial Power of Attorney: A Financial POA allows someone to manage financial affairs on behalf of another. It mirrors the general POA but is tailored to financial transactions, such as paying bills or managing investments.

- Trust Agreement: A Trust Agreement establishes a fiduciary relationship where one party holds assets for the benefit of another. While a POA grants authority to act, a trust creates a legal entity for managing assets, often used for estate planning.

- Authorization for Release of Information: This document permits a designated person to access specific information, such as medical records or financial data. It shares the concept of granting authority but is more limited in scope than a full POA.

- Living Trust: A Living Trust allows individuals to transfer assets into a trust during their lifetime. While it serves a different purpose than a POA, both documents involve the management and control of one’s assets, particularly in planning for incapacity.

- Advance Directive: An Advance Directive combines elements of a Living Will and a Healthcare Proxy. It provides instructions for medical care and designates a representative, similar to a POA focused on health decisions.

Understanding these documents can empower individuals to make informed decisions about their legal and financial affairs. Each serves a unique purpose but shares the common thread of granting authority or expressing wishes regarding personal matters.

Guidelines on Writing California Power of Attorney

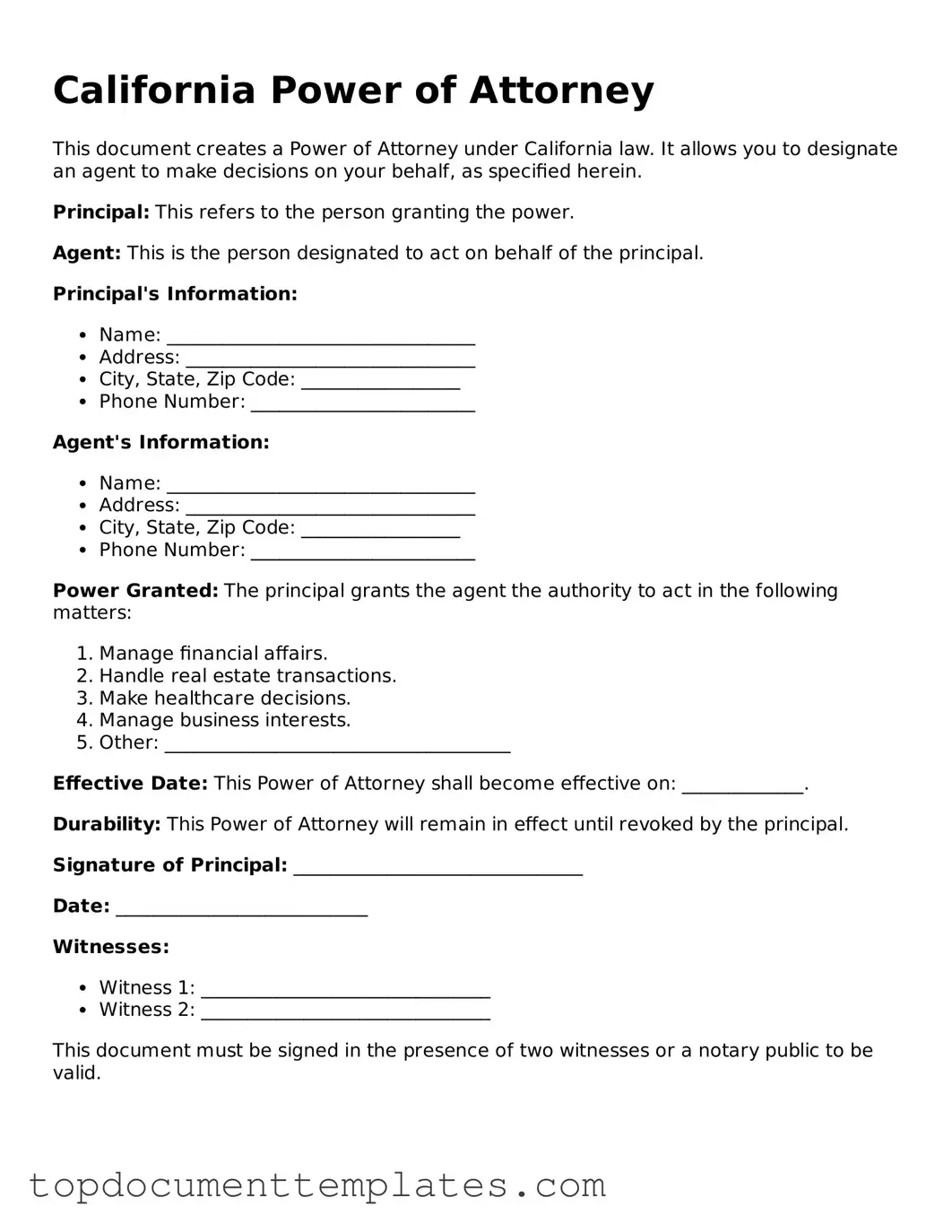

Filling out a California Power of Attorney form is an important step in designating someone to make decisions on your behalf. Once completed, the form must be signed and witnessed or notarized, depending on the specific requirements. This ensures that your wishes are respected and legally recognized. Below are the steps to guide you through the process of filling out the form.

- Obtain the California Power of Attorney form. You can find it online or through legal stationery stores.

- Read the instructions carefully to understand what information is required.

- Fill in your name and address at the top of the form. This identifies you as the principal.

- Next, provide the name and address of the person you are appointing as your agent. This person will act on your behalf.

- Specify the powers you are granting to your agent. You can choose general powers or limit them to specific tasks.

- Indicate whether the power of attorney is effective immediately or only upon a certain event, such as your incapacity.

- Sign and date the form in the designated area. Your signature must match the name you provided at the top.

- Have the form witnessed or notarized, depending on your choice. California law requires either a notary public or two witnesses.

- Provide a copy of the completed form to your agent and keep a copy for your records.

File Information

| Fact Name | Details |

|---|---|

| Purpose | A California Power of Attorney allows an individual to appoint someone else to make decisions on their behalf regarding financial matters or healthcare. |

| Governing Law | The California Power of Attorney is governed by the California Probate Code, specifically Sections 4000-4545. |

| Types | There are two main types: Durable Power of Attorney, which remains effective if the principal becomes incapacitated, and Springing Power of Attorney, which only takes effect under specific conditions. |

| Requirements | The form must be signed by the principal and notarized or witnessed by at least one adult who is not named in the document. |

Other Popular Power of Attorney State Forms

Financial Power of Attorney Michigan - May be subject to state laws and definitions of authority.

Iowa Power of Attorney - It's essential to choose someone you trust when filling out this form.