Valid Loan Agreement Form for California State

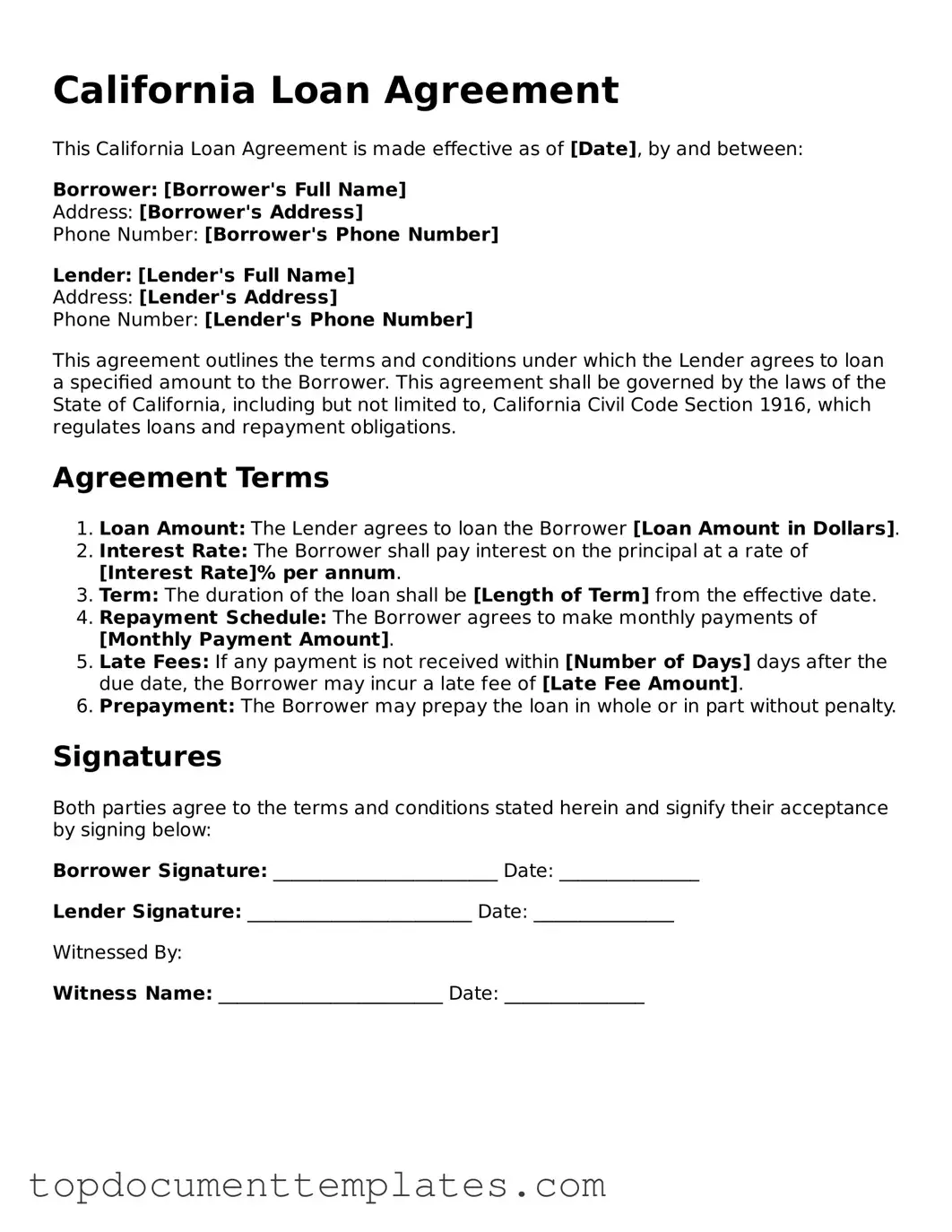

When entering into a loan agreement in California, it's essential to understand the key components that make up this important document. The California Loan Agreement form serves as a legally binding contract between a lender and a borrower, outlining the terms and conditions of the loan. This form typically includes details such as the loan amount, interest rate, repayment schedule, and any collateral that may be required. Additionally, it addresses the rights and responsibilities of both parties, ensuring clarity and protecting their interests. Borrowers should pay close attention to any fees or penalties associated with late payments, as these can significantly impact the total cost of the loan. The form also often includes provisions for default, outlining the steps that may be taken if the borrower fails to meet their obligations. Understanding these aspects is crucial for anyone looking to secure a loan in California, as it can help prevent misunderstandings and disputes down the line.

Similar forms

Promissory Note: A promissory note is a written promise to pay a specific amount of money at a specified time. Like a loan agreement, it outlines the terms of the loan, including the interest rate and repayment schedule.

- Quitclaim Deed: A quitclaim deed is used to transfer ownership of real estate without warranty. It's commonly used in real estate transactions among family members. For more information, you can access and download the form.

Mortgage Agreement: This document secures a loan with real property. Similar to a loan agreement, it details the loan amount, interest rate, and terms of repayment, but it also includes provisions regarding the property in case of default.

Security Agreement: A security agreement provides collateral for a loan. It outlines the assets that secure the loan, much like a loan agreement specifies the obligations of the borrower.

Credit Agreement: This document governs the terms of a credit facility. It shares similarities with a loan agreement by detailing the amount of credit, interest rates, and repayment terms, but often includes additional clauses regarding fees and covenants.

Lease Agreement: While primarily for renting property, a lease agreement can resemble a loan agreement in that it specifies payment terms and obligations over a set period, especially in commercial leases.

Partnership Agreement: This document outlines the terms of a partnership, including financial contributions. Like a loan agreement, it details the responsibilities and expectations of each party, particularly regarding financial matters.

Service Agreement: A service agreement outlines the terms under which services are provided. Similar to a loan agreement, it specifies payment terms, duration, and obligations of the parties involved.

Sales Agreement: This document details the terms of a sale, including payment terms. It shares similarities with a loan agreement by outlining the obligations of both the buyer and seller, particularly regarding payment.

Personal Guarantee: A personal guarantee provides assurance that an individual will repay a loan. It parallels a loan agreement in that it outlines the obligations of the guarantor, similar to the borrower's responsibilities.

Guidelines on Writing California Loan Agreement

Filling out the California Loan Agreement form requires careful attention to detail. Each section must be completed accurately to ensure a clear understanding between the parties involved. Once the form is filled out, it should be reviewed thoroughly before being signed.

- Begin by entering the date at the top of the form.

- Provide the names and addresses of both the lender and the borrower in the designated sections.

- Clearly state the loan amount in the appropriate field.

- Specify the interest rate, if applicable, and indicate whether it is fixed or variable.

- Detail the repayment terms, including the schedule of payments and due dates.

- Include any late fees or penalties for missed payments in the specified section.

- Outline any collateral that may be required to secure the loan.

- Provide a section for any additional terms or conditions that both parties agree upon.

- Ensure both parties sign and date the form at the bottom.

- Make copies of the completed agreement for both the lender and the borrower for their records.

File Information

| Fact Name | Details |

|---|---|

| Purpose | The California Loan Agreement form is used to outline the terms and conditions of a loan between a lender and a borrower. |

| Governing Law | This agreement is governed by California state law, specifically the California Civil Code. |

| Key Components | It typically includes details such as loan amount, interest rate, repayment schedule, and any collateral involved. |

| Signatures | Both parties must sign the agreement for it to be legally binding, indicating their acceptance of the terms. |

Other Popular Loan Agreement State Forms

Georgia Promissory Note - The form may require consent before the borrower takes additional loans.

Understanding the intricacies of a Durable Power of Attorney is essential for anyone planning for the future, as it allows a trusted individual to manage important decisions during times of incapacity. For more detailed information about this crucial legal document, you can visit https://onlinelawdocs.com/, which offers valuable resources to help individuals navigate the complexities of establishing a Durable Power of Attorney.

Florida Promissory Note Template - The agreement might specify any fees associated with the loan process.