Valid Gift Deed Form for California State

The California Gift Deed form serves as a vital tool for individuals wishing to transfer property ownership without the exchange of money. This legal document allows a donor to convey real estate to a recipient, often a family member or close friend, as a gesture of goodwill. By utilizing this form, the donor can ensure that their intentions are clearly outlined, providing protection against potential disputes in the future. The Gift Deed must be executed with the appropriate signatures and notarization to be considered valid, and it typically includes essential details such as the names of both the donor and recipient, a description of the property being transferred, and any conditions that may apply. Understanding the nuances of this form is crucial for anyone considering a property gift, as it not only facilitates the transfer but also addresses tax implications and the rights of the recipient. With proper execution, a Gift Deed can simplify the process of transferring property while fostering familial bonds and supporting loved ones in meaningful ways.

Similar forms

Quitclaim Deed: This document transfers ownership of property without any warranties. It is often used when the property is given as a gift, similar to a Gift Deed.

- DA Form 31: This form is essential for U.S. Army members to formally request leave, ensuring proper documentation and authorization. More information can be found at https://onlinelawdocs.com/.

Warranty Deed: This deed guarantees that the grantor holds clear title to the property. While it offers more protection than a Gift Deed, it serves a similar purpose of transferring property ownership.

Transfer on Death Deed: This allows an individual to transfer property to a beneficiary upon their death. Like a Gift Deed, it facilitates the transfer of ownership without going through probate.

Beneficiary Deed: Similar to a Transfer on Death Deed, this document allows property to be transferred to a designated beneficiary upon the owner's death, making it a non-probate transfer.

Bill of Sale: While typically used for personal property, a Bill of Sale can also document the transfer of ownership, similar to how a Gift Deed documents the gifting of real estate.

Deed of Trust: This document secures a loan with real property. Though it serves a different purpose, it involves the transfer of interest in property, akin to a Gift Deed.

Lease Agreement: While primarily for renting property, a Lease Agreement can sometimes be used to transfer rights temporarily, similar to how a Gift Deed transfers ownership.

Affidavit of Heirship: This document establishes the heirs of a deceased person, allowing for the transfer of property ownership without a will, similar to the intent behind a Gift Deed.

Power of Attorney: This allows one person to act on behalf of another, including transferring property. It can facilitate a gift in a manner similar to a Gift Deed.

Guidelines on Writing California Gift Deed

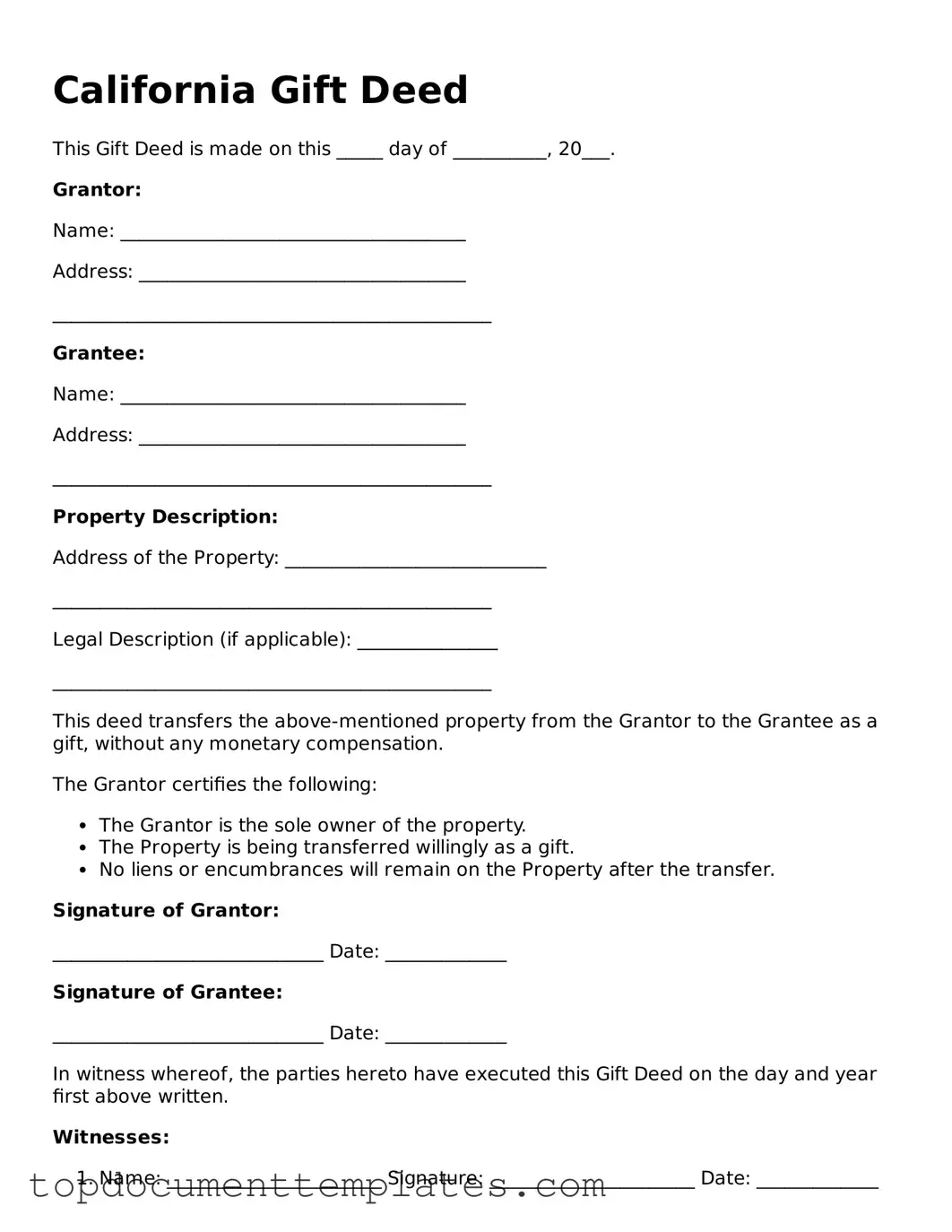

After gathering the necessary information, you can begin filling out the California Gift Deed form. This process involves entering specific details about the property and the parties involved. Make sure to have all required information ready before you start.

- Obtain the California Gift Deed form. You can find it online or at a local legal office.

- Fill in the date at the top of the form. This is the date you are completing the deed.

- Provide the names and addresses of the grantor (the person giving the gift) and the grantee (the person receiving the gift). Ensure that the names are spelled correctly.

- Describe the property being transferred. Include the address and any legal description, if available.

- Indicate the relationship between the grantor and the grantee. This helps clarify the nature of the gift.

- Sign the form in the presence of a notary public. This step is essential for the deed to be legally valid.

- Have the notary public complete their section of the form. They will verify your identity and witness your signature.

- Make copies of the completed form for your records.

- File the original Gift Deed with the county recorder’s office where the property is located. This ensures that the transfer is officially recorded.

Once the form is filled out and filed, the gift deed will be processed by the county. You will receive confirmation once the recording is complete. Keep your copies in a safe place for future reference.

File Information

| Fact Name | Description |

|---|---|

| Purpose | The California Gift Deed form is used to transfer property as a gift without any exchange of money. |

| Governing Law | The form is governed by California Civil Code Sections 11911-11915. |

| Requirements | The deed must be signed by the donor and must be notarized to be valid. |

| Property Types | Real property, including land and buildings, can be transferred using this deed. |

| Tax Implications | Gift tax may apply, and both the donor and recipient should consult tax professionals. |

| Recording | The completed deed must be recorded with the county recorder's office to be effective against third parties. |

| Revocation | A gift deed cannot be revoked once it has been executed and delivered, unless specific conditions are met. |

| Beneficiary Designation | The recipient of the gift is typically designated as the grantee in the deed. |

Other Popular Gift Deed State Forms

Gift Deed Georgia - This document can enhance transparency among family members concerning property distribution.

The IRS W-9 form is a document used by individuals and businesses to provide their taxpayer identification information to others, typically for tax reporting purposes. This form is essential for freelancers, contractors, and service providers who need to report their earnings to the IRS. By completing the W-9, individuals and entities ensure compliance with tax laws while facilitating clear communication of financial information. For more information on the W-9 form, you can visit documentonline.org/blank-irs-w-9.