Valid Deed in Lieu of Foreclosure Form for California State

In the landscape of real estate transactions, particularly for homeowners facing financial difficulties, the California Deed in Lieu of Foreclosure form serves as a crucial tool. This legal document allows a homeowner to voluntarily transfer their property title to the lender, effectively sidestepping the often lengthy and stressful foreclosure process. By choosing this option, homeowners can mitigate the impact on their credit score and potentially avoid the emotional turmoil associated with foreclosure. The form outlines the terms under which the property is transferred, ensuring that both parties understand their rights and obligations. Importantly, it can also address any remaining debts related to the mortgage, providing clarity on whether the lender will pursue a deficiency judgment. Understanding the implications of this form is essential for anyone considering it, as it can lead to a smoother transition and offer a fresh start in challenging financial times.

Similar forms

- Short Sale Agreement: This document allows a homeowner to sell their property for less than the amount owed on the mortgage, with the lender's approval. Both processes aim to avoid foreclosure.

- Loan Modification Agreement: This document modifies the terms of an existing loan to make payments more manageable. Like a Deed in Lieu, it seeks to prevent foreclosure by keeping the homeowner in their property.

- Forbearance Agreement: This agreement temporarily pauses or reduces mortgage payments. It offers relief to homeowners facing financial difficulties, similar to the relief provided by a Deed in Lieu.

- Mortgage Release: This document releases a borrower from their mortgage obligations. It serves a similar purpose to a Deed in Lieu by allowing the homeowner to exit the mortgage without foreclosure.

- Repayment Plan: A repayment plan outlines how a borrower will catch up on missed payments. It can prevent foreclosure, much like a Deed in Lieu by providing a structured way to address financial hardship.

- Power of Attorney for Motor Vehicle: This document allows an owner to designate an individual to manage motor vehicle transactions, akin to the authority granted in a Deed in Lieu of Foreclosure. For detailed information, you can visit TopTemplates.info.

- Deed of Trust: This document secures a loan by transferring the title of the property to a trustee until the loan is repaid. It shares similarities with a Deed in Lieu in terms of property transfer.

- Bankruptcy Filing: Filing for bankruptcy can halt foreclosure proceedings and provide a fresh start. It serves as an alternative to a Deed in Lieu, allowing the homeowner to manage debts differently.

- Property Settlement Agreement: This document outlines the division of property in divorce or separation. It can be similar to a Deed in Lieu when it involves transferring property ownership to resolve financial disputes.

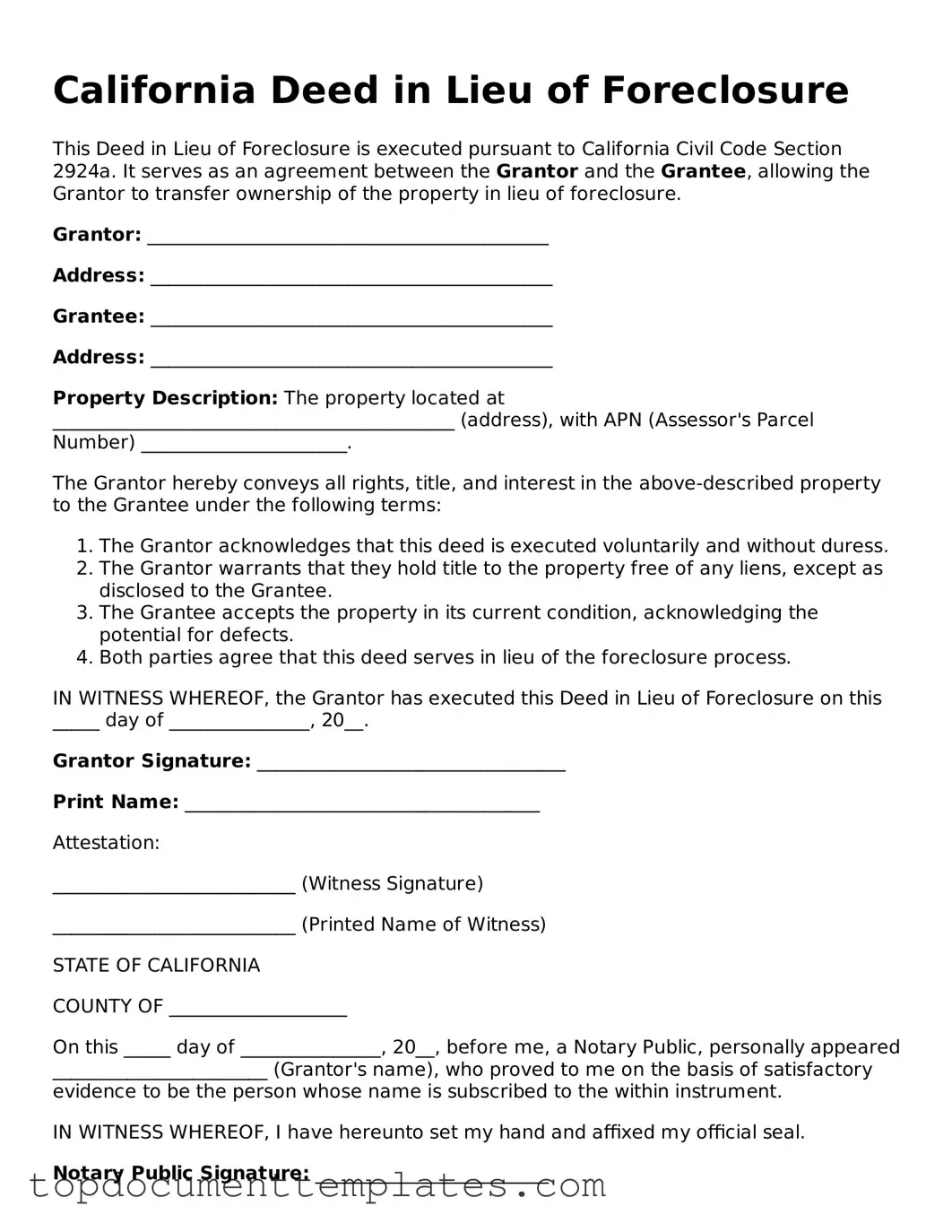

Guidelines on Writing California Deed in Lieu of Foreclosure

Once you have the California Deed in Lieu of Foreclosure form, it is essential to complete it accurately to ensure a smooth process. After filling out the form, you will typically need to submit it to the appropriate parties, which may include your lender and local government offices.

- Begin by entering the date at the top of the form.

- Fill in the name of the current property owner(s) in the designated section.

- Provide the address of the property, including the city, state, and ZIP code.

- Include the legal description of the property. This may be found on your property deed or tax documents.

- Indicate the lender's name and address as the recipient of the deed.

- Sign the form where indicated. All property owners must sign.

- Have the signatures notarized. This step is crucial for the document to be valid.

- Make copies of the completed form for your records.

- Submit the original signed and notarized form to your lender and any relevant local authorities.

File Information

| Fact Name | Description |

|---|---|

| Definition | A Deed in Lieu of Foreclosure is an agreement where a borrower voluntarily transfers property ownership to the lender to avoid foreclosure. |

| Purpose | This form helps homeowners avoid the lengthy and stressful foreclosure process. |

| Eligibility | Typically, borrowers must be facing financial hardship and unable to continue mortgage payments. |

| Governing Law | The process is governed by California Civil Code Section 1475. |

| Impact on Credit | A Deed in Lieu of Foreclosure may have a less severe impact on credit scores compared to a foreclosure. |

| Tax Implications | Borrowers should consult a tax professional, as there may be tax consequences related to debt forgiveness. |

| Process | The borrower must submit a request to the lender, who will review the circumstances before accepting the deed. |

| Documentation | Required documents may include the original mortgage, financial statements, and a hardship letter. |

| Alternatives | Homeowners may also consider loan modification or short sale as alternatives to a Deed in Lieu of Foreclosure. |

| Legal Advice | It is advisable to seek legal counsel to understand all implications before proceeding with this option. |

Other Popular Deed in Lieu of Foreclosure State Forms

Deed in Lieu Vs Foreclosure - It primarily benefits those who do not wish to maintain a property they cannot afford.

When completing a transaction involving personal property in Illinois, it is crucial to utilize the Illinois Bill of Sale form, which can be accessed online at https://documentonline.org/blank-illinois-bill-of-sale/. This document ensures that both the buyer and seller have a clear and documented proof of ownership transfer, protecting their respective rights and interests.

Georgia Foreclosure Laws - It offers a way to resolve mortgage default without the court intervention typically involved in foreclosures.

Sample Deed in Lieu of Foreclosure - A Deed in Lieu can be less stressful compared to the formal foreclosure process.