Official Business Purchase and Sale Agreement Template

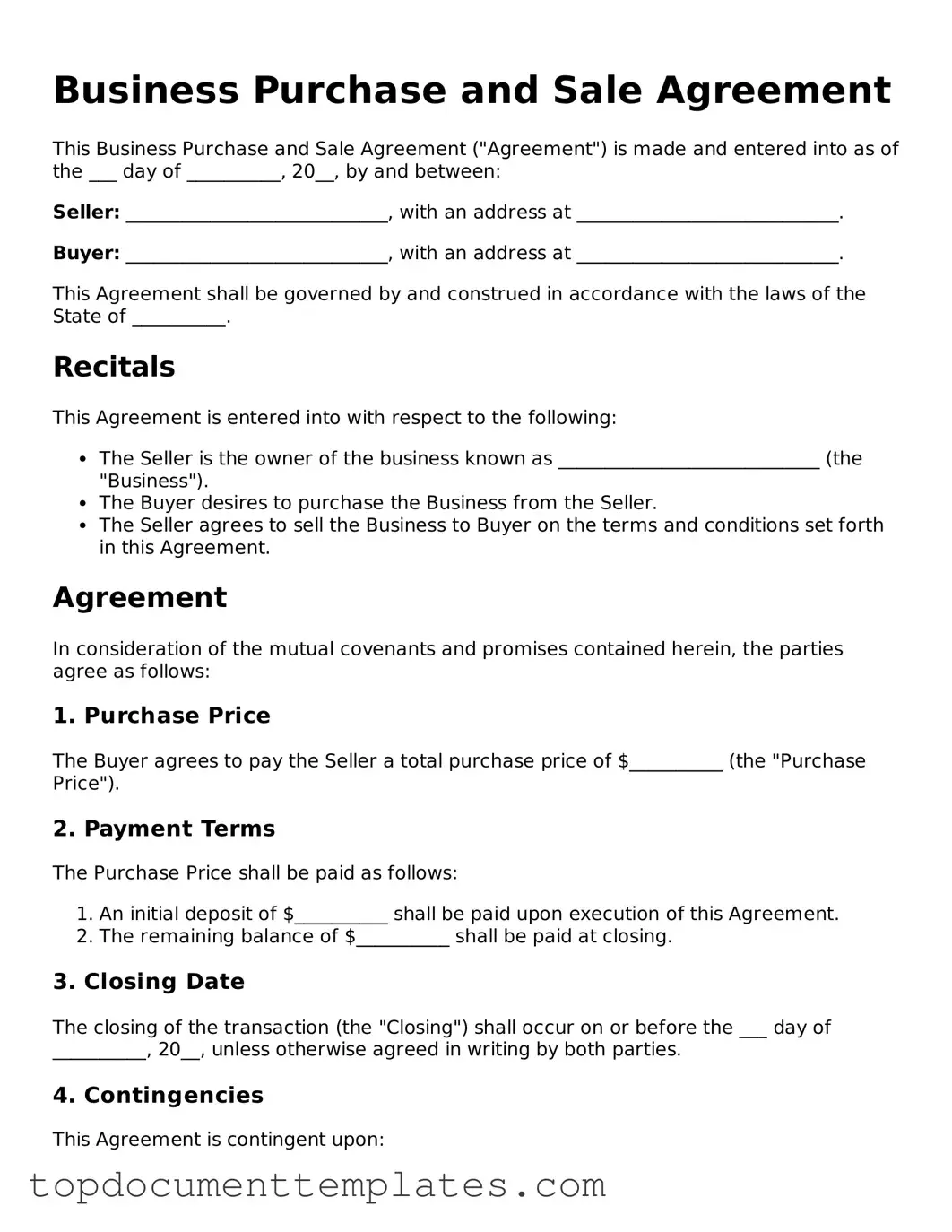

When contemplating the sale or purchase of a business, one of the most critical documents involved is the Business Purchase and Sale Agreement. This agreement serves as a comprehensive blueprint for the transaction, detailing the terms and conditions under which the business will change hands. It typically includes essential elements such as the purchase price, payment structure, and the specific assets being transferred. Additionally, the agreement outlines any liabilities that the buyer may assume and the representations and warranties made by both parties. Another vital aspect is the timeline for the transaction, which helps ensure that all parties are aligned on key dates. Furthermore, the agreement often addresses contingencies that could affect the sale, such as financing approval or regulatory compliance. By laying out these crucial details, the Business Purchase and Sale Agreement not only facilitates a smoother transaction but also protects the interests of both the buyer and the seller, making it an indispensable tool in the business acquisition process.

Similar forms

- Asset Purchase Agreement: This document outlines the terms for buying specific assets of a business rather than the entire company. It details what assets are included in the sale, similar to how a Business Purchase and Sale Agreement specifies the business being sold.

- Stock Purchase Agreement: This agreement focuses on the purchase of shares in a company. Like the Business Purchase and Sale Agreement, it includes details about the purchase price and conditions for the sale.

- Letter of Intent: This document expresses a party's intention to enter into a business transaction. It often includes preliminary terms and conditions, much like the initial discussions in a Business Purchase and Sale Agreement.

- Confidentiality Agreement: Also known as a non-disclosure agreement, this document protects sensitive information shared during negotiations. It is similar in purpose to the confidentiality clauses often found in a Business Purchase and Sale Agreement.

Investment Letter of Intent: This preliminary agreement is crucial for outlining the essential framework for potential investment deals. It details the terms under which an investor proposes capital, serving as a foundation for further negotiations and the eventual formal agreement. For more information, visit https://toptemplates.info.

- Due Diligence Checklist: This is a list of items to review before finalizing a sale. It helps ensure that all necessary information is considered, much like the due diligence process referenced in a Business Purchase and Sale Agreement.

- Bill of Sale: This document serves as proof of transfer of ownership of assets. It is related to the Business Purchase and Sale Agreement as it finalizes the transaction once the sale is complete.

- Operating Agreement: For businesses structured as LLCs, this document outlines the management and operational procedures. It is similar in that it provides clarity on how the business will operate post-sale, akin to the operational terms in a Business Purchase and Sale Agreement.

Guidelines on Writing Business Purchase and Sale Agreement

Filling out a Business Purchase and Sale Agreement is an important step in ensuring a smooth transaction when buying or selling a business. By following the steps below, you can confidently complete the form, ensuring that all necessary details are included for a clear understanding between both parties.

- Identify the Parties: Begin by entering the names and addresses of both the buyer and the seller. Make sure to include any business names if applicable.

- Describe the Business: Provide a detailed description of the business being sold. This may include the business name, location, and type of business activities.

- Purchase Price: Clearly state the total purchase price for the business. Break down the payment terms, including any deposits, installment payments, or financing arrangements.

- Assets Included: List all assets that are included in the sale. This can encompass inventory, equipment, intellectual property, and any other relevant assets.

- Liabilities: Specify any liabilities that the buyer will assume as part of the sale. This might include debts, leases, or pending legal issues.

- Closing Date: Enter the agreed-upon closing date for the transaction. This is the date when the sale will be finalized.

- Contingencies: Outline any conditions that must be met before the sale can proceed. This could involve financing approvals or inspections.

- Signatures: Ensure that both parties sign and date the agreement. It’s advisable to have a witness or notary if required by state law.

Once you have completed the form, review it carefully to ensure all information is accurate and complete. This will help avoid any misunderstandings in the future and pave the way for a successful business transaction.

File Information

| Fact Name | Description |

|---|---|

| Definition | A Business Purchase and Sale Agreement is a legal document that outlines the terms and conditions under which a business is sold. |

| Parties Involved | The agreement typically involves a seller, who is the current owner of the business, and a buyer, who intends to purchase the business. |

| Key Components | It usually includes details such as purchase price, payment terms, and representations and warranties of both parties. |

| Governing Law | The governing law can vary by state. For example, in California, the agreement is governed by California Business and Professions Code. |

| Confidentiality Clause | Many agreements contain a confidentiality clause to protect sensitive business information during and after the sale process. |

| Closing Process | The closing process, which finalizes the sale, typically requires the execution of the agreement and the transfer of funds and ownership. |

Consider Other Forms

Job Application Spanish - Be prepared for potential follow-up interviews or calls.

To ensure a smooth rental experience in Florida, it is essential to have a thorough understanding of the terms outlined in the Florida Residential Lease Agreement. This legally binding document protects both the landlord and tenant by detailing crucial aspects such as the lease duration and financial responsibilities. For those looking to formalize their rental agreements, you can download the form now to get started.

How to File Mechanics Lien - Utilized when traditional payment methods fail to provide resolution.

Miscellaneous Information - Contractors should ensure they receive the form from each business they’ve worked with.