Blank Business Credit Application PDF Form

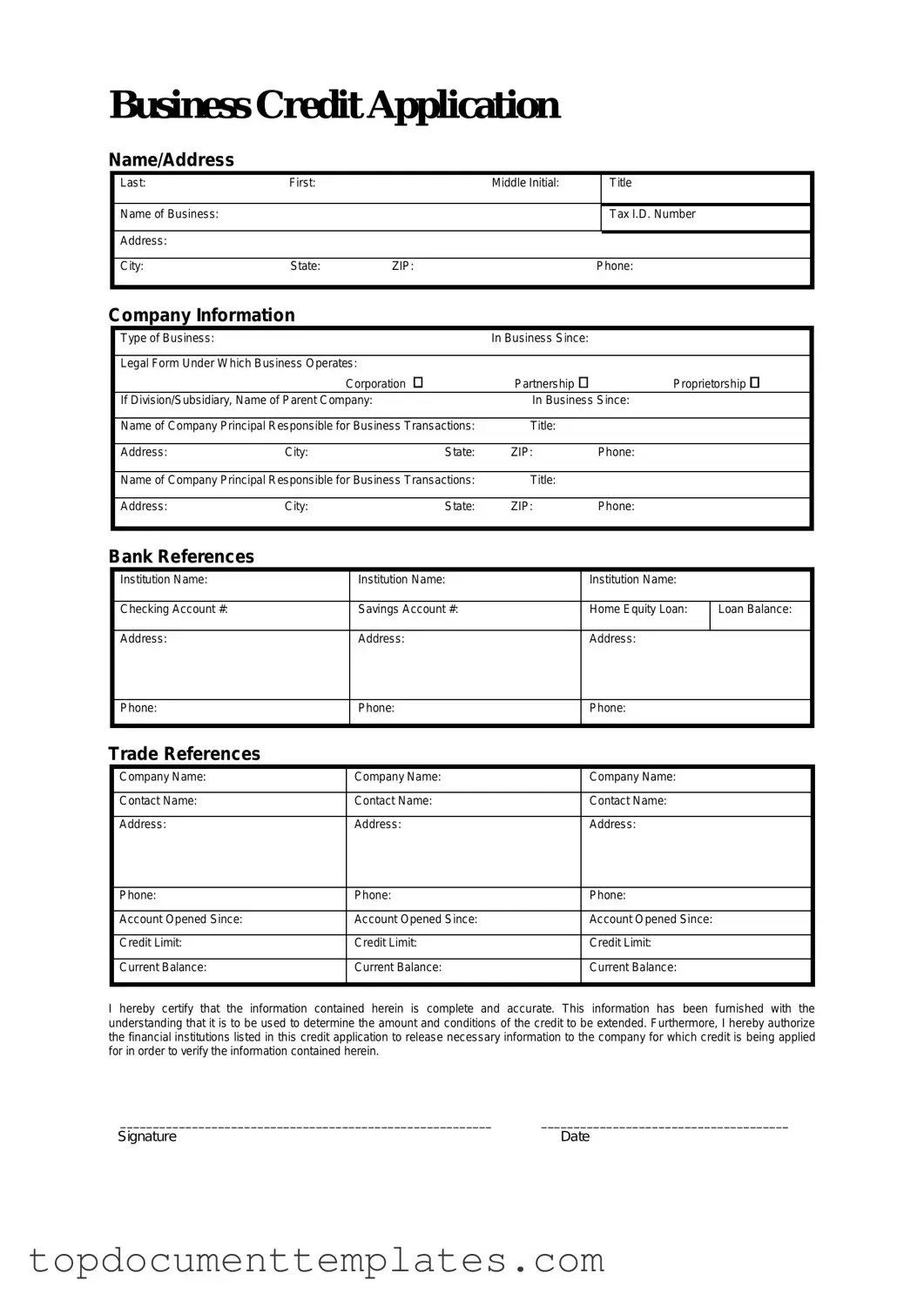

When seeking to establish a business relationship with suppliers or lenders, the Business Credit Application form serves as a crucial first step. This document not only helps organizations assess the creditworthiness of potential clients but also provides valuable insights into the financial health and operational stability of a business. Typically, the form requests essential information such as the legal name of the business, contact details, and the type of business structure, whether it’s a sole proprietorship, partnership, or corporation. Additionally, it often requires details about the business's ownership, including the names and addresses of owners or partners, as well as their Social Security numbers for identification purposes. Financial history is another key component; applicants usually need to disclose their annual revenue, existing debts, and banking relationships. Furthermore, references from other suppliers or creditors may be requested to gauge the applicant's reliability. Completing this form accurately and thoroughly can pave the way for favorable credit terms and a fruitful business partnership.

Similar forms

- Personal Credit Application: This document is used by individuals to apply for credit. Like the Business Credit Application, it collects personal information, financial history, and employment details to assess creditworthiness.

- Loan Application Form: Similar to the Business Credit Application, this form is used when seeking a loan. It gathers detailed information about the applicant's financial status, purpose of the loan, and repayment plans.

- Vendor Credit Application: This document is specifically for businesses applying for credit with vendors. It shares similarities in structure, requesting business details, references, and financial information to evaluate credit risk.

- Lease Application: When businesses seek to lease property or equipment, they fill out a lease application. This form, like the Business Credit Application, assesses financial stability and includes similar personal and business information.

- Business Loan Agreement: Once a business secures a loan, this agreement outlines the terms. While it is a different stage in the process, it relies on the information provided in the Business Credit Application to determine eligibility.

- Partnership Agreement: When forming a partnership, this document outlines the roles and responsibilities of each partner. It often requires financial disclosures similar to those found in a Business Credit Application to ensure transparency.

- Credit Reference Request: This document is used to obtain references from other creditors. It is similar in that it seeks to validate the creditworthiness of a business, relying on the same type of financial information.

Guidelines on Writing Business Credit Application

After obtaining the Business Credit Application form, you will need to complete it accurately to ensure a smooth processing experience. This form typically requires information about your business, its financial status, and your credit history. Follow these steps to fill out the form correctly.

- Begin by entering your business name in the designated field.

- Provide the business address, including city, state, and ZIP code.

- List the type of business entity (e.g., corporation, partnership, sole proprietorship).

- Indicate the date your business was established.

- Fill in the Federal Employer Identification Number (EIN) if applicable.

- Provide the name and title of the primary contact person.

- Enter the contact phone number and email address for the primary contact.

- Detail your business’s annual revenue and the number of employees.

- List any trade references, including names, addresses, and contact information.

- Sign and date the application to certify the information is accurate.

Form Data

| Fact Name | Description |

|---|---|

| Purpose | The Business Credit Application form is used by businesses to apply for credit from lenders or suppliers, providing essential information about the business's financial health and creditworthiness. |

| Required Information | Typically, the form requires details such as the business name, address, tax identification number, ownership structure, and financial statements. |

| State-Specific Forms | Some states may have specific requirements for the Business Credit Application, governed by local commercial laws, such as the Uniform Commercial Code (UCC) in many states. |

| Confidentiality | Information submitted on the application is usually treated as confidential by lenders, but businesses should review privacy policies to understand how their data will be used. |

Other PDF Documents

Child Guardianship Forms - The temporary custody form outlines the conditions under which custody is granted.

Ucc 1-308 Meaning - Explicit reservation of rights is emphasized in this document.

Da - When in use, ensure all parties have access to the completed form.