Blank Broker Price Opinion PDF Form

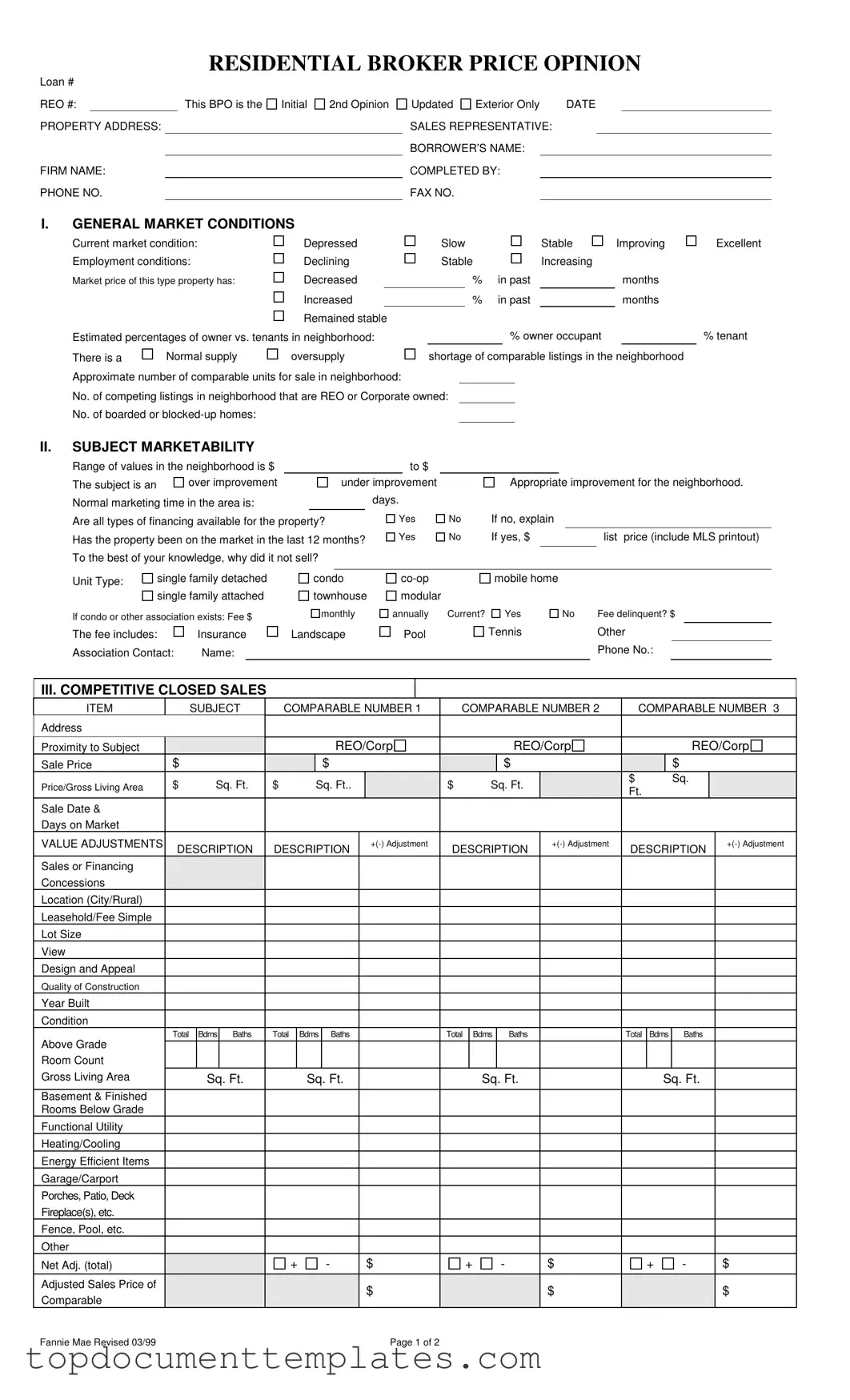

The Broker Price Opinion (BPO) form serves as a crucial tool for assessing the value of residential properties, particularly in situations involving real estate owned (REO) properties. This comprehensive document captures essential details such as the property address, loan number, and the name of the firm conducting the evaluation. It provides insights into the current market conditions, including employment trends and the availability of comparable listings in the neighborhood. The BPO outlines the subject property's marketability, noting whether it is over or under improved compared to local standards. Additionally, it includes a comparative analysis of recently closed sales and active listings, allowing for adjustments based on various factors like location, condition, and amenities. By summarizing necessary repairs and estimating a suggested list price, the BPO guides sellers, buyers, and lenders in making informed decisions. Ultimately, this form plays a vital role in establishing a property's fair market value in a dynamic real estate landscape.

Similar forms

- Comparative Market Analysis (CMA): A CMA evaluates similar properties in a specific area to determine a fair market value. Like a Broker Price Opinion, it uses recent sales data and current listings to provide an estimated value for a property.

- Appraisal Report: An appraisal report is a professional assessment of a property's value. Both documents consider property condition and market trends, but appraisals are usually performed by licensed appraisers and are more detailed.

- Listing Agreement: A listing agreement outlines the terms under which a property will be sold. Similar to a Broker Price Opinion, it often includes a suggested price based on market analysis, but it also formalizes the relationship between the seller and the real estate agent.

- Sales Contract: A sales contract is a legal agreement between a buyer and seller. It may reference a Broker Price Opinion to justify the selling price, similar to how it may reference an appraisal or CMA.

- Market Analysis Report: This report provides insights into market trends and property values. Like a Broker Price Opinion, it helps determine pricing strategies, but it may focus more broadly on market conditions rather than individual properties.

- Property Inspection Report: A property inspection report assesses the condition of a property. While it does not provide a value, it can influence the conclusions of a Broker Price Opinion by highlighting necessary repairs or improvements.

- Investment Property Analysis: This analysis evaluates the potential return on investment for a property. It shares similarities with a Broker Price Opinion in assessing property value but also includes financial metrics like cash flow and ROI.

- Real Estate Market Report: A real estate market report summarizes data on property sales, trends, and forecasts. It can inform a Broker Price Opinion by providing context on market dynamics affecting property values.

- Asylum Application Summary: The USCIS I-589 form is vital for individuals seeking asylum, delineating their fears of persecution. Completing this accurately is crucial for assessment, as discussed at TopTemplates.info.

- Rent Roll: A rent roll lists the rental income from a property. While it does not assess property value directly, it can influence a Broker Price Opinion for income-generating properties by showing potential cash flow.

- Property Tax Assessment: A property tax assessment determines the value of a property for tax purposes. It is similar to a Broker Price Opinion in that both assess property value, but tax assessments are often based on different criteria and may not reflect current market conditions.

Guidelines on Writing Broker Price Opinion

Filling out the Broker Price Opinion (BPO) form requires careful attention to detail. This document is crucial for assessing property value based on various market factors and comparable sales. Follow these steps to ensure accurate completion of the form.

- Begin with the top section. Fill in the Loan #, REO #, and PROPERTY ADDRESS.

- Enter your FIRM NAME and PHONE NO.. Specify if this is an Initial, 2nd Opinion, or Updated Exterior Only report.

- Fill in the DATE, SALES REPRESENTATIVE, BORROWER’S NAME, COMPLETED BY, and FAX NO..

- In the GENERAL MARKET CONDITIONS section, assess the current market condition and employment conditions. Choose options like Depressed, Stable, or Increasing.

- Indicate the market price changes for the property type and estimate the percentage of owners versus tenants in the neighborhood.

- Evaluate the supply of comparable listings. Note the approximate number of comparable units for sale and any boarded or blocked-up homes.

- Move to the SUBJECT MARKETABILITY section. Specify the range of values in the neighborhood and whether the property is an over or under improvement.

- Document the normal marketing time and financing availability. If the property was on the market in the last 12 months, include the list price.

- In the COMPETITIVE CLOSED SALES section, fill in details for the subject property and up to three comparable properties. Include addresses, sale prices, and adjustments.

- Assess the MARKETING STRATEGY. Indicate if the property will be sold as-is or if minimal repairs are required.

- Detail any repairs needed in the REPAIRS section. List all necessary repairs and their estimated costs.

- For the COMPETITIVE LISTINGS, enter information about comparable properties currently on the market, including list prices and adjustments.

- Finally, determine the MARKET VALUE based on your findings. Include a suggested list price and any relevant comments regarding the property.

- Sign and date the form to complete the process.

Once you’ve filled out the form, review it for accuracy. Ensure all information is clear and complete. This will help in making informed decisions regarding the property’s value and marketing strategy.

Form Data

| Fact Name | Description |

|---|---|

| Purpose | The Broker Price Opinion (BPO) form is used by real estate professionals to estimate the value of a property, often for lenders or banks considering a short sale or foreclosure. |

| Components | This form includes sections for market conditions, subject property details, competitive sales, and marketing strategies, providing a comprehensive view of the property’s value. |

| State-Specific Regulations | In California, the BPO must comply with the California Business and Professions Code, which outlines the qualifications and responsibilities of real estate brokers in providing these opinions. |

| Market Analysis | The BPO requires an analysis of comparable properties, including their sale prices and conditions, to help determine a fair market value for the subject property. |

Other PDF Documents

Simple Boyfriend Application Form - This application helps us understand what you're looking for in a boyfriend.

The IRS Form 2553 is used by small businesses to elect to be treated as an S Corporation for federal tax purposes. This designation allows income, deductions, and credits to flow through to shareholders, thus avoiding double taxation. To enhance your understanding and compliance, you can refer to the detailed guidelines available at documentonline.org/blank-irs-2553/, as completing this form correctly is essential for ensuring compliance and optimizing tax benefits.

Puppy Health Record - Document birth time to establish precise age.

Tractor Trailer Pre Trip Inspection Diagram - Ensure that the vehicle is free of any personal items that could be distracting.