Blank Auto Insurance Card PDF Form

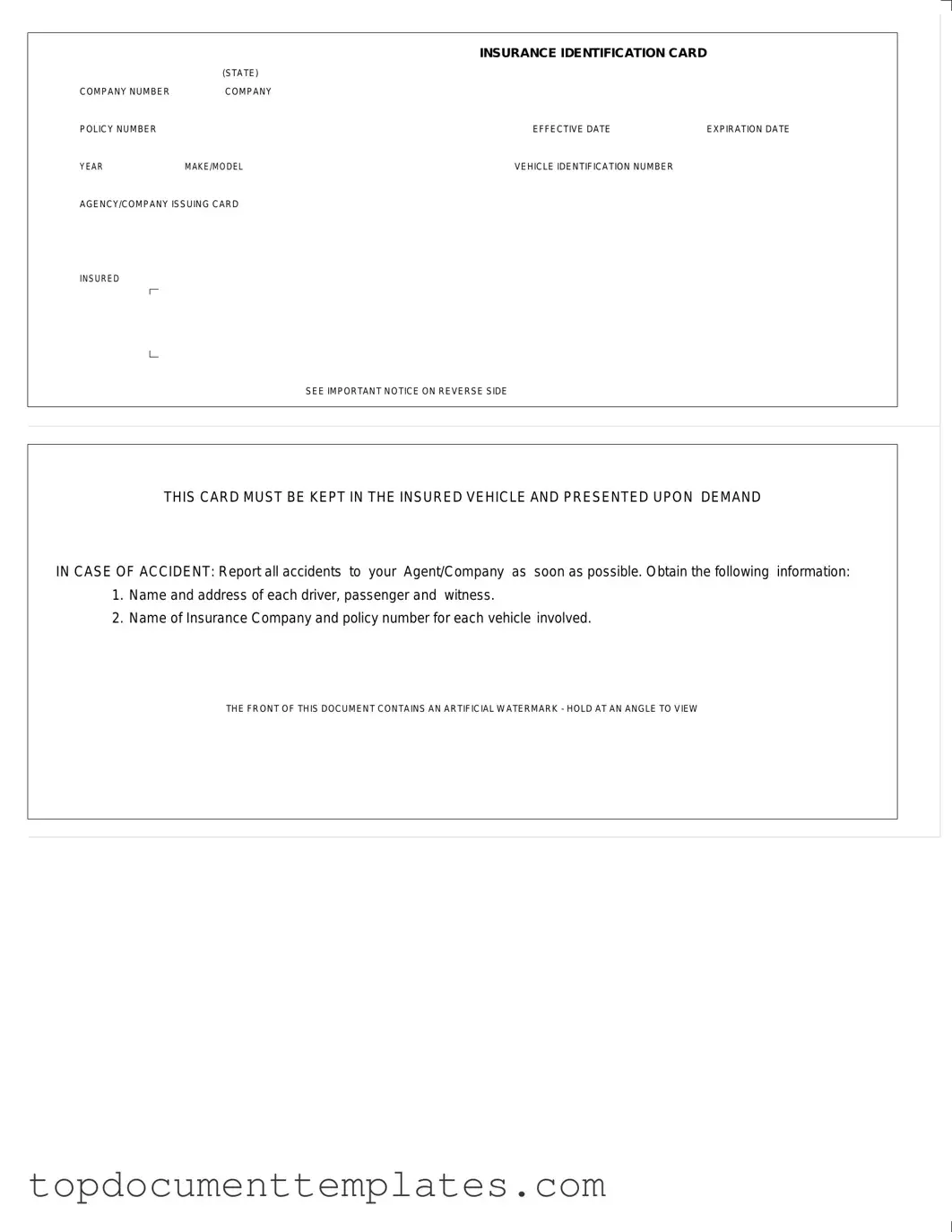

The Auto Insurance Card is a crucial document for any vehicle owner, serving as proof of insurance coverage while on the road. This card contains essential information that not only identifies the insurance provider but also outlines the specifics of the policy. Key details include the insurance company’s name, the policy number, and the effective and expiration dates of the coverage. Additionally, the card features the vehicle’s year, make, model, and the Vehicle Identification Number (VIN), which uniquely identifies the vehicle. It is important to note that the card must be kept in the insured vehicle at all times and should be presented upon request in the event of an accident. In such situations, it is vital to report the incident to the insurance agent or company as soon as possible. The card also emphasizes the importance of gathering relevant information from all parties involved, including names and addresses of drivers, passengers, and witnesses, as well as the insurance details of other vehicles. Furthermore, the card includes an artificial watermark for security purposes, which can be viewed by holding the card at an angle. The reverse side of the card often contains important notices that should not be overlooked, making it imperative for vehicle owners to familiarize themselves with all aspects of this document.

Similar forms

-

Driver's License: Like the Auto Insurance Card, a driver's license serves as an official identification document. It contains personal information such as the driver's name, address, and date of birth. Both documents are required to be presented when operating a vehicle.

- Bill of Sale: A legal document that facilitates the transfer of ownership of personal property between individuals. For a detailed template, you can refer to https://documentonline.org/blank-new-york-bill-of-sale, ensuring clarity and protection for both parties involved.

-

Vehicle Registration Document: This document proves that a vehicle is registered with the state. It includes details like the owner's name, vehicle identification number (VIN), and registration expiration date. Similar to the insurance card, it must be kept in the vehicle and shown upon request.

-

Proof of Insurance Certificate: This certificate is issued by an insurance company and confirms that a vehicle is insured. It includes information about the policyholder, coverage details, and policy numbers. It functions similarly to the Auto Insurance Card in that it must be presented during traffic stops or accidents.

-

Accident Report Form: After an accident, this form is often filled out to document the incident. It requires details such as names, addresses, and insurance information of those involved. While not always required to be carried in the vehicle, it serves a similar purpose in recording essential information related to vehicle incidents.

-

Rental Car Agreement: When renting a vehicle, this agreement outlines the terms of the rental, including insurance coverage options. It provides necessary information about the vehicle and rental company, similar to how the Auto Insurance Card provides essential details about the insured vehicle.

Guidelines on Writing Auto Insurance Card

Once you have the Auto Insurance Card form in front of you, it’s time to fill it out carefully. This card is essential for proving that you have valid insurance coverage while driving. Make sure to have your insurance policy details and vehicle information on hand as you proceed through the following steps.

- Locate the section labeled COMPANY NUMBER and enter the unique number assigned to your insurance company.

- In the COMPANY POLICY NUMBER field, write down your specific policy number.

- Fill in the EFFECTIVE DATE with the date your policy starts.

- Next, enter the EXPIRATION DATE, indicating when your coverage will end.

- For the YEAR MAKE/MODEL section, provide the year, make, and model of your vehicle.

- In the VEHICLE IDENTIFICATION NUMBER field, input the VIN, which is usually found on the dashboard or inside the driver’s door frame.

- Identify the AGENCY/COMPANY ISSUING CARD and write the name of the agency that provided your insurance.

After you have filled in all the necessary fields, double-check your entries for accuracy. It’s crucial to keep this card in your vehicle at all times, as you may need to present it if you are involved in an accident. Remember to report any accidents to your insurance agent as soon as possible.

Form Data

| Fact Name | Description |

|---|---|

| Document Purpose | The Auto Insurance Card serves as proof of insurance coverage for the vehicle listed. |

| State-Specific Requirement | Each state has its own regulations governing the format and information required on the insurance card. |

| Mandatory Information | The card must include the insurance company name, policy number, and effective dates. |

| Vehicle Details | Details such as the year, make, model, and Vehicle Identification Number (VIN) are required. |

| Agency Information | The issuing agency or company’s name must be clearly stated on the card. |

| Legal Obligation | Most states mandate that this card be kept in the insured vehicle at all times. |

| Presentation Requirement | The card must be presented upon demand during an accident or traffic stop. |

| Accident Reporting | Insured individuals are required to report accidents to their insurance agent or company promptly. |

| Information Collection | In case of an accident, gather names and addresses of all drivers, passengers, and witnesses involved. |

| Watermark Feature | The front of the card includes an artificial watermark, which can be viewed by holding it at an angle. |

Other PDF Documents

Sample Incident Report - Promotes accountability in reporting workplace accidents.

Western Union Receipt Generator - Utilize feedback and reviews for guidance.

Understanding the intricacies of the Florida Power of Attorney form is essential for anyone looking to designate authority effectively. As this legal document empowers an agent to act on behalf of the principal, it addresses vital matters ranging from financial decisions to health-related choices. For more information on creating this document accurately, you can visit OnlineLawDocs.com, making sure that your planning aligns with your specific intentions.

Letter of Permission to Travel - Each cruise may have specific requirements regarding the form’s submission timeline.