Valid Transfer-on-Death Deed Form for Arizona State

In Arizona, the Transfer-on-Death Deed (TOD) serves as a valuable estate planning tool, allowing property owners to pass on their real estate to designated beneficiaries without the need for probate. This straightforward form enables individuals to retain full control of their property during their lifetime, while ensuring a smooth transition upon their death. By simply filling out the TOD deed, property owners can specify who will inherit their property, eliminating potential disputes among heirs. Importantly, the form must be properly executed and recorded to be legally binding. The TOD deed can cover various types of real estate, including residential homes, land, and commercial properties. Additionally, it provides flexibility, as property owners can revoke or change their beneficiaries at any time before their passing. Understanding the nuances of the Transfer-on-Death Deed is essential for anyone looking to streamline their estate planning process and secure their loved ones' future. With this form, property owners can confidently navigate the complexities of inheritance while minimizing the burdens often associated with transferring real estate after death.

Similar forms

Last Will and Testament: A legal document that outlines how a person wishes their assets to be distributed after their death. Like the Transfer-on-Death Deed, it allows for the transfer of property but requires probate, which can be time-consuming.

Living Trust: This document places assets into a trust during a person's lifetime, allowing for management and distribution of those assets without going through probate. It serves a similar purpose to a Transfer-on-Death Deed but provides more control during the grantor's life.

Beneficiary Designation Forms: Often used for financial accounts and insurance policies, these forms allow individuals to name beneficiaries who will receive assets upon their death. Like the Transfer-on-Death Deed, they facilitate direct transfer without probate.

Joint Tenancy Deeds: This form of property ownership allows two or more individuals to own property together, with rights of survivorship. When one owner dies, their share automatically transfers to the surviving owner, similar to the Transfer-on-Death Deed.

- Employment Verification: The Florida Employment Verification form is essential for validating an employee's eligibility to work and aligns with legal standards, as detailed at onlinelawdocs.com.

Payable-on-Death (POD) Accounts: These bank accounts allow the account holder to name a beneficiary who will receive the funds upon their death. The process mirrors the Transfer-on-Death Deed by bypassing probate for the transfer of assets.

Transfer-on-Death Registration for Securities: This allows individuals to designate a beneficiary for stocks and bonds, ensuring a smooth transfer upon death. Like the Transfer-on-Death Deed, it avoids the complexities of probate.

Life Estate Deed: This deed allows a person to retain the right to use property during their lifetime, with the property passing to another person upon their death. It shares similarities with the Transfer-on-Death Deed in terms of post-death property transfer.

Community Property with Right of Survivorship: This form of ownership is available in some states and allows spouses to own property together. Upon the death of one spouse, the property automatically transfers to the surviving spouse, akin to the Transfer-on-Death Deed.

Family Limited Partnership Agreements: These agreements can facilitate the transfer of family-owned business interests and assets upon death, similar to the Transfer-on-Death Deed, while also providing potential tax benefits.

Health Care Proxy or Advance Directive: While primarily focused on medical decisions, these documents allow individuals to designate someone to make health care decisions on their behalf if they become incapacitated. This aspect of planning, like the Transfer-on-Death Deed, emphasizes the importance of clear intentions for future circumstances.

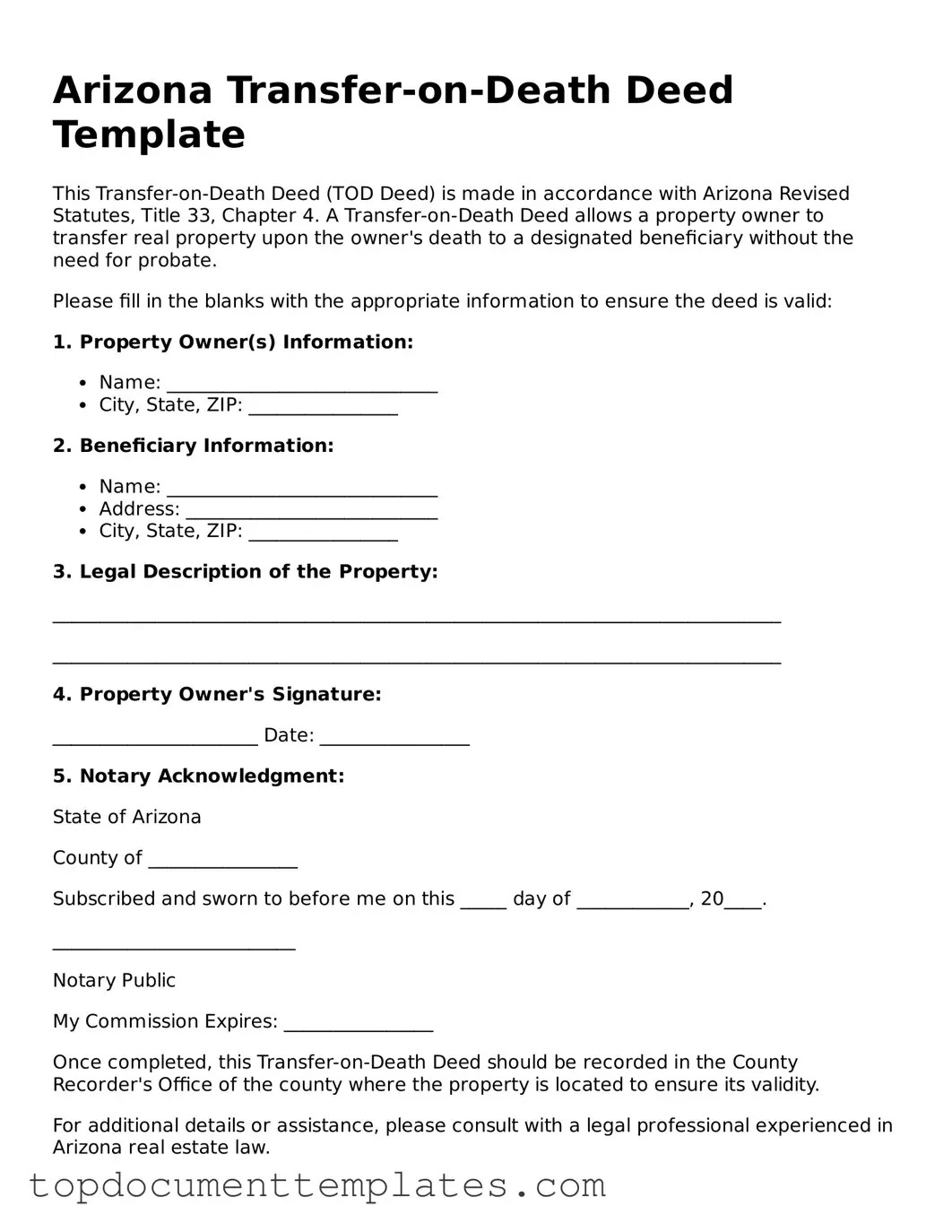

Guidelines on Writing Arizona Transfer-on-Death Deed

Once you have the Arizona Transfer-on-Death Deed form, it's important to fill it out accurately. After completing the form, you will need to sign it in front of a notary and then record it with the county recorder's office where the property is located. This ensures that the deed is legally recognized and effective upon your passing.

- Begin by entering your full name as the current owner of the property.

- Provide your address, including city, state, and zip code.

- Clearly describe the property you wish to transfer. Include the legal description and address of the property.

- List the names of the beneficiaries who will receive the property after your death. Make sure to include their full names.

- Indicate the relationship of each beneficiary to you, such as spouse, child, or friend.

- Sign the form in the designated area. Ensure your signature matches the name you provided at the beginning.

- Have the form notarized. A notary public will verify your identity and witness your signature.

- Make copies of the completed and notarized deed for your records.

- Visit the county recorder's office to file the deed. Pay any required recording fees.

File Information

| Fact Name | Description |

|---|---|

| Definition | An Arizona Transfer-on-Death Deed allows property owners to transfer real estate to beneficiaries upon their death without going through probate. |

| Governing Law | The Transfer-on-Death Deed is governed by Arizona Revised Statutes, Title 33, Chapter 4.01. |

| Eligibility | Any individual who owns real property in Arizona can create a Transfer-on-Death Deed. |

| Beneficiary Designation | Property owners can designate one or more beneficiaries to receive the property after their death. |

| No Immediate Transfer | The property does not transfer to the beneficiary until the owner's death, allowing the owner to retain full control during their lifetime. |

| Revocability | The deed can be revoked or modified at any time before the owner's death, providing flexibility to the owner. |

| Filing Requirements | The Transfer-on-Death Deed must be recorded with the county recorder in Arizona to be valid. |

| Tax Implications | There are no immediate tax implications for the beneficiary until the property is sold or transferred after the owner's death. |

| Limitations | The deed cannot be used for certain types of property, such as property held in a trust or jointly owned property. |

| Legal Advice | While creating a Transfer-on-Death Deed is straightforward, seeking legal advice is recommended to ensure it meets your specific needs. |

Other Popular Transfer-on-Death Deed State Forms

Transfer on Death Deed Florida Form - It's essential that your signature on the deed is witnessed by a notary public.

In the context of navigating separation, it's essential for couples to understand the importance of formalizing their arrangements through the Arizona Marital Separation Agreement form, which not only clarifies obligations but also aids in mitigating potential disputes. For further guidance and resources, you can find comprehensive documentation at All Arizona Forms, making the process smoother and more transparent for both parties involved.

Transfer on Death Deed Illinois Cost - The deed can be particularly beneficial for single property owners who wish to specify heirs directly.

Transfer on Death Deed Iowa Form - The deed can often be filed with local property records, solidifying the transfer intentions and protecting the beneficiaries' rights.

How to Avoid Probate in New Jersey - The deed is valid even if the property owner and beneficiary live in different states.