Valid Tractor Bill of Sale Form for Arizona State

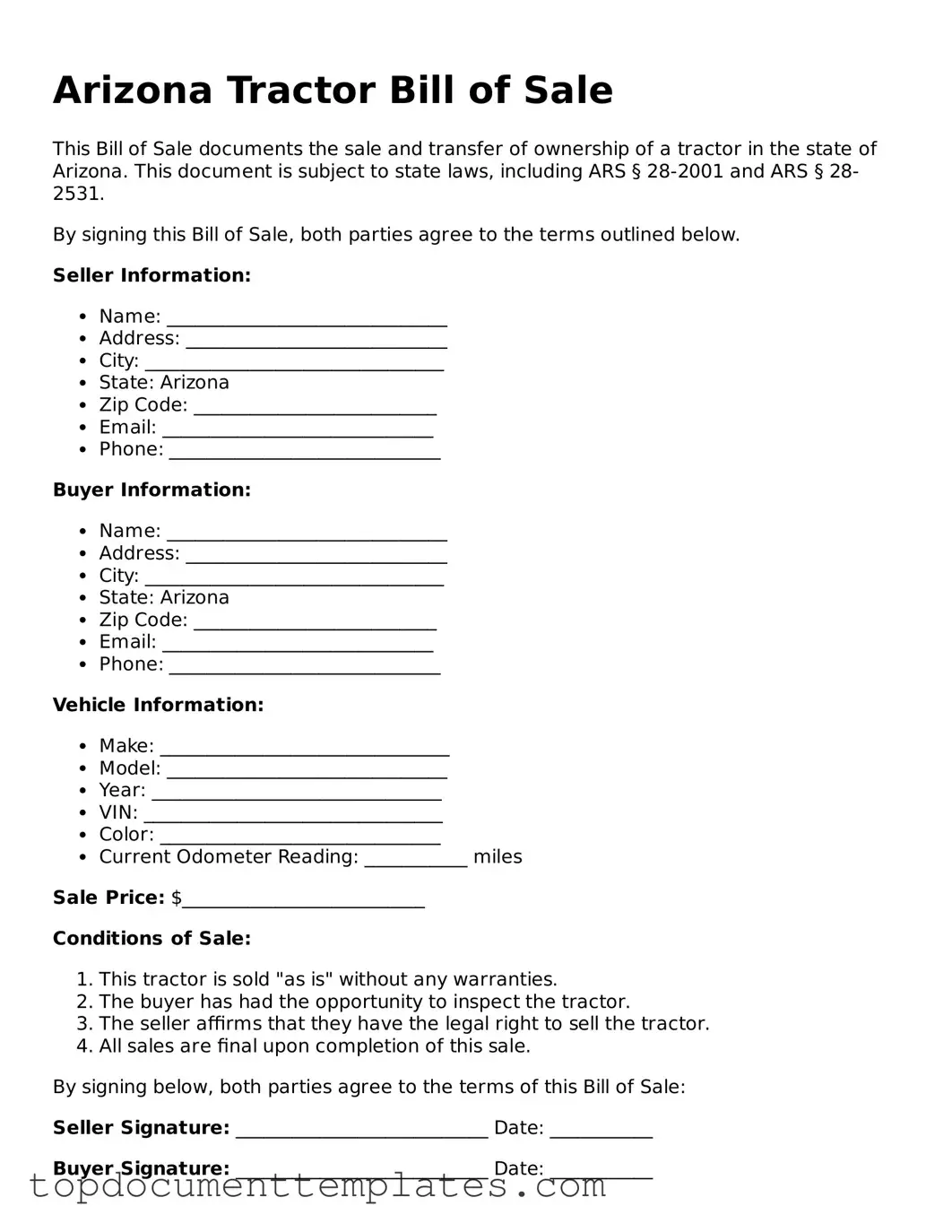

When purchasing or selling a tractor in Arizona, having a well-drafted bill of sale is essential for both parties involved in the transaction. The Arizona Tractor Bill of Sale form serves as a legal document that outlines the details of the sale, ensuring that both the buyer and seller have a clear understanding of the terms. This form typically includes important information such as the names and addresses of both parties, a detailed description of the tractor—including its make, model, year, and vehicle identification number (VIN)—and the purchase price. Additionally, it may contain sections for any warranties or representations made by the seller, as well as space for signatures to validate the agreement. By documenting the sale in this manner, individuals can protect themselves from potential disputes in the future and provide a record that may be required for registration or titling purposes. Understanding the components and significance of the Arizona Tractor Bill of Sale form can help facilitate a smooth transaction and ensure compliance with state regulations.

Similar forms

-

Vehicle Bill of Sale: Similar to the Tractor Bill of Sale, this document serves as proof of the transfer of ownership for a motor vehicle. It includes details about the vehicle, such as make, model, and VIN, along with the buyer and seller's information.

- CDC U.S. Standard Certificate of Live Birth: This form is essential for officially registering a birth in the United States. Its meticulous design captures a wide range of information, from basic demographics to health-related data, and plays a critical role in legal identification processes and public health analytics. For more detailed information, visit OnlineLawDocs.com.

-

Boat Bill of Sale: This document is used for the sale of a boat. It outlines the specifics of the boat, including its registration number and condition, and serves to protect both the buyer and seller in the transaction.

-

Motorcycle Bill of Sale: Like the Tractor Bill of Sale, this form facilitates the transfer of ownership for a motorcycle. It includes essential details about the motorcycle and ensures that both parties have a record of the transaction.

-

ATV Bill of Sale: This document is similar in function, used for all-terrain vehicles. It provides a record of the sale and includes information about the ATV, ensuring clarity for both the buyer and seller.

-

Equipment Bill of Sale: This form is used for heavy equipment transactions. It outlines the specifics of the equipment being sold and protects both parties by documenting the sale.

-

Real Estate Purchase Agreement: While it pertains to real property rather than personal property, this agreement similarly details the terms of a sale, including price and property description, ensuring a clear transfer of ownership.

-

Personal Property Bill of Sale: This document covers the sale of personal items, such as furniture or electronics. It serves a similar purpose by documenting the transaction and protecting both parties involved.

-

Mobile Home Bill of Sale: This document is used for the sale of a mobile home. Like the Tractor Bill of Sale, it includes details about the property and serves as proof of ownership transfer.

Guidelines on Writing Arizona Tractor Bill of Sale

Once you have your Arizona Tractor Bill of Sale form ready, it’s time to fill it out accurately. This document will help ensure a smooth transfer of ownership. Here are the steps you need to follow to complete the form correctly.

- Obtain the form: Make sure you have the correct Arizona Tractor Bill of Sale form. You can usually find it online or at your local DMV office.

- Fill in the seller’s information: Write down the full name, address, and contact number of the seller. This is the person transferring ownership.

- Fill in the buyer’s information: Enter the full name, address, and contact number of the buyer. This is the person receiving ownership.

- Provide vehicle details: Include the make, model, year, and Vehicle Identification Number (VIN) of the tractor. This helps identify the specific vehicle being sold.

- State the sale price: Clearly write the amount for which the tractor is being sold. This should be a specific dollar amount.

- Include the date of sale: Write the date when the transaction is taking place. This is important for record-keeping.

- Signatures: Both the seller and buyer must sign the form. This indicates that both parties agree to the terms of the sale.

After completing the form, make sure both parties keep a copy for their records. This will serve as proof of the transaction and can be useful for future reference.

File Information

| Fact Name | Description |

|---|---|

| Purpose | The Arizona Tractor Bill of Sale form is used to document the sale or transfer of ownership of a tractor in Arizona. |

| Governing Law | This form is governed by Arizona Revised Statutes, specifically Title 28, which covers motor vehicles. |

| Parties Involved | The form requires information from both the seller and the buyer, ensuring both parties are clearly identified. |

| Vehicle Information | Details about the tractor, such as make, model, year, and Vehicle Identification Number (VIN), must be included. |

| Sale Price | The agreed-upon sale price must be clearly stated to avoid any misunderstandings. |

| Date of Sale | It is essential to include the date when the sale takes place for record-keeping purposes. |

| Signatures | Both the buyer and seller must sign the document to validate the sale and transfer of ownership. |

| Notarization | While notarization is not required, it is recommended to add an extra layer of authenticity to the transaction. |

| Record Keeping | Both parties should keep a copy of the Bill of Sale for their records, as it serves as proof of the transaction. |

Other Popular Tractor Bill of Sale State Forms

Bill of Sale Truck - Recommended for anyone buying a tractor, new or used.

The IRS W-9 form is a document used by individuals and businesses to provide their taxpayer identification information to others, typically for tax reporting purposes. This form is essential for freelancers, contractors, and service providers who need to report their earnings to the IRS. For those looking for an easy way to access the form, you can find it at documentonline.org/blank-irs-w-9/. By completing the W-9, individuals and entities ensure compliance with tax laws while facilitating clear communication of financial information.

Does a Tractor Have a Title - Capture all necessary details of the tractor sale for both parties.