Valid Promissory Note Form for Arizona State

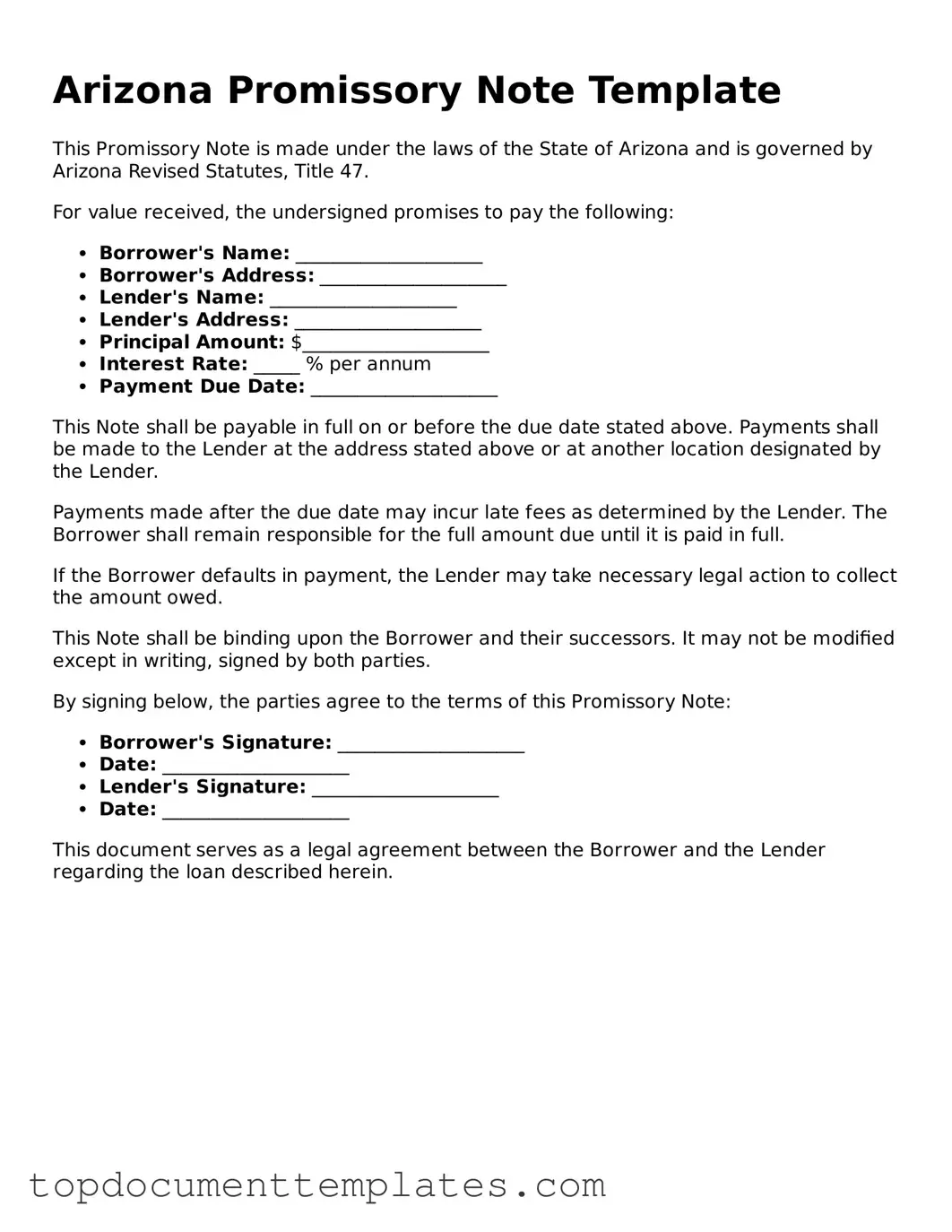

The Arizona Promissory Note is an essential financial document that serves as a written promise from one party to another, outlining the terms of a loan. This form is commonly used in various lending scenarios, including personal loans, business financing, and real estate transactions. It typically includes critical details such as the names of the borrower and lender, the principal amount being borrowed, the interest rate, and the repayment schedule. Additionally, the note specifies the consequences of default, ensuring both parties understand their rights and responsibilities. By providing clarity and structure to the lending process, the Arizona Promissory Note helps to foster trust and accountability between the involved parties. Understanding the components of this document is vital for anyone considering entering into a loan agreement in Arizona, as it lays the foundation for a secure financial transaction.

Similar forms

- Loan Agreement: A loan agreement outlines the terms and conditions of a loan, similar to a promissory note. Both documents specify the amount borrowed, repayment terms, and interest rates. However, a loan agreement may include additional clauses regarding collateral and default provisions.

- Mortgage: A mortgage is a specific type of loan agreement secured by real property. Like a promissory note, it involves a promise to repay borrowed funds. The primary difference lies in the fact that a mortgage also grants the lender a security interest in the property.

- Installment Agreement: An installment agreement details the terms for repaying a debt in regular payments over time. This is similar to a promissory note, which also establishes a repayment schedule. However, installment agreements may cover various types of debts, not just loans.

-

IRS Form 2553: This form is essential for small businesses looking to elect S Corporation status, allowing income and deductions to pass through to shareholders and avoiding double taxation. For more details, visit https://documentonline.org/blank-irs-2553/.

- Personal Guarantee: A personal guarantee is a document in which an individual agrees to be responsible for another party's debt. It shares similarities with a promissory note in that it involves a commitment to pay. However, a personal guarantee is typically used in business contexts to secure loans.

- Debt Acknowledgment: A debt acknowledgment is a written statement confirming the existence of a debt. This document is similar to a promissory note as it recognizes an obligation to pay. However, it may not include detailed repayment terms or interest rates, focusing instead on the acknowledgment of the debt itself.

Guidelines on Writing Arizona Promissory Note

Once you have the Arizona Promissory Note form in hand, you're ready to provide the necessary details. This document requires specific information to ensure clarity and legality. Follow the steps below to complete the form accurately.

- Begin by entering the date at the top of the form. Use the format MM/DD/YYYY.

- In the first section, fill in the names of both the borrower and the lender. Make sure to include their full legal names.

- Next, specify the principal amount being borrowed. This should be a clear numerical value, such as $5,000.

- Indicate the interest rate. If applicable, write the percentage as a decimal (e.g., 5% as 0.05).

- Detail the repayment terms. Specify how often payments will be made (e.g., monthly, quarterly) and the duration of the loan.

- In the next section, outline any late fees or penalties for missed payments. Be clear about the conditions that apply.

- Include the borrower's address and contact information. This ensures the lender can reach them if necessary.

- After that, provide the lender's address and contact information as well.

- Finally, both parties should sign and date the document at the bottom. This step is crucial for the validity of the note.

After completing the form, make copies for both the borrower and lender. This ensures that everyone has a record of the agreement. It's always a good idea to keep these documents organized and accessible for future reference.

File Information

| Fact Name | Details |

|---|---|

| Definition | An Arizona Promissory Note is a written promise to pay a specified amount of money to a designated person or entity. |

| Governing Law | The Arizona Promissory Note is governed by Arizona Revised Statutes Title 47, Uniform Commercial Code. |

| Parties Involved | The note involves at least two parties: the borrower (maker) and the lender (payee). |

| Payment Terms | It specifies the amount to be paid, the due date, and the interest rate, if applicable. |

| Signatures Required | Both the borrower and lender must sign the note for it to be legally binding. |

| Consideration | A valid consideration must exist, meaning something of value must be exchanged between the parties. |

| Default Terms | The document may outline the consequences of defaulting on the payment. |

| Transferability | The note can often be transferred or assigned to another party unless stated otherwise. |

| Legal Enforcement | If necessary, the lender can enforce the note through legal action in case of non-payment. |

Other Popular Promissory Note State Forms

Notarized Promissory Note Sample - Borrowers should consider whether they can realistically meet the terms set in the note before signing.

A California Power of Attorney form is a legal document that allows a person to appoint someone else to make decisions on their behalf. This can relate to financial, legal, or health-related matters. It's crucial for individuals looking to ensure their affairs are handled according to their wishes, especially in situations where they may not be able to make decisions for themselves. For more information on this important document, visit OnlineLawDocs.com.

Illinois Promissory Note - This form clarifies the amount borrowed, interest rates, and repayment schedule.

Georgia Promissory Note - Obtaining a promissory note can help resolve disputes amicably and efficiently.