Valid Deed in Lieu of Foreclosure Form for Arizona State

The Arizona Deed in Lieu of Foreclosure form serves as a crucial tool for homeowners facing financial difficulties and potential foreclosure. This legal document allows a homeowner to voluntarily transfer ownership of their property back to the lender, effectively bypassing the lengthy and often stressful foreclosure process. By signing this form, the homeowner can settle their mortgage obligations more efficiently, potentially mitigating the impact on their credit score. The form typically includes essential information such as the property description, the names of the parties involved, and any relevant details regarding the mortgage. Additionally, it may outline any agreements concerning the release of liability for the homeowner, which can provide significant relief. Understanding the implications of this form is vital for anyone considering this option, as it offers a way to regain control over a challenging financial situation while preserving dignity and minimizing losses.

Similar forms

- Mortgage Release: This document releases the borrower from the mortgage obligation when the property is sold or transferred. Similar to a deed in lieu, it allows the borrower to avoid foreclosure.

- Short Sale Agreement: In a short sale, the lender agrees to accept less than the total owed on the mortgage. Like a deed in lieu, it helps the borrower avoid foreclosure while settling the debt.

- Loan Modification Agreement: This document alters the terms of the existing mortgage to make payments more manageable. Both options aim to prevent foreclosure and provide relief to the borrower.

- Power of Attorney Form - A legal document that enables a person to designate someone else to manage their affairs, ensuring decisions reflect their wishes, especially when they are unable to make choices themselves. For more information, visit OnlineLawDocs.com.

- Bankruptcy Filing: Filing for bankruptcy can halt foreclosure proceedings and allow for debt restructuring. It serves as a legal way to address financial difficulties, similar to a deed in lieu.

- Foreclosure Defense: This involves legal strategies to challenge a foreclosure. While it seeks to stop the process, a deed in lieu offers a more amicable resolution.

- Quitclaim Deed: This document transfers ownership of property without warranties. It can be used to relinquish property rights, akin to a deed in lieu, but without the lender's involvement.

- Property Settlement Agreement: Often used in divorce, this document outlines the division of property. Like a deed in lieu, it facilitates a transfer of ownership to resolve financial obligations.

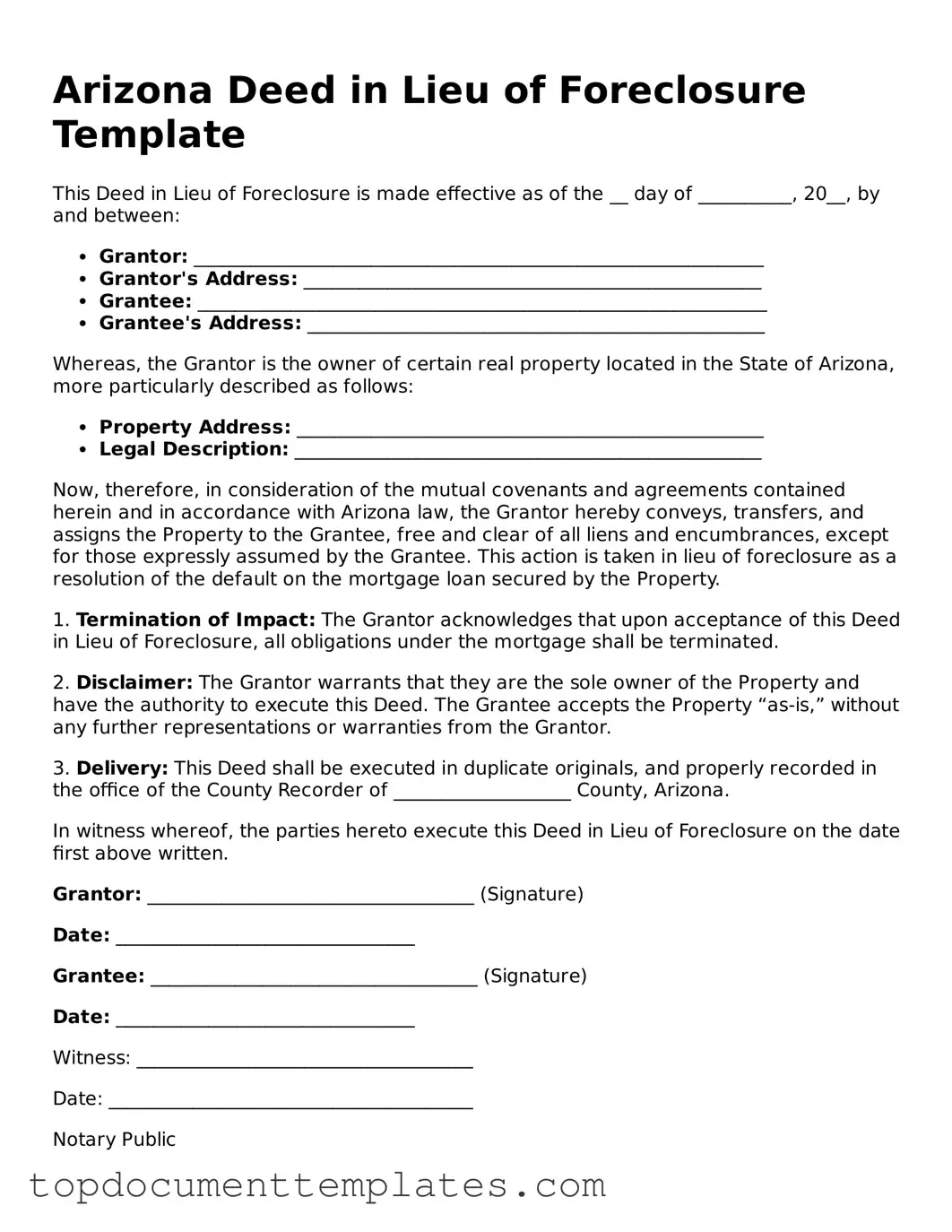

Guidelines on Writing Arizona Deed in Lieu of Foreclosure

After completing the Arizona Deed in Lieu of Foreclosure form, you will need to submit it to the appropriate parties. This typically includes the lender and may also involve local government offices, depending on your situation. Make sure to keep copies for your records.

- Obtain the Arizona Deed in Lieu of Foreclosure form. You can find it online or through a legal forms provider.

- Fill in the names of the parties involved. Include the name of the borrower (you) and the lender.

- Provide the property address. Ensure that you include the full legal description of the property, if required.

- State the date of the deed. This is the date when you are signing the document.

- Include any necessary details about the loan. This may involve the loan number or account information.

- Sign the form. Make sure to sign in the presence of a notary public, as notarization is often required.

- Have the notary complete their section. They will verify your identity and witness your signature.

- Make copies of the completed form for your records before submitting it.

- Submit the form to your lender and any other required parties. Follow their instructions for submission.

File Information

| Fact Name | Details |

|---|---|

| Definition | A Deed in Lieu of Foreclosure is a legal document where a borrower voluntarily transfers property ownership to the lender to avoid foreclosure. |

| Governing Law | The process is governed by Arizona Revised Statutes, Title 33, Chapter 6. |

| Eligibility | Borrowers facing financial difficulties and unable to maintain mortgage payments may consider this option. |

| Process Initiation | The borrower must initiate the process by contacting the lender to discuss the possibility of a deed in lieu. |

| Documentation | Borrowers may need to provide financial documents and a hardship letter to support their request. |

| Title Transfer | Upon agreement, the borrower signs the deed, transferring the title of the property to the lender. |

| Impact on Credit | A deed in lieu of foreclosure may negatively affect the borrower’s credit score, though typically less than a foreclosure. |

| Deficiency Judgments | In Arizona, lenders may not pursue deficiency judgments after a deed in lieu, provided certain conditions are met. |

| Alternative Options | Borrowers should consider other alternatives, such as loan modifications or short sales, before proceeding with a deed in lieu. |

Other Popular Deed in Lieu of Foreclosure State Forms

Sample Deed in Lieu of Foreclosure - This approach prioritizes a cooperative resolution between the lender and homeowner.

The IRS Form 2553 is used by small businesses to elect to be treated as an S Corporation for federal tax purposes. This designation allows income, deductions, and credits to flow through to shareholders, thus avoiding double taxation. To ensure compliance and optimize tax benefits, it's crucial to complete this form correctly, and for additional information, you can visit documentonline.org/blank-irs-2553/.

California Voluntary Foreclosure Deed - This process can help homeowners avoid a lengthy foreclosure, allowing for a faster resolution of their mortgage issues.

Georgia Foreclosure Laws - Many lenders look favorably upon deeds in lieu as they maintain their investments by expediting property recovery.