Blank Adp Pay Stub PDF Form

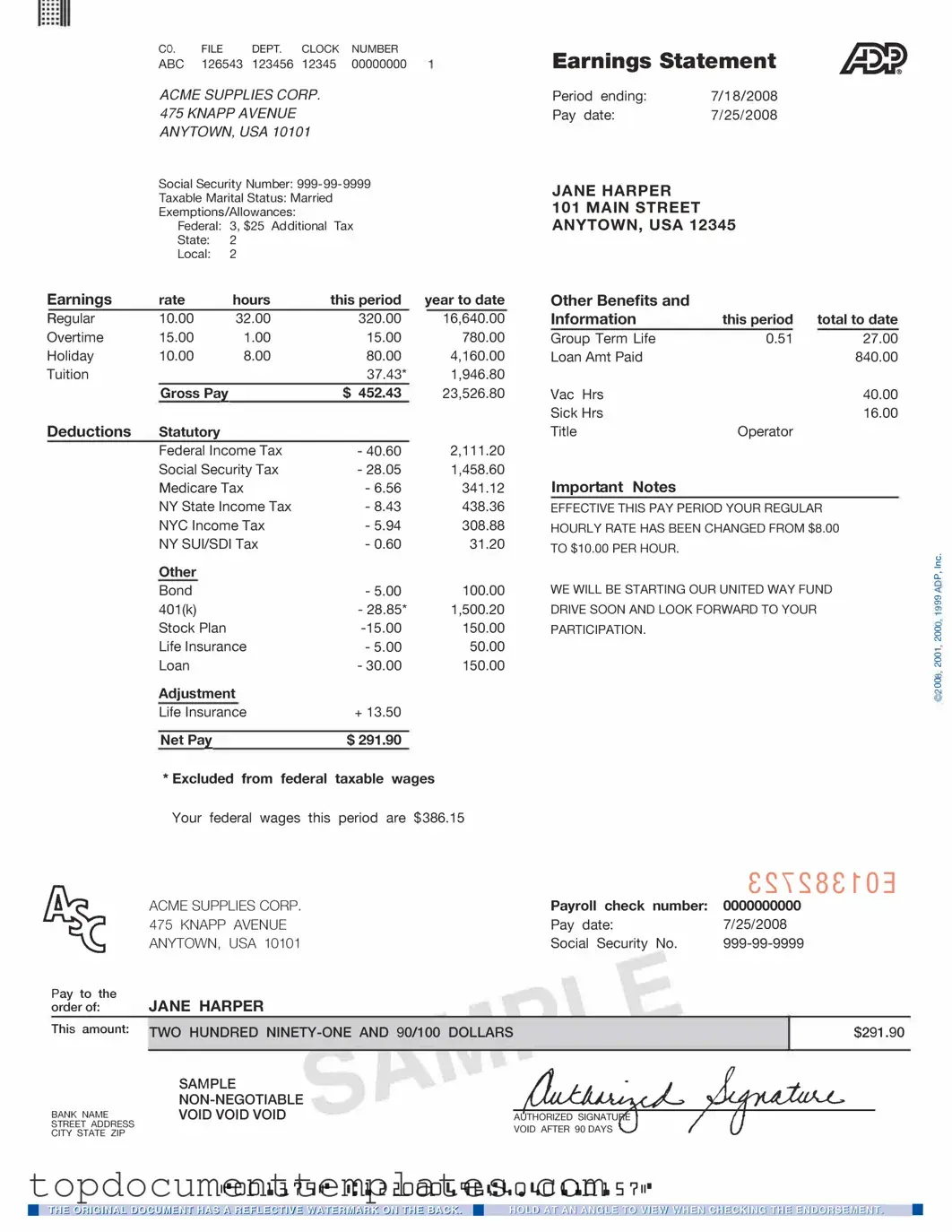

The ADP Pay Stub form is an essential document for employees, providing a detailed breakdown of their earnings and deductions for each pay period. This form typically includes critical information such as gross pay, net pay, and various deductions, including taxes and benefits. Employees can easily track their income and understand how their pay is calculated. Additionally, the pay stub often outlines year-to-date earnings, helping individuals monitor their financial progress throughout the year. Understanding the components of the ADP Pay Stub form empowers employees to manage their finances more effectively and ensures transparency in payroll practices.

Similar forms

- W-2 Form: This document summarizes an employee's annual wages and the taxes withheld. Like the ADP Pay Stub, it provides a breakdown of earnings, but it covers a full year rather than a single pay period.

- Paycheck: A physical or electronic payment method given to employees. It includes gross pay, deductions, and net pay, similar to the ADP Pay Stub, but often lacks detailed breakdowns of hours worked or specific deductions.

- Direct Deposit Receipt: This document confirms that an employee's paycheck has been deposited directly into their bank account. It typically shows the amount deposited and may include some details about deductions, mirroring the ADP Pay Stub's focus on net pay.

- Payroll Summary Report: This report provides an overview of all employees' pay for a specific period. It includes total gross pay, deductions, and net pay for each employee, akin to the information found on an ADP Pay Stub.

- Time Sheet: This document records the hours worked by an employee. While it does not include pay details, it is essential for calculating the gross pay shown on the ADP Pay Stub.

- Benefits Statement: This document outlines the benefits an employee receives, such as health insurance and retirement contributions. It often includes deductions from pay, similar to how the ADP Pay Stub lists deductions for benefits.

Guidelines on Writing Adp Pay Stub

Filling out the ADP Pay Stub form is a straightforward process that requires attention to detail. Following the steps below will help ensure that all necessary information is accurately provided. After completing the form, you will be able to review your pay details and confirm that everything is correct.

- Gather your personal information, including your name, address, and Social Security number.

- Locate your employer's information, including the company name and address.

- Enter the pay period start and end dates. Make sure these dates are correct.

- Fill in your gross earnings for the pay period. This is the total amount earned before any deductions.

- List all deductions, such as taxes, retirement contributions, and health insurance. Be sure to include the amounts for each deduction.

- Calculate your net pay by subtracting the total deductions from your gross earnings.

- Review all the information entered for accuracy. Double-check names, numbers, and amounts.

- Sign and date the form, if required.

Once you have completed these steps, you can submit the form as needed. This will help ensure that your pay stub reflects the correct information for your records.

Form Data

| Fact Name | Description |

|---|---|

| Purpose | The ADP Pay Stub form provides employees with a detailed breakdown of their earnings, deductions, and net pay for each pay period. |

| Components | The form typically includes information such as gross pay, taxes withheld, benefits deductions, and year-to-date totals. |

| Access | Employees can usually access their pay stubs online through the ADP portal or receive them via email or physical copies. |

| State-Specific Regulations | Some states, like California, require specific information on pay stubs, including the employer's name and address as per California Labor Code Section 226. |

| Frequency | Pay stubs are issued regularly, typically on a bi-weekly or monthly basis, depending on the employer's payroll schedule. |

| Importance | These forms are essential for employees to understand their compensation, track earnings, and prepare for tax filings. |

Other PDF Documents

Chick-fil-a Careers - State how you heard about the job opening at Chick-fil-A.

Child Guardianship Forms - Temporary custody allows a guardian to make decisions for a child for a specified period.